Global Healthcare Asset Management Market - Key Trends and Drivers Summarized

Why Is Healthcare Asset Management Becoming Essential for Optimizing Operations, Reducing Costs, and Ensuring Patient Safety in Modern Healthcare Facilities?

Healthcare Asset Management has become essential for optimizing operations, reducing costs, and ensuring patient safety in modern healthcare facilities. But why is healthcare asset management so critical today? Hospitals and healthcare systems manage a vast range of physical assets, from medical devices and equipment to patient beds, pharmaceuticals, and IT infrastructure. Ensuring that these assets are properly tracked, maintained, and utilized is crucial to providing high-quality patient care, reducing operational inefficiencies, and cutting costs. Asset mismanagement can lead to wasted time, equipment shortages, and delayed medical procedures, which in turn impacts patient outcomes and hospital profitability.With the growing complexity of healthcare operations, asset management solutions help streamline workflows by providing real-time visibility into the location, status, and availability of critical assets. This enables staff to quickly locate essential equipment, reduces downtime caused by maintenance issues, and improves inventory control. Furthermore, healthcare asset management systems enhance regulatory compliance by automating maintenance schedules, ensuring that equipment is properly calibrated and functioning safely. These systems are particularly vital for maintaining high-cost medical equipment like MRI machines, ventilators, and infusion pumps, which must be regularly serviced to ensure both patient safety and operational efficiency.

How Are Technological Advancements and Innovations Improving the Efficiency, Accuracy, and Scalability of Healthcare Asset Management?

Technological advancements are significantly improving the efficiency, accuracy, and scalability of healthcare asset management, making it easier for hospitals and healthcare facilities to track and maintain their assets. One of the most impactful innovations is the integration of real-time location systems (RTLS) and radio-frequency identification (RFID) technology. RTLS and RFID tags allow healthcare facilities to track the real-time location of medical equipment, medications, and even personnel. This technology drastically reduces the time spent searching for critical assets, ensuring that medical devices and supplies are always available when needed. RFID and RTLS solutions can also monitor equipment usage, helping administrators identify underused assets and optimize their deployment across departments.Another key advancement is the use of Internet of Things (IoT) devices in asset management. IoT-enabled medical equipment can transmit data on its usage, performance, and condition to a central platform, allowing healthcare providers to remotely monitor the health of their assets. For example, an IoT-connected infusion pump can automatically alert the maintenance team if it detects a malfunction or deviation from normal operation, enabling proactive maintenance before the issue impacts patient care. These predictive maintenance capabilities not only enhance patient safety but also extend the lifespan of expensive medical devices, saving healthcare facilities money in the long run.

Cloud-based asset management platforms are another innovation transforming the industry. By leveraging cloud computing, healthcare organizations can centralize their asset management systems, enabling easy access to data from multiple locations and departments. This is especially beneficial for large healthcare networks or multisite hospitals, where managing assets across multiple facilities can be complex and inefficient. Cloud-based systems allow for seamless data sharing, real-time updates, and scalability, ensuring that the asset management platform can grow alongside the healthcare organization without requiring significant hardware investments.

Artificial intelligence (AI) and machine learning (ML) are playing an increasingly important role in enhancing the capabilities of healthcare asset management systems. AI-driven algorithms can analyze historical data from asset management systems to identify patterns and predict future maintenance needs, helping healthcare facilities optimize their equipment maintenance schedules. Machine learning models can also assess the performance and utilization of assets across departments to make recommendations for equipment allocation, ensuring that resources are distributed efficiently and effectively. Additionally, AI can be used to automate inventory management, ensuring that stock levels for medications and consumables are maintained at optimal levels without manual intervention.

Another significant innovation is the integration of mobile and handheld devices into asset management workflows. Healthcare staff can now use smartphones or tablets equipped with asset management apps to scan RFID tags, log equipment usage, and access real-time data on the status and location of assets. This mobile access increases operational flexibility, allowing clinicians and maintenance teams to update records or locate equipment on the go, reducing delays and improving overall workflow efficiency. By digitizing asset tracking and management, mobile solutions reduce the likelihood of errors associated with manual data entry and paperwork.

Why Is Healthcare Asset Management Critical for Reducing Costs, Improving Equipment Utilization, and Enhancing Patient Safety?

Healthcare Asset Management is critical for reducing costs, improving equipment utilization, and enhancing patient safety because it ensures that valuable assets are properly tracked, maintained, and deployed within healthcare facilities. One of the primary reasons healthcare asset management is so valuable is its ability to reduce unnecessary spending by preventing the over-purchasing or underutilization of equipment. In many hospitals, a lack of visibility into asset usage leads to duplicate purchases or the hoarding of equipment by departments, which increases costs. By providing real-time insights into asset location and usage, asset management systems help administrators make more informed purchasing decisions and ensure that existing equipment is fully utilized before new purchases are made.Improving equipment utilization is another major benefit of healthcare asset management. Hospitals often face bottlenecks in patient care due to inefficient allocation of resources, such as when critical equipment is unavailable at the point of care. Asset management systems eliminate these inefficiencies by tracking the availability of medical devices, beds, and other equipment, ensuring that they are quickly allocated to where they are needed most. This leads to faster patient turnover, more efficient workflows, and reduced waiting times, ultimately improving both patient outcomes and staff productivity. Additionally, asset management data can reveal patterns in equipment usage, allowing hospitals to redistribute resources to areas of high demand or invest in additional equipment where necessary.

Healthcare asset management also plays a vital role in enhancing patient safety by ensuring that all medical equipment is properly maintained and functioning correctly. Regular maintenance of medical devices, such as ventilators, dialysis machines, and defibrillators, is essential to prevent malfunctions that could lead to serious patient harm. Asset management systems automate maintenance schedules and provide reminders for upcoming service dates, ensuring that healthcare staff are alerted when equipment requires calibration or repair. This proactive approach reduces the risk of equipment failure during critical procedures, ensuring that patients receive safe and reliable care.

Infection control is another critical aspect of healthcare asset management. In hospitals, medical equipment is shared among multiple patients, increasing the risk of cross-contamination if assets are not properly sanitized between uses. Asset management systems can track the cleaning status of medical devices, ensuring that they undergo the necessary disinfection procedures before being reused. This tracking system helps reduce the spread of hospital-acquired infections (HAIs) and improves overall hygiene protocols within the facility, contributing to better patient safety outcomes.

Furthermore, healthcare asset management improves regulatory compliance, which is essential in ensuring that healthcare facilities meet industry standards and avoid penalties. Regulatory bodies such as the Joint Commission, the FDA, and other international organizations have strict guidelines on the maintenance, calibration, and tracking of medical devices. Asset management systems automatically generate reports and audit trails for each asset, providing detailed records of maintenance history, usage, and compliance with safety standards. This simplifies the process of passing regulatory inspections and ensures that hospitals are always prepared for audits, reducing the risk of fines or operational disruptions.

What Factors Are Driving the Growth of the Healthcare Asset Management Market?

Several key factors are driving the rapid growth of the Healthcare Asset Management market, including the increasing demand for cost control in healthcare, the rise of advanced technologies like IoT and AI, the need for real-time asset tracking, and the growing focus on patient safety and regulatory compliance. One of the primary drivers is the increasing pressure on healthcare facilities to control operational costs while maintaining high standards of patient care. Rising healthcare expenditures have forced hospitals to optimize their use of resources, and asset management solutions are seen as a way to reduce waste, prevent unnecessary purchases, and improve overall efficiency.The adoption of advanced technologies, such as IoT-enabled devices and RFID tracking, is another major factor contributing to the growth of the healthcare asset management market. These technologies offer real-time visibility into the location and status of assets, which is essential for maintaining efficient operations in large, complex healthcare environments. IoT and RFID solutions allow hospitals to monitor equipment usage and performance remotely, improving the accuracy and speed of asset tracking. The ability to predict maintenance needs and track equipment across multiple facilities also helps healthcare organizations reduce downtime and improve overall asset utilization.

The growing emphasis on real-time asset tracking is particularly important for improving patient care and streamlining hospital operations. Healthcare facilities need to ensure that critical equipment is available when and where it is needed, especially during emergencies or periods of high patient demand. The ability to track assets in real-time reduces delays in treatment, improves the efficiency of care delivery, and enhances the overall patient experience. This real-time capability is especially important for managing high-cost assets like MRI machines, surgical tools, and infusion pumps, which must be quickly located and serviced to prevent operational bottlenecks.

Another important factor driving the market's growth is the increasing focus on patient safety and regulatory compliance. As healthcare becomes more data-driven and regulations become stricter, hospitals must ensure that their medical devices and equipment are regularly maintained and compliant with safety standards. Healthcare asset management solutions automate maintenance schedules, generate compliance reports, and ensure that all assets are properly inspected and serviced according to regulatory requirements. The ability to streamline these processes helps hospitals avoid penalties, reduce risks to patient safety, and maintain a high standard of care.

Finally, the rise of telemedicine and remote healthcare services is influencing the healthcare asset management market. With the increasing adoption of virtual care, many healthcare providers are extending their services to patients' homes, which requires careful management of mobile medical equipment. Asset management solutions are helping healthcare providers track and maintain equipment that is used outside traditional hospital settings, ensuring that remote patients receive the same level of care and equipment reliability as those in hospitals.

Report Scope

The report analyzes the Healthcare Asset Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Radiofrequency Identification (RFID) Devices, Real-Time Location Systems (RTLS), Ultrasound & Infrared Tags); Application (Hospital Asset Management, Pharmaceutical Asset Management).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Radiofrequency Identification (RFID) Devices segment, which is expected to reach US$58 Billion by 2030 with a CAGR of 23.1%. The Real-Time Location Systems (RTLS) segment is also set to grow at 33.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.2 Billion in 2024, and China, forecasted to grow at an impressive 26.4% CAGR to reach $19.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Healthcare Asset Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Healthcare Asset Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Healthcare Asset Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airista Flow, CenTrak, Inc., Elpas Ltd., GE Healthcare, IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 22 companies featured in this Healthcare Asset Management market report include:

- Airista Flow

- CenTrak, Inc.

- Elpas Ltd.

- GE Healthcare

- IBM Corporation

- Intelligent InSites

- Sonitor Technologies AS

- Stanley Black & Decker, Inc.

- ThingMagic, Inc.

- Zebra Technologies Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airista Flow

- CenTrak, Inc.

- Elpas Ltd.

- GE Healthcare

- IBM Corporation

- Intelligent InSites

- Sonitor Technologies AS

- Stanley Black & Decker, Inc.

- ThingMagic, Inc.

- Zebra Technologies Corporation

Table Information

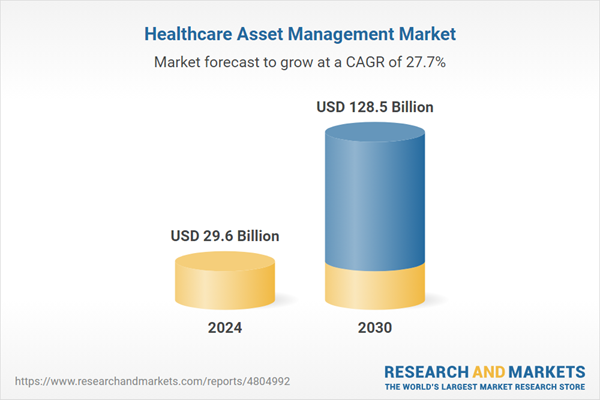

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.6 Billion |

| Forecasted Market Value ( USD | $ 128.5 Billion |

| Compound Annual Growth Rate | 27.7% |

| Regions Covered | Global |