Global Health Information Exchange (HIE) Market - Key Trends and Drivers Summarized

Why Is Health Information Exchange (HIE) Becoming Essential for Improving Patient Care and Streamlining Healthcare Systems?

Health Information Exchange (HIE) has become essential for improving patient care and streamlining operations within healthcare systems. But why is HIE so critical today? The healthcare industry is increasingly data-driven, with providers needing access to comprehensive patient records to deliver effective and timely care. HIE enables the secure, electronic sharing of patient information across different healthcare providers, hospitals, labs, and pharmacies, ensuring that healthcare professionals have access to accurate and up-to-date medical histories, treatment plans, and lab results, regardless of where the patient was previously treated.HIE improves care coordination by reducing the need for redundant tests, preventing medication errors, and facilitating faster decision-making. This is particularly vital in emergency situations or when patients move between different healthcare facilities. Additionally, HIE enhances communication between care teams, enabling a more collaborative approach to managing complex cases or chronic conditions. By integrating electronic health records (EHR) across various systems, HIE ensures that patients receive better, more personalized care, reducing the risk of medical errors and improving overall healthcare outcomes.

How Are Technological Advancements and Innovations Improving the Efficiency and Security of Health Information Exchange (HIE) Systems?

Technological advancements are significantly improving the efficiency, security, and interoperability of Health Information Exchange (HIE) systems, making them more effective in connecting healthcare providers. One of the most impactful innovations is the development of cloud-based HIE platforms, which allow for seamless data sharing across various healthcare organizations. Cloud infrastructure provides the scalability needed to handle large volumes of patient data while reducing the costs associated with traditional on-premise systems. With cloud-based HIE solutions, healthcare providers can access real-time data, even across geographically dispersed locations, improving patient care by ensuring that medical information is readily available when needed.Another key advancement is the integration of advanced interoperability standards, such as Fast Healthcare Interoperability Resources (FHIR) and Health Level Seven (HL7). These standards enable different electronic health record (EHR) systems to communicate more effectively, allowing for smoother data exchange between hospitals, clinics, and labs. By standardizing the way health data is transmitted, FHIR and HL7 reduce barriers to data sharing, making it easier for healthcare providers to access complete and accurate patient records, regardless of the systems they use. This level of interoperability is crucial for eliminating information silos and ensuring continuity of care, especially for patients with complex medical histories.

Security is another area where technological advancements have made a significant impact. Given the sensitive nature of health information, robust security measures are essential in HIE systems to protect patient data from breaches and unauthorized access. Encryption techniques, secure access protocols, and multi-factor authentication are now standard features in HIE platforms, ensuring that data is protected both in transit and at rest. Additionally, blockchain technology is emerging as a potential solution for enhancing the security and transparency of HIE systems. Blockchain's decentralized ledger system ensures that all data exchanges are traceable and tamper-proof, providing an extra layer of security for health information.

Machine learning and artificial intelligence (AI) are also playing a growing role in enhancing the efficiency of HIE systems. AI-driven analytics can process vast amounts of health data to identify patterns, predict patient outcomes, and offer personalized treatment recommendations. Machine learning algorithms can streamline the sorting and integration of patient data, helping healthcare providers focus on the most relevant information and reducing administrative burdens. AI can also help identify data discrepancies or inconsistencies in patient records, ensuring that the information shared through HIE systems is accurate and reliable.

The rise of mobile health (mHealth) technologies is further improving the reach and accessibility of HIE. Patients can now use mobile devices and apps to access their medical records, communicate with healthcare providers, and even share personal health data with their care teams. This patient-centered approach to data sharing empowers individuals to take more control of their health while ensuring that providers have a comprehensive view of their medical history. The integration of mHealth into HIE systems enables better patient engagement, improved chronic disease management, and more proactive healthcare delivery.

Why Is Health Information Exchange (HIE) Critical for Enhancing Care Coordination, Reducing Costs, and Improving Patient Outcomes?

Health Information Exchange (HIE) is critical for enhancing care coordination, reducing healthcare costs, and improving patient outcomes because it facilitates the seamless sharing of vital medical information across different healthcare providers and organizations. One of the main reasons HIE is so valuable is its ability to improve care coordination by ensuring that all members of a patient's care team - whether in primary care, specialty clinics, or emergency services - have access to the same up-to-date information. This access enables healthcare providers to make more informed decisions, avoid duplicative tests or procedures, and coordinate treatment plans more effectively. For example, if a patient is referred to a specialist, the specialist can instantly access the patient's full medical history, avoiding delays and ensuring continuity of care.Reducing healthcare costs is another critical benefit of HIE. By improving access to comprehensive patient information, HIE helps eliminate unnecessary diagnostic tests, reduce hospital readmissions, and prevent medical errors, all of which contribute to lowering overall healthcare expenses. For instance, when a hospital has access to a patient's prior imaging or lab results through an HIE network, they can avoid ordering redundant tests, saving both time and resources. Furthermore, HIE systems reduce administrative burdens by automating data sharing, which minimizes paperwork, cuts down on manual errors, and streamlines billing processes.

HIE also plays a crucial role in improving patient outcomes by enabling healthcare providers to deliver more personalized and accurate care. With comprehensive, real-time access to patient data - including medications, allergies, lab results, and prior treatments - healthcare providers can make more precise diagnoses and tailor treatment plans to individual patient needs. This is especially important for patients with chronic conditions or complex medical histories, where timely access to accurate data can prevent complications, improve treatment adherence, and enhance long-term health outcomes. For example, a diabetic patient with multiple specialists will benefit from an HIE system that ensures all care providers have the latest information about their blood sugar levels, medication changes, and dietary recommendations.

Additionally, HIE systems reduce the risk of medication errors, one of the leading causes of preventable harm in healthcare. When a patient's medication history is readily available, healthcare providers can avoid prescribing drugs that may interact negatively with current medications, ensuring safer treatment protocols. In emergency situations, where patients may be unable to provide their medical history, HIE can be life-saving by giving emergency responders and physicians instant access to critical information, allowing for faster and more accurate treatment decisions.

The impact of HIE on population health management is another reason why it is so critical for improving healthcare outcomes. By aggregating data across multiple providers and institutions, HIE systems enable healthcare organizations to analyze trends, track the spread of diseases, and identify at-risk populations. This data-driven approach helps public health officials and healthcare providers develop targeted interventions, manage outbreaks, and allocate resources more effectively. In managing chronic diseases like diabetes or hypertension, HIE allows providers to track patient progress over time, ensuring better adherence to treatment plans and reducing the long-term burden on healthcare systems.

What Factors Are Driving the Growth of the Health Information Exchange (HIE) Market?

Several key factors are driving the rapid growth of the Health Information Exchange (HIE) market, including the increasing need for interoperability between healthcare systems, the rise of digital health initiatives, the push for improved patient outcomes, and evolving government regulations. One of the primary drivers is the demand for greater interoperability between electronic health record (EHR) systems. Healthcare organizations often operate on different EHR platforms, creating barriers to seamless data sharing. HIE solves this problem by providing a standardized, secure way for different systems to exchange patient information. As healthcare providers, hospitals, and clinics aim to enhance care coordination and improve efficiency, the demand for HIE platforms that bridge these gaps is on the rise.The global rise of digital health initiatives is another significant factor fueling the growth of the HIE market. Governments and healthcare systems worldwide are increasingly investing in digital health technologies to modernize healthcare delivery, improve accessibility, and reduce costs. HIE plays a critical role in these initiatives by enabling real-time data exchange between healthcare providers, patients, and public health authorities. As digital health adoption accelerates, HIE will continue to be a cornerstone of healthcare modernization efforts, supporting the integration of various health technologies, including telemedicine, remote monitoring, and AI-driven diagnostics.

Improving patient outcomes is a key focus for healthcare providers, and HIE is playing an important role in achieving this goal. The ability to share comprehensive and up-to-date patient data across different care teams ensures that providers can make better decisions, leading to more accurate diagnoses and improved treatment plans. HIE also enables proactive care by allowing for early intervention in patients who are at risk of developing chronic conditions or complications. As healthcare providers strive to deliver more personalized and effective care, HIE systems are increasingly being seen as a valuable tool for enhancing patient outcomes and improving the overall quality of care.

Evolving government regulations and healthcare policies are another major factor driving HIE market growth. In many countries, governments have introduced mandates requiring healthcare organizations to adopt interoperable health IT systems to improve care coordination and patient safety. In the U.S., for example, initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act and the 21st Century Cures Act have incentivized the adoption of EHRs and HIE systems to promote better data sharing. Similarly, the European Union has implemented policies to encourage the digitalization of healthcare services, driving the demand for HIE solutions across the region. As these regulatory frameworks continue to evolve, healthcare organizations are investing more in HIE technologies to comply with new standards and improve care delivery.

The growing focus on value-based care models is another key driver of HIE adoption. Value-based care emphasizes improving patient outcomes while controlling costs, shifting the focus from volume-based services to quality of care. HIE supports this shift by enabling healthcare providers to coordinate care more effectively, avoid unnecessary tests, and reduce hospital readmissions, all of which contribute to better outcomes at lower costs. As more healthcare systems transition to value-based care models, the demand for HIE systems that can facilitate these objectives will continue to grow.

In conclusion, the growth of the Health Information Exchange (HIE) market is driven by increasing interoperability needs, the rise of digital health, a focus on improving patient outcomes, and government regulations aimed at promoting better data sharing and healthcare delivery. As healthcare systems strive to become more efficient, patient-centric, and cost-effective, HIE will remain an essential tool for ensuring that patient information is shared seamlessly and securely across the healthcare continuum, enhancing care coordination and improving health outcomes globally.

Report Scope

The report analyzes the Health Information Exchange (HIE) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Set-Up Type (Private, Public); Type (Query-Based Exchange, Consumer-Mediated Exchange, Directed Exchange); Application (Web Portal Development, Workflow Management, Secure Messaging, Internal Interfacing, Other Applications); End-Use (Healthcare Providers, Healthcare Payers, Pharmacies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Web Portal Development Application segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of 10%. The Workflow Management Application segment is also set to grow at 10.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $654.9 Million in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $730.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Health Information Exchange (HIE) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Health Information Exchange (HIE) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Health Information Exchange (HIE) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allscripts Healthcare Solutions, Inc., Arcadia Solutions LLC, Cerner Corporation, Covisint Corp., eClinicalWorks LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Health Information Exchange (HIE) market report include:

- Allscripts Healthcare Solutions, Inc.

- Arcadia Solutions LLC

- Cerner Corporation

- Covisint Corp.

- eClinicalWorks LLC

- Infor

- InterSystems Corporation

- Medicity, Inc.

- NextGen Healthcare Information Systems LLC

- Optum, Inc.

- Orion Health

- RelayHealth

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allscripts Healthcare Solutions, Inc.

- Arcadia Solutions LLC

- Cerner Corporation

- Covisint Corp.

- eClinicalWorks LLC

- Infor

- InterSystems Corporation

- Medicity, Inc.

- NextGen Healthcare Information Systems LLC

- Optum, Inc.

- Orion Health

- RelayHealth

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

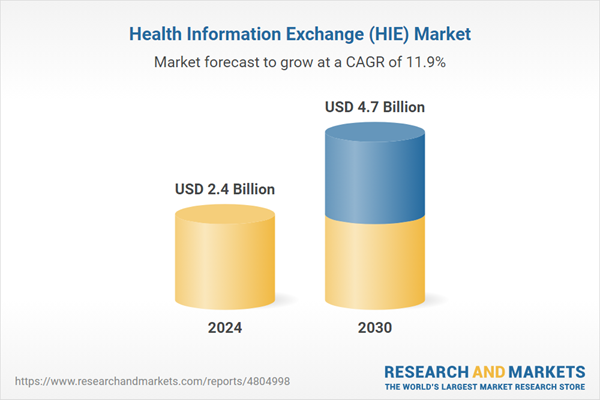

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |