Global Harmonic Filters Market - Key Trends and Drivers Summarized

Why Are Harmonic Filters Becoming Essential for Power Quality and Electrical Efficiency in Modern Systems?

Harmonic filters have become essential for improving power quality and ensuring electrical efficiency in modern industrial and commercial systems. But why are harmonic filters so critical today? As industries and businesses increasingly rely on sophisticated electrical equipment - such as variable frequency drives (VFDs), uninterruptible power supplies (UPS), and advanced automation systems - these devices introduce harmonics into the electrical network. Harmonics are electrical distortions that can degrade the quality of the power supply, leading to inefficiencies, overheating, equipment malfunction, and even system failures.Harmonic filters are designed to mitigate these unwanted electrical disturbances by reducing harmonic distortion, ensuring that power flows smoothly and efficiently. By filtering out harmonics, these devices prevent issues like voltage drops, excessive heating of transformers and cables, and reduced equipment lifespan. In sectors such as manufacturing, data centers, healthcare, and utilities, harmonic filters play a vital role in ensuring reliable and stable electrical operations, reducing downtime, and lowering energy costs.

How Are Technological Advancements Improving the Efficiency and Flexibility of Harmonic Filters?

Technological advancements are significantly improving the efficiency, flexibility, and performance of harmonic filters, making them more effective at addressing power quality issues across various applications. One of the most important innovations is the development of active harmonic filters (AHFs), which dynamically adapt to varying loads and electrical conditions in real time. Unlike passive harmonic filters, which are tuned to specific frequencies and may require manual adjustment, AHFs use advanced digital controllers to continuously monitor and correct harmonic distortion as it occurs. This real-time responsiveness makes them ideal for environments with fluctuating loads, such as manufacturing plants or commercial buildings with varying electrical demands.Another key advancement is the integration of smart monitoring and diagnostic capabilities into harmonic filters. Modern filters now come equipped with built-in sensors and monitoring systems that provide real-time data on power quality, harmonic levels, and system performance. This data can be accessed remotely through digital platforms, enabling facility managers to proactively manage power quality and identify issues before they cause system failures or inefficiencies. These smart filters also allow for predictive maintenance, alerting operators when adjustments or repairs are needed, thereby preventing costly downtime and improving overall system reliability.

Improvements in energy efficiency have also made harmonic filters more attractive for businesses looking to reduce operational costs. Advanced filters are now designed to minimize energy losses during operation, ensuring that they consume less power while filtering out harmonics. This is especially important in large-scale operations where energy efficiency is crucial for reducing overhead costs and meeting sustainability goals. By optimizing the efficiency of electrical systems, modern harmonic filters contribute to lower energy consumption and improved sustainability, which aligns with the growing emphasis on environmental responsibility in industries such as manufacturing, data centers, and utilities.

Modular design is another technological improvement that enhances the flexibility of harmonic filters. Many filters are now designed with modular components, allowing for easy installation, scaling, and customization based on the specific needs of a facility. This modular approach enables businesses to add or remove filtering capacity as their electrical demands evolve, making harmonic filters adaptable to a wide range of applications. Whether it's a small commercial setup or a large industrial plant, modular filters can be tailored to meet the unique harmonic mitigation requirements of different environments, providing a cost-effective and scalable solution.

Furthermore, advancements in hybrid filtering technologies combine the benefits of both passive and active harmonic filters. These hybrid systems offer the precision and adaptability of active filters while retaining the robustness and simplicity of passive designs. Hybrid harmonic filters can handle both high and low-frequency harmonics, making them highly effective in environments where a wide range of electrical disturbances occur. This innovation expands the range of applications for harmonic filters, ensuring that they can handle even the most challenging power quality issues.

Why Are Harmonic Filters Critical for Ensuring Electrical Reliability, Reducing Equipment Wear, and Lowering Energy Costs?

Harmonic filters are critical for ensuring electrical reliability, reducing equipment wear, and lowering energy costs because they directly address the harmful effects of harmonic distortion, which can severely impact electrical systems. One of the main reasons harmonic filters are so important is their ability to improve power quality by filtering out harmonic frequencies that cause distortions in the electrical waveform. Poor power quality, characterized by harmonic distortion, can lead to voltage fluctuations, frequent system failures, and equipment malfunctions. By installing harmonic filters, businesses can ensure that their electrical systems operate smoothly and without interruptions, leading to greater reliability in day-to-day operations.Harmonic filters are also essential for protecting sensitive equipment from the damaging effects of harmonics. Electrical devices such as motors, transformers, and generators are vulnerable to the heat and stress caused by harmonic distortion. Over time, this can lead to overheating, excessive vibration, and premature failure of equipment, resulting in costly repairs or replacements. Harmonic filters help reduce the strain on these devices by eliminating the harmonic distortions that cause such wear and tear. In doing so, they extend the lifespan of critical electrical components, reduce maintenance requirements, and prevent unplanned downtime.

Reducing energy costs is another significant benefit of harmonic filters. Harmonics introduce inefficiencies into electrical systems, causing components like transformers and cables to work harder than necessary and consume more energy. This extra strain leads to energy losses, increased operational costs, and reduced overall system efficiency. By removing harmonics from the electrical network, harmonic filters help optimize energy consumption, allowing businesses to achieve more efficient use of power and lowering utility bills. This is particularly important in energy-intensive industries, such as manufacturing or data centers, where even small improvements in power efficiency can lead to substantial cost savings.

In addition to reducing direct energy costs, harmonic filters help improve the overall power factor of electrical systems. Power factor is a measure of how efficiently electrical power is being used, and low power factors are often caused by harmonics. A poor power factor can result in higher electricity charges from utility providers, as well as the need for larger, more expensive electrical infrastructure. By improving the power factor through harmonic filtration, businesses can avoid penalties, reduce the need for oversized equipment, and ensure a more efficient use of their electrical systems.

Furthermore, harmonic filters contribute to meeting regulatory standards and reducing environmental impact. In many regions, electrical utilities enforce strict limits on harmonic distortion, and failing to comply with these regulations can result in fines or restrictions on power usage. By mitigating harmonics, harmonic filters help businesses meet these compliance requirements, ensuring smooth operations without regulatory complications. Additionally, by improving energy efficiency and reducing losses, harmonic filters indirectly contribute to lowering a facility's carbon footprint, supporting sustainability initiatives and environmental goals.

What Factors Are Driving the Growth of the Harmonic Filter Market?

Several key factors are driving the rapid growth of the harmonic filter market, including the increasing adoption of non-linear electrical loads, the rising demand for energy efficiency, the growing use of automation technologies, and the need for compliance with power quality standards. One of the primary drivers is the widespread use of non-linear loads - such as variable frequency drives (VFDs), rectifiers, and switching power supplies - in industrial and commercial settings. These devices are essential for improving efficiency and control in modern electrical systems, but they also generate significant harmonic distortion. As industries continue to adopt these technologies, the demand for harmonic filters to mitigate their impact on power quality is increasing.The rising emphasis on energy efficiency is another major factor contributing to market growth. Businesses are under increasing pressure to reduce energy consumption and lower operational costs, particularly as energy prices rise and sustainability becomes a higher priority. Harmonic filters play a crucial role in achieving these goals by improving the efficiency of electrical systems, minimizing energy losses, and optimizing power consumption. As a result, more industries are investing in harmonic filters to improve energy performance and meet both financial and environmental objectives.

The growing use of automation technologies, particularly in manufacturing, is further driving the demand for harmonic filters. Automated systems rely heavily on electronic devices such as VFDs and programmable logic controllers (PLCs), which introduce harmonics into the electrical network. As factories and plants increasingly transition to automated processes, harmonic filters are becoming essential for ensuring the stability and reliability of these systems. Without proper harmonic mitigation, automation systems may suffer from malfunctions, reduced efficiency, or even damage, making harmonic filters a necessary investment for businesses looking to leverage automation technologies.

Another important driver is the need for compliance with power quality regulations. Electrical utilities and government agencies in many regions enforce strict limits on harmonic distortion, as high levels of harmonics can negatively affect the grid and other connected systems. Non-compliance with these regulations can result in penalties, reduced power availability, or even disconnection from the electrical grid. By installing harmonic filters, businesses can ensure compliance with power quality standards, avoid penalties, and maintain uninterrupted access to electricity.

The increasing integration of renewable energy sources into the power grid is also contributing to the growth of the harmonic filter market. Renewable energy systems, such as solar panels and wind turbines, often use power electronics like inverters, which can introduce harmonic distortions into the grid. As the world transitions to cleaner energy sources, harmonic filters are becoming necessary to mitigate the power quality issues associated with renewable energy generation, ensuring the stability and reliability of the grid.

In conclusion, the growth of the harmonic filter market is driven by the increasing adoption of non-linear electrical loads, the demand for improved energy efficiency, the rise of automation technologies, and the need for regulatory compliance. As industries and businesses seek to improve the reliability, efficiency, and sustainability of their electrical systems, harmonic filters will continue to play a critical role in maintaining power quality and optimizing electrical performance across a wide range of applications.

Report Scope

The report analyzes the Harmonic Filters market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Active, Passive); Voltage Level (Low, Medium, High); End-Use (Industrial, Commercial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passive Harmonic Filters segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of 6.6%. The Active Harmonic Filters segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $369.2 Million in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $310.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Harmonic Filters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Harmonic Filters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Harmonic Filters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Arteche, AVX Corporation, Baron Power Ltd., CG Power and Industrial Solutions Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Harmonic Filters market report include:

- ABB Group

- Arteche

- AVX Corporation

- Baron Power Ltd.

- CG Power and Industrial Solutions Ltd.

- Clariant Power System Ltd.

- Comsys AB

- Danfoss A/S

- Eaton Corporation PLC

- Enspec Power Ltd.

- Inphase Power Technologies Private Limited

- Treffer Power System Solutions Pvt. Ltd

- Larsen & Toubro Ltd.

- LPi-NZ Ltd.

- Mesta Electronic Inc.

- MIRUS International Inc.

- MTE Corporation

- Rem Electromach Pvt. Ltd.

- Reo AG

- Schaffner Holding AG

- Schneider Electric SA

- Siemens AG

- TCI, LLC

- TDK Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Arteche

- AVX Corporation

- Baron Power Ltd.

- CG Power and Industrial Solutions Ltd.

- Clariant Power System Ltd.

- Comsys AB

- Danfoss A/S

- Eaton Corporation PLC

- Enspec Power Ltd.

- Inphase Power Technologies Private Limited

- Treffer Power System Solutions Pvt. Ltd

- Larsen & Toubro Ltd.

- LPi-NZ Ltd.

- Mesta Electronic Inc.

- MIRUS International Inc.

- MTE Corporation

- Rem Electromach Pvt. Ltd.

- Reo AG

- Schaffner Holding AG

- Schneider Electric SA

- Siemens AG

- TCI, LLC

- TDK Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 209 |

| Published | February 2026 |

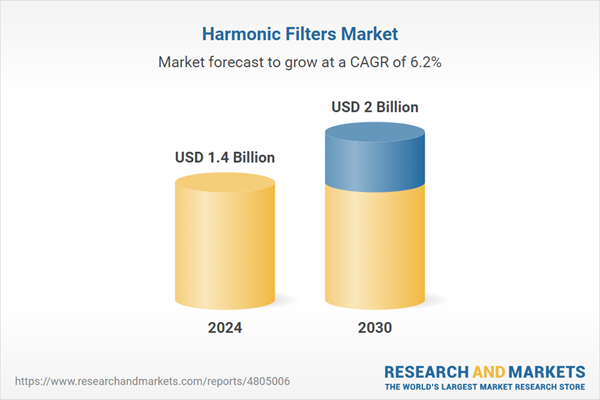

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |