Global Guidewires Market - Key Trends and Drivers Summarized

Why Are Guidewires Becoming Essential in Minimally Invasive Procedures and Medical Interventions?

Guidewires have become indispensable in modern medicine, particularly in minimally invasive procedures and various medical interventions. But why are guidewires so critical today? Guidewires are thin, flexible wires used by surgeons and interventionalists to navigate through blood vessels, the gastrointestinal tract, or other bodily pathways during procedures like angioplasty, stent placement, or catheterization. These procedures require precision, and guidewires act as a navigational tool that helps doctors access hard-to-reach areas of the body with minimal invasiveness, reducing recovery times and improving patient outcomes.Minimally invasive procedures are increasingly preferred over traditional open surgeries due to their lower risk, reduced recovery time, and less scarring. Guidewires enable these procedures by allowing medical devices such as catheters, stents, or balloons to be safely and accurately positioned within the body. From treating cardiovascular conditions to performing endoscopic procedures, guidewires play a crucial role in ensuring that these medical devices are guided to their target locations with precision. With the rising prevalence of chronic diseases like cardiovascular issues and the growing demand for minimally invasive treatments, guidewires are becoming essential tools in the healthcare landscape.

How Are Technological Advancements Improving the Precision and Safety of Guidewires?

Technological advancements are significantly enhancing the precision, safety, and effectiveness of guidewires, making them more reliable for a broad range of medical procedures. One of the most notable advancements is the development of hydrophilic and hydrophobic coatings on guidewires. Hydrophilic coatings, in particular, make the guidewire surface slick and slippery when in contact with fluids, reducing friction and making it easier to navigate through tortuous or narrow anatomical pathways. This feature is especially valuable in delicate procedures such as vascular interventions or when treating complex blockages, where precision and gentle maneuvering are crucial to avoid damaging blood vessels or surrounding tissues.Another key advancement is the innovation of steerable guidewires. Traditional guidewires had limited directional control, but modern steerable guidewires allow physicians to precisely control the direction of the wire's tip, enabling them to navigate complex anatomy with greater accuracy. This is especially important in procedures like coronary angioplasty, where the guidewire needs to navigate through tight or curved arteries. Steerable guidewires reduce the need for multiple guidewire insertions and adjustments, thereby minimizing procedural time and improving safety by reducing the risk of complications like vessel perforation or dissection.

The development of guidewires with improved radiopacity has also enhanced procedural safety and efficacy. Radiopaque materials, such as platinum or tungsten, are incorporated into guidewires to make them visible under fluoroscopy or X-ray imaging. This visibility allows physicians to track the exact position of the guidewire in real-time, ensuring that it is correctly placed and reducing the risk of misplacement. This is particularly useful in procedures like angiography or the placement of stents, where precise positioning is essential for the success of the procedure. Modern guidewires offer a combination of flexibility and rigidity, providing a balance of strength for navigating through tough blockages and flexibility for accessing delicate areas without causing damage.

Another important advancement is the use of advanced materials like nitinol in guidewire construction. Nitinol, a shape-memory alloy known for its flexibility and resilience, is increasingly being used in guidewires due to its ability to bend and return to its original shape without breaking. This material allows guidewires to traverse challenging anatomical structures while maintaining their integrity, reducing the risk of wire breakage during procedures. Nitinol guidewires are particularly valuable in long, complex interventions where durability and flexibility are crucial.

Additionally, guidewires are now being designed with specialty tips and customized configurations for specific medical procedures. For example, tapered-tip guidewires are used in coronary procedures, allowing them to cross tight lesions or blockages more easily. Dual-core guidewires, which have varying stiffness along their length, provide added support in challenging anatomical areas, making them suitable for procedures that require both flexibility and strength. These specialized designs ensure that guidewires are optimized for different medical applications, improving procedural outcomes.

Why Are Guidewires Critical for Minimally Invasive Procedures, Reducing Complications, and Enhancing Patient Outcomes?

Guidewires are critical for minimally invasive procedures, reducing complications, and enhancing patient outcomes because they provide a safe, precise, and controlled way to navigate medical devices through the body. One of the primary benefits of guidewires is their ability to facilitate minimally invasive procedures, which are preferred over traditional open surgeries due to their lower risk profile and quicker recovery times. In minimally invasive interventions, guidewires serve as a roadmap, guiding catheters, stents, and other medical devices to target areas without the need for large incisions. This reduces trauma to surrounding tissues and organs, leading to faster healing, less pain, and shorter hospital stays for patients.By enabling more precise control over the placement of medical devices, guidewires also play a critical role in reducing procedural complications. In procedures like angioplasty, for instance, the accurate positioning of a balloon or stent within a narrowed artery is essential for the success of the treatment. Guidewires allow doctors to navigate tight, tortuous vessels with minimal risk of perforation or injury to the vessel walls. This precision reduces the likelihood of complications such as bleeding, vessel dissection, or misplacement of the device, ensuring a safer procedure and improving the patient's overall prognosis.

Guidewires also enhance procedural efficiency, which directly contributes to better patient outcomes. In complex medical procedures, time is of the essence, and reducing the time spent in surgery or intervention can lead to improved recovery rates and lower the risk of infections or other complications. Advanced guidewires, with features such as steerability, radiopacity, and hydrophilic coatings, allow physicians to navigate challenging anatomy more quickly and accurately, reducing procedural time. For patients undergoing emergency interventions, such as those for acute coronary syndrome or stroke, the speed and efficiency of guidewire-guided procedures can make a critical difference in survival and recovery outcomes.

In addition to facilitating minimally invasive procedures, guidewires are essential in treating chronic conditions like peripheral artery disease (PAD) and coronary artery disease (CAD), where blockages in the blood vessels restrict blood flow and require intervention to restore circulation. Guidewires enable the safe and effective delivery of treatment modalities, such as angioplasty balloons or stents, directly to the site of the blockage. By restoring blood flow through these minimally invasive techniques, guidewires help prevent the progression of serious complications like heart attacks, strokes, or amputations, greatly enhancing long-term patient outcomes.

Guidewires also contribute to reducing the need for repeated procedures. In many cases, accurate and successful placement of medical devices in a single intervention eliminates the need for follow-up surgeries or additional interventions, reducing the overall healthcare burden on patients. Furthermore, the durability of modern guidewires - thanks to advancements in materials like nitinol - ensures that they perform reliably even in long and complex procedures, minimizing the risk of device failure or breakage, which can lead to complications or the need for further medical interventions.

What Factors Are Driving the Growth of the Guidewire Market?

Several key factors are driving the rapid growth of the guidewire market, including the increasing prevalence of cardiovascular diseases, the rising demand for minimally invasive procedures, technological advancements in medical devices, and the expansion of healthcare infrastructure globally. First, the growing incidence of cardiovascular diseases, such as coronary artery disease, peripheral artery disease, and strokes, is a major driver of the guidewire market. As these conditions become more prevalent due to aging populations, sedentary lifestyles, and rising rates of diabetes and obesity, there is an increasing need for medical interventions like angioplasty and stent placement. Guidewires are essential tools in these procedures, and their demand is expected to rise as cardiovascular diseases continue to affect a significant portion of the global population.Second, the rising demand for minimally invasive procedures is a major factor contributing to the growth of the guidewire market. Patients and healthcare providers are increasingly opting for minimally invasive techniques over traditional open surgeries due to the lower risk, reduced recovery times, and better cosmetic outcomes associated with these procedures. Guidewires are fundamental to minimally invasive techniques, allowing physicians to perform complex interventions with greater precision and control. As the trend toward minimally invasive procedures continues to grow across various medical specialties, from cardiology to urology, the demand for advanced guidewires is expected to increase.

Technological advancements in guidewire design and materials are also driving market growth. Innovations such as hydrophilic coatings, steerable guidewires, and radiopaque materials have made guidewires safer and more effective, leading to their broader adoption in complex procedures. For instance, the development of specialized guidewires for neurovascular and peripheral interventions has opened new possibilities for treating conditions like aneurysms or peripheral artery blockages that were previously difficult to address. Additionally, the introduction of bioabsorbable guidewires, which dissolve after completing their function, is an exciting innovation that could reduce the risk of long-term complications and further boost demand in the market.

The expansion of healthcare infrastructure in emerging markets is another significant factor contributing to the growth of the guidewire market. Countries in regions such as Asia-Pacific, Latin America, and the Middle East are investing heavily in healthcare infrastructure to meet the growing demand for advanced medical treatments. As access to healthcare improves in these regions, there is a corresponding increase in the number of medical procedures requiring guidewires. Additionally, rising awareness about the benefits of early diagnosis and treatment of cardiovascular diseases is driving demand for interventional procedures, further fueling the growth of the guidewire market.

Moreover, the aging population globally is another key driver of the guidewire market. As populations age, the incidence of conditions requiring medical interventions, such as cardiovascular diseases, increases. The elderly are more likely to suffer from diseases like atherosclerosis, heart disease, and peripheral artery disease, all of which may require the use of guidewires during treatment. As a result, the growing aging population is expected to continue driving demand for guidewires in both developed and developing regions.

In conclusion, the growth of the guidewire market is driven by the rising prevalence of cardiovascular diseases, increasing demand for minimally invasive procedures, technological innovations in guidewire design, and the expansion of healthcare infrastructure. As medical technology advances and healthcare providers focus on improving patient outcomes through safer, more efficient procedures, the demand for guidewires is expected to continue growing. With ongoing innovations and their critical role in numerous medical interventions, guidewires are poised to remain a cornerstone of modern medicine, ensuring precision and safety in a wide range of treatments.

Report Scope

The report analyzes the Guidewires market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Stainless Steel, Nitinol, Hybrid, Other Materials); Product (Coronary Guidewires, Peripheral Guidewires, Urology Guidewires, Neurovascular Guidewires, Other Products); End-Use (Hospitals, Diagnostic Centers & Surgical Centers, Ambulatory Surgery Centers, Research Laboratories & Academic Institutes).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coronary Guidewires segment, which is expected to reach US$402.6 Million by 2030 with a CAGR of 4.9%. The Peripheral Guidewires segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $185 Million in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $186.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Guidewires Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Guidewires Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Guidewires Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, AngioDynamics, Inc., Asahi Intecc Co., Ltd., B. Braun Melsungen AG, BARD, A Becton, Dickinson Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Guidewires market report include:

- Abbott Laboratories

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group, Inc.

- Johnson & Johnson

- Medtronic PLC

- Merit Medical Systems, Inc.

- Olympus Corporation

- Stryker Corporation

- Teleflex Inc.

- Terumo Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group, Inc.

- Johnson & Johnson

- Medtronic PLC

- Merit Medical Systems, Inc.

- Olympus Corporation

- Stryker Corporation

- Teleflex Inc.

- Terumo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

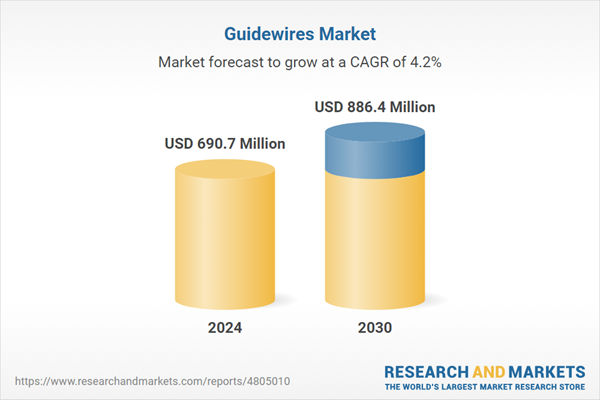

| Estimated Market Value ( USD | $ 690.7 Million |

| Forecasted Market Value ( USD | $ 886.4 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |