Global Government Cloud Market - Key Trends and Drivers Summarized

Why Is Government Cloud Becoming Critical for Public Sector Digital Transformation and Data Security?

Government cloud is becoming essential for public sector digital transformation and data security as governments worldwide modernize their IT infrastructure to improve efficiency, agility, and citizen services. But why is government cloud so critical today? Government cloud refers to cloud computing solutions tailored specifically to meet the unique requirements of government agencies, including stringent security, privacy, and regulatory compliance standards. By leveraging cloud technology, government agencies can store, manage, and process large volumes of data while ensuring that sensitive information is protected from cyber threats.One of the main reasons government cloud is so crucial is the need for enhanced cybersecurity. Governments handle sensitive data related to national security, public safety, healthcare, and citizen information, which makes them prime targets for cyberattacks. Cloud service providers specializing in government cloud solutions offer advanced security protocols, encryption, and compliance measures to ensure that government data is protected against breaches and unauthorized access. Additionally, cloud platforms provide governments with greater flexibility and scalability, enabling them to quickly adapt to changing demands, such as during natural disasters or public health crises, where rapid response and data analysis are essential.

Furthermore, government cloud enables better collaboration and communication between departments and agencies, facilitating the seamless exchange of data and resources. This, in turn, improves the quality of public services, allowing governments to offer more efficient, citizen-centric solutions. As public sector organizations worldwide embrace digital transformation, the government cloud is becoming an integral part of their strategy to modernize IT infrastructure, reduce costs, and enhance public service delivery.

How Are Technological Advancements Accelerating the Adoption and Effectiveness of Government Cloud?

Technological advancements are accelerating the adoption and effectiveness of government cloud solutions by making cloud platforms more secure, scalable, and specialized for the unique needs of the public sector. One of the most significant advancements is the development of hybrid and multi-cloud architectures, which allow governments to adopt a flexible approach to cloud computing. Hybrid cloud solutions enable government agencies to maintain sensitive data and applications on private clouds while leveraging the scalability and cost-efficiency of public cloud platforms for less sensitive workloads. This approach allows governments to balance security with flexibility, ensuring that they can meet regulatory requirements while benefiting from cloud innovations.Another critical advancement is the integration of artificial intelligence (AI) and machine learning (ML) into government cloud platforms. AI and ML tools can analyze vast amounts of data to identify patterns, trends, and anomalies, improving decision-making and operational efficiency for government agencies. For instance, AI-driven analytics can help law enforcement agencies analyze crime data, healthcare systems predict disease outbreaks, or city planners optimize traffic flow in smart cities. These capabilities enable governments to harness data more effectively, leading to smarter, data-driven public services. AI and ML also help improve cybersecurity by detecting and responding to cyber threats in real time, providing enhanced protection for government networks and data.

The rise of edge computing is also enhancing the performance of government cloud solutions. Edge computing allows data processing to occur closer to the source, reducing latency and improving the speed of data analysis. This is particularly valuable for government agencies that rely on real-time data, such as emergency services, defense, and transportation systems. By integrating edge computing with cloud platforms, governments can deploy faster, more reliable services that respond to real-time events, such as disaster recovery, traffic monitoring, or public safety operations.

Cloud-based disaster recovery and continuity planning solutions are another major advancement that is driving the adoption of government cloud. Government agencies must be prepared to handle unforeseen events such as cyberattacks, natural disasters, or pandemics. Cloud-based disaster recovery solutions ensure that data is backed up and easily recoverable, minimizing downtime and maintaining the continuity of essential public services. These solutions offer governments the ability to quickly restore systems and data in the event of a crisis, helping them provide uninterrupted services to citizens.

Additionally, advancements in cloud security, such as zero-trust architectures, data encryption, and automated compliance tools, have made government cloud platforms more secure than ever before. Zero-trust models ensure that every user, device, and application is continuously verified before being granted access to sensitive data, reducing the risk of insider threats or breaches. Automated compliance tools help government agencies navigate complex regulatory frameworks by ensuring that their cloud environments meet the necessary security and privacy standards, such as those outlined in the Federal Risk and Authorization Management Program (FedRAMP) or the General Data Protection Regulation (GDPR). These innovations are helping governments maintain a high level of security while adopting cloud technologies.

Why Is Government Cloud Critical for Efficiency, Scalability, and Cost Savings in Public Sector Operations?

Government cloud is critical for enhancing efficiency, scalability, and cost savings in public sector operations because it offers a more flexible and cost-effective approach to managing IT infrastructure compared to traditional, on-premises data centers. One of the key benefits of government cloud is the ability to scale resources up or down based on demand, providing governments with the agility to respond quickly to changing needs. This scalability is especially important during emergencies or public health crises, where the demand for data processing and analysis can spike rapidly. For example, during the COVID-19 pandemic, many governments turned to cloud platforms to manage public health data, enable remote work for government employees, and provide real-time updates to citizens.The flexibility of cloud computing also allows governments to modernize their operations without the need for significant upfront investments in physical infrastructure. Cloud platforms operate on a pay-as-you-go model, meaning governments only pay for the computing resources they use, helping reduce overall IT costs. This cost-efficiency is particularly valuable for smaller municipalities and local governments with limited budgets, enabling them to access cutting-edge technology without the expense of maintaining large data centers.

Government cloud services also streamline operational processes by enabling automation and digital workflows. Tasks that were traditionally time-consuming and manual, such as document processing, data entry, and service requests, can be automated through cloud-based systems. For instance, government agencies can use cloud solutions to automate the processing of permits, licenses, or tax filings, reducing wait times for citizens and improving the efficiency of public services. By moving these services to the cloud, governments can eliminate paper-based systems, reduce human error, and increase transparency and accountability in their operations.

Another critical advantage of government cloud is the ability to improve collaboration and data sharing between government departments and agencies. Cloud-based platforms provide a centralized location for storing and accessing data, making it easier for different government entities to collaborate on joint initiatives. For example, public safety agencies can share real-time data with emergency responders during a crisis, improving coordination and decision-making. The ability to access and share information quickly is essential for responding to public safety incidents, natural disasters, or public health emergencies.

Government cloud also supports the implementation of smart city initiatives by providing the infrastructure needed to collect and analyze data from IoT devices and sensors deployed across urban environments. With cloud computing, city governments can gather data on traffic patterns, energy usage, waste management, and air quality, enabling them to optimize city services and improve the quality of life for residents. Cloud platforms provide the processing power and data storage capacity necessary to handle the vast amounts of data generated by IoT devices, making smart city projects more feasible and effective.

What Factors Are Driving the Growth of the Government Cloud Market?

Several key factors are driving the rapid growth of the government cloud market, including the need for enhanced cybersecurity, the increasing demand for digital transformation in the public sector, cost savings associated with cloud adoption, and advancements in cloud technology. First, the need for enhanced cybersecurity is a major driver of government cloud adoption. Government agencies are often prime targets for cyberattacks due to the sensitive nature of the data they handle, including personal information, defense intelligence, and healthcare records. Cloud providers that specialize in government solutions offer advanced security measures, such as data encryption, multi-factor authentication, and continuous monitoring, helping governments safeguard their data from cyber threats. Additionally, cloud platforms help governments comply with strict regulatory requirements, ensuring that sensitive data is stored and processed securely.Second, the increasing demand for digital transformation in the public sector is fueling the growth of the government cloud market. As citizens expect more efficient and accessible public services, governments are under pressure to modernize their IT infrastructure and offer digital services such as online portals, mobile apps, and real-time updates. Government cloud solutions enable public sector organizations to digitize their operations, streamline workflows, and provide services that are more responsive to the needs of citizens. From e-governance platforms to cloud-based healthcare systems, government cloud is helping transform how public services are delivered in the digital age.

Cost savings are another significant factor driving the growth of the government cloud market. Traditional on-premises data centers require substantial capital investments in hardware, software, maintenance, and personnel. In contrast, cloud computing operates on a subscription-based model, allowing governments to pay only for the resources they use. This reduction in upfront costs and the ability to scale resources as needed provide significant financial benefits, especially for smaller government agencies with limited budgets. Cloud adoption also reduces the costs associated with maintaining and upgrading legacy systems, enabling governments to allocate their resources more effectively.

Technological advancements in cloud computing are further propelling the growth of the government cloud market. The development of hybrid cloud solutions, AI-powered analytics, edge computing, and IoT integration has expanded the capabilities of government cloud platforms. Hybrid cloud environments allow governments to balance the use of public and private clouds, providing flexibility and control over how data is stored and processed. AI-powered analytics enable governments to make data-driven decisions, while edge computing allows real-time data processing for services like traffic management or emergency response. These innovations are making government cloud solutions more powerful and adaptable, helping governments meet their evolving technology needs.

The increasing focus on sustainability is also contributing to the growth of the government cloud market. Governments are under pressure to reduce their carbon footprints and adopt greener technologies, and cloud computing can help them achieve these goals. Cloud providers often operate large-scale, energy-efficient data centers that are more environmentally friendly than smaller, on-premises data centers. By moving to the cloud, governments can reduce their energy consumption, lower carbon emissions, and contribute to sustainability efforts.

In conclusion, the growth of the government cloud market is being driven by the need for enhanced cybersecurity, the demand for digital transformation in public services, cost-saving opportunities, and advancements in cloud technology. As governments increasingly prioritize the modernization of their IT infrastructure, improve service delivery, and enhance security, government cloud will play a central role in shaping the future of public sector operations.

Report Scope

The report analyzes the Government Cloud market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Solutions, Services); Service Model (IaaS, SaaS, PaaS).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the IaaS Model segment, which is expected to reach US$54.8 Billion by 2030 with a CAGR of 18.2%. The SaaS Model segment is also set to grow at 16.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.9 Billion in 2024, and China, forecasted to grow at an impressive 15.9% CAGR to reach $15.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Government Cloud Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Government Cloud Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Government Cloud Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon Web Services, Inc., CGI Group, Inc., Cisco Systems, Inc., Dell Technologies, Google Cloud Platform and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Government Cloud market report include:

- Amazon Web Services, Inc.

- CGI Group, Inc.

- Cisco Systems, Inc.

- Dell Technologies

- Google Cloud Platform

- HPE (Hewlett Packard Enterprise India Pvt. Ltd.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- Verizon Enterprise Solutions

- VMware, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Web Services, Inc.

- CGI Group, Inc.

- Cisco Systems, Inc.

- Dell Technologies

- Google Cloud Platform

- HPE (Hewlett Packard Enterprise India Pvt. Ltd.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- Verizon Enterprise Solutions

- VMware, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

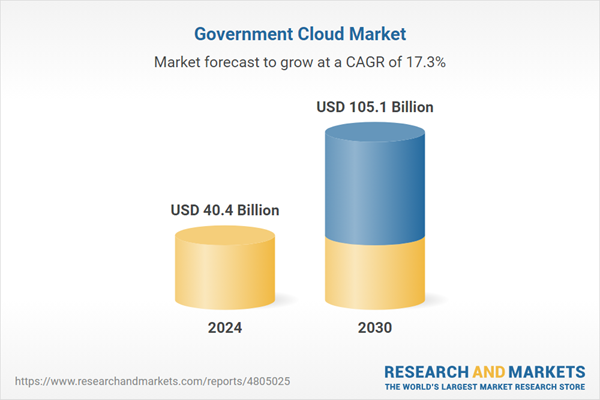

| Estimated Market Value ( USD | $ 40.4 Billion |

| Forecasted Market Value ( USD | $ 105.1 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |