Global Geographic Information Systems (GIS) Market - Key Trends and Drivers Summarized

Why Are Geographic Information Systems (GIS) Transforming Decision-Making and Spatial Analysis Across Industries?

Geographic Information Systems (GIS) are transforming how industries manage, analyze, and visualize spatial data, enabling more informed decision-making and efficient resource management across sectors such as urban planning, transportation, agriculture, and environmental management. But why are GIS so essential today? GIS integrates hardware, software, and data to capture, manage, and analyze spatially referenced information. It allows users to create maps and visualizations that reveal patterns, relationships, and trends in geographical spaces, helping organizations optimize operations, plan infrastructure, and respond to environmental changes.GIS has become indispensable in urban planning, where city governments use it to map infrastructure, analyze traffic flows, and plan sustainable development. In agriculture, GIS helps farmers optimize crop yields by analyzing soil conditions, rainfall patterns, and weather data. Environmental scientists use GIS to monitor climate change, track deforestation, and assess the impact of natural disasters. By providing a framework for analyzing geographical data and visualizing complex relationships, GIS allows decision-makers to better understand the spatial context of their challenges, offering powerful insights that drive strategic planning and operational efficiency.

How Are Technological Advancements Expanding the Capabilities of GIS?

Technological advancements are significantly enhancing the capabilities and applications of Geographic Information Systems (GIS), making them more powerful, accessible, and integral to a variety of industries. One of the most transformative advancements is the integration of GIS with real-time data sources such as satellites, drones, and IoT sensors. These technologies provide continuous streams of spatial data, allowing GIS platforms to offer real-time analysis and updates. For example, in disaster management, real-time GIS data from satellites and drones can provide critical insights into flood levels, wildfire spread, or earthquake damage, enabling faster and more effective response strategies.Another major advancement is the use of cloud computing in GIS. Cloud-based GIS platforms such as Esri's ArcGIS Online or Google Earth Engine allow users to access, process, and analyze massive datasets without the need for specialized hardware. This makes GIS more scalable and accessible to businesses, governments, and individuals. Cloud GIS also enhances collaboration, allowing multiple users to work on the same datasets from different locations, sharing insights and developing coordinated strategies. For instance, in urban planning, teams from different departments can collaborate on a single GIS platform to plan infrastructure, utilities, and zoning regulations seamlessly.

Artificial intelligence (AI) and machine learning (ML) are also revolutionizing GIS by automating data analysis and providing predictive insights. AI can analyze large volumes of spatial data to identify patterns, predict future trends, and detect anomalies. In agriculture, AI-integrated GIS systems can analyze historical weather patterns, soil conditions, and crop performance to predict the best planting times and optimize water usage. Machine learning models can also help automate map updates, such as detecting changes in land use or infrastructure development, making GIS data more accurate and up-to-date.

Additionally, advancements in 3D and 4D GIS technology are enabling more detailed and immersive spatial analysis. 3D GIS allows users to visualize complex environments like buildings, landscapes, and underground utilities in three dimensions, offering more precise insights for infrastructure design and environmental assessments. 4D GIS incorporates the dimension of time, allowing users to visualize how landscapes, cities, or ecosystems evolve over time, which is crucial for long-term planning, such as tracking the impact of climate change or urban sprawl. These technological innovations are vastly expanding the scope and effectiveness of GIS, making it a critical tool for spatial analysis in a wide range of applications.

Why Is GIS Critical for Enhancing Resource Management, Urban Planning, and Environmental Protection?

GIS is critical for enhancing resource management, urban planning, and environmental protection because it provides the spatial intelligence needed to optimize operations, plan efficiently, and make data-driven decisions. In resource management, GIS helps industries and governments track and allocate resources like water, energy, and land more efficiently. For example, utility companies use GIS to map and monitor infrastructure such as power lines, pipelines, and water systems, enabling better maintenance scheduling, preventing failures, and optimizing distribution networks. By analyzing spatial data, GIS can identify areas with high energy usage or water scarcity, helping organizations prioritize resource allocation and reduce waste.In urban planning, GIS is indispensable for designing smarter, more sustainable cities. City planners use GIS to analyze land use patterns, transportation networks, and population growth to make informed decisions about where to build new roads, housing developments, and public facilities. GIS helps planners visualize how different scenarios will impact the community, such as the effects of adding a new highway on traffic congestion or the impact of zoning changes on green space. In transportation planning, GIS is used to optimize routes for public transit, analyze pedestrian flow, and ensure accessibility. The ability to simulate and visualize various planning scenarios makes GIS a powerful tool for creating livable, sustainable cities that meet the needs of growing populations.

In environmental protection, GIS is essential for monitoring ecosystems, managing natural resources, and responding to climate change. Environmental agencies use GIS to track deforestation, monitor biodiversity, and manage protected areas. By mapping changes in land use, vegetation, and wildlife populations, GIS helps scientists and policymakers assess the health of ecosystems and implement conservation measures. Additionally, GIS plays a key role in disaster management, where it is used to map areas at risk of natural disasters such as floods, wildfires, or hurricanes. By identifying high-risk areas and predicting the impact of disasters, GIS enables authorities to plan evacuation routes, allocate resources, and protect vulnerable communities.

Moreover, GIS is increasingly used to monitor and mitigate the effects of climate change. By analyzing spatial data on temperature changes, sea-level rise, and extreme weather events, GIS provides critical insights into how climate change is affecting different regions. Governments and organizations can use this data to develop adaptation strategies, such as building flood defenses in coastal areas or implementing water conservation measures in drought-prone regions. GIS enables long-term planning and helps policymakers make informed decisions to protect the environment and promote sustainable development.

What Factors Are Driving the Growth of the GIS Market?

Several factors are driving the rapid growth of the Geographic Information Systems (GIS) market, including increasing demand for location-based services, advancements in technology, growing adoption in key industries, and the need for environmental and disaster management. First, the growing demand for location-based services across industries is a major driver of GIS market expansion. Businesses in retail, logistics, real estate, and marketing are leveraging GIS to provide personalized, location-based services to customers, optimize delivery routes, and improve asset management. For example, logistics companies use GIS to optimize delivery routes and monitor vehicle locations in real time, reducing fuel costs and improving efficiency.Second, technological advancements in cloud computing, AI, and IoT are accelerating the adoption of GIS. The shift toward cloud-based GIS platforms has made the technology more scalable and affordable, allowing organizations of all sizes to access and analyze geospatial data. The integration of AI and machine learning into GIS systems is further enhancing their capabilities by automating spatial analysis, predicting trends, and providing real-time insights. IoT devices, such as sensors and GPS-enabled equipment, are generating vast amounts of location-based data that can be fed into GIS platforms for real-time monitoring and decision-making. These technological innovations are making GIS more powerful, flexible, and user-friendly, driving its adoption across industries.

Third, the adoption of GIS in key sectors such as agriculture, transportation, and urban planning is contributing to market growth. In agriculture, GIS is used for precision farming, enabling farmers to optimize irrigation, manage crops, and monitor soil conditions more efficiently. The ability to analyze spatial data on weather patterns, soil health, and crop yields helps farmers make informed decisions that improve productivity and reduce resource usage. In transportation, GIS is used to plan public transit routes, optimize traffic flow, and manage infrastructure. As governments invest in smart cities and modern transportation systems, the demand for GIS technology continues to grow.

The increasing need for environmental and disaster management is another major factor driving the GIS market. Governments and environmental organizations are using GIS to track climate change, monitor natural resources, and manage protected areas. As the frequency of natural disasters such as hurricanes, floods, and wildfires increases, GIS is becoming a critical tool for disaster preparedness and response. By mapping risk areas and predicting the impact of disasters, GIS enables authorities to plan and allocate resources more effectively, minimizing damage and saving lives.

Finally, the rise of smart cities and urbanization is fueling demand for GIS solutions. As urban populations grow, cities are facing challenges related to infrastructure, traffic management, and resource allocation. GIS provides the spatial analysis needed to address these challenges, helping city planners design more efficient, sustainable urban environments. Smart cities use GIS to integrate data from sensors, infrastructure, and public services, enabling real-time monitoring and optimization of everything from traffic lights to public transportation. The growing focus on smart cities and sustainable urban development is driving demand for advanced GIS solutions that can support long-term planning and real-time decision-making.

In conclusion, the GIS market is experiencing rapid growth due to the increasing demand for location-based services, technological advancements, adoption in key industries, and the need for environmental and disaster management. As businesses, governments, and organizations continue to prioritize data-driven decision-making, GIS will play an increasingly important role in shaping the future of industries ranging from agriculture and transportation to urban planning and environmental protection.

Report Scope

The report analyzes the Geographic Information Systems (GIS) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Data, Software, Hardware); End-Use (Government, Water & Wastewater, Engineering & Business Services, Telecommunications, Aerospace & Defense, Oil & Gas Refining, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the GIS Data segment, which is expected to reach US$12.5 Billion by 2030 with a CAGR of 10.4%. The GIS Software segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 13.4% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Geographic Information Systems (GIS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Geographic Information Systems (GIS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Geographic Information Systems (GIS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autodesk, Inc., Bentley Systems, Inc., Caliper Corporation, Computer Aided Development Corporation Limited (Cadcorp), Environmental Systems Research Institute, Inc. (ESRI) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 222 companies featured in this Geographic Information Systems (GIS) market report include:

- Autodesk, Inc.

- Bentley Systems, Inc.

- Caliper Corporation

- Computer Aided Development Corporation Limited (Cadcorp)

- Environmental Systems Research Institute, Inc. (ESRI)

- General Electric Company

- Hexagon AB

- Hi-Target Surveying Instrument Co., Ltd.

- MacDonald, Dettwiler and Associates Ltd.

- Pitney Bowes, Inc.

- Topcon Corporation

- Trimble, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autodesk, Inc.

- Bentley Systems, Inc.

- Caliper Corporation

- Computer Aided Development Corporation Limited (Cadcorp)

- Environmental Systems Research Institute, Inc. (ESRI)

- General Electric Company

- Hexagon AB

- Hi-Target Surveying Instrument Co., Ltd.

- MacDonald, Dettwiler and Associates Ltd.

- Pitney Bowes, Inc.

- Topcon Corporation

- Trimble, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

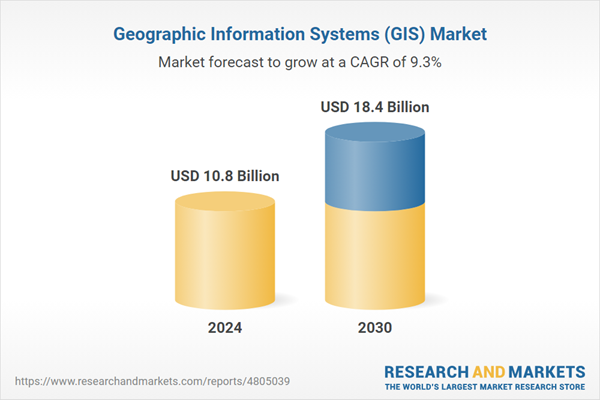

| Estimated Market Value ( USD | $ 10.8 Billion |

| Forecasted Market Value ( USD | $ 18.4 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |