Global General Aviation Market - Key Trends and Drivers Summarized

Why Is General Aviation Vital for Transportation, Commerce, and Recreation?

General aviation is a fundamental component of the global aviation ecosystem, providing critical services for transportation, commerce, and recreation. But why is general aviation so important today? General aviation (GA) encompasses all civil aviation operations outside of commercial airlines and military aviation, including private flights, business aviation, flight training, medical transport, and agricultural applications. It serves a wide range of needs, from personal travel and recreational flying to vital services such as emergency medical evacuation, search and rescue operations, and aerial firefighting. In many regions, general aviation is the only viable means of transportation for remote or underserved areas, offering flexibility and access that larger commercial aircraft cannot provide.In the business world, GA is essential for corporate travel, allowing executives and professionals to fly directly to their destinations without the constraints of commercial flight schedules. This saves time and increases productivity, especially when traveling to areas not well-served by commercial airlines. General aviation also plays a key role in the transportation of goods, offering expedited delivery of cargo and important supplies, particularly in rural or isolated regions. In addition to its practical uses, GA is a major driver of the recreational aviation sector, providing aviation enthusiasts the freedom to fly for leisure, engage in flight training, and participate in aviation events. By facilitating transportation, supporting industries, and offering recreational opportunities, general aviation is a vital element of modern transportation and economic activity.

How Are Technological Advancements Transforming General Aviation?

Technological advancements are dramatically reshaping general aviation, making aircraft safer, more efficient, and accessible to a broader range of users. One of the most significant developments in recent years is the integration of advanced avionics systems. Modern GA aircraft are increasingly equipped with sophisticated glass cockpits that feature digital displays, GPS navigation, and real-time weather updates, which enhance situational awareness for pilots and improve flight safety. These avionics systems, such as Garmin's G1000 or Avidyne's Entegra, offer intuitive interfaces that allow pilots to access critical flight information at a glance, reducing workload and minimizing the risk of errors during flight.Another major advancement is the rise of electric propulsion systems. Electric aircraft, powered by batteries or hybrid-electric systems, are being developed to reduce the environmental impact of aviation and lower operating costs. These aircraft promise quieter, cleaner, and more efficient flight, particularly for short-haul travel and training purposes. Companies like Pipistrel and Eviation are leading the way in electric aircraft innovation, with models that offer zero-emission flight and reduced maintenance compared to traditional piston-powered aircraft. This shift toward electric propulsion is expected to revolutionize general aviation by making flying more sustainable and accessible to a new generation of pilots and operators.

Moreover, advancements in automated and autonomous flight technologies are making their way into general aviation. The development of autopilot systems that allow for greater automation in flight, as well as the potential for fully autonomous aircraft, is transforming the way GA aircraft are flown. These systems reduce pilot workload and enhance safety by taking over routine tasks such as maintaining altitude, speed, and heading. Additionally, autonomous technologies could make flying more accessible by reducing the need for extensive pilot training and certification. The future of GA could see a growing number of semi-autonomous or fully autonomous aircraft, especially for short-distance travel and cargo transport.

Additionally, advancements in materials and manufacturing processes, such as the use of composite materials, are making GA aircraft lighter, stronger, and more fuel-efficient. Composite materials like carbon fiber allow aircraft to be more aerodynamically efficient while reducing weight, leading to improved fuel economy and performance. These technological innovations are making general aviation safer, more efficient, and environmentally friendly, ensuring its continued relevance in the evolving transportation landscape.

Why Is General Aviation Essential for Economic Growth and Regional Connectivity?

General aviation plays a crucial role in promoting economic growth and enhancing regional connectivity, particularly in areas underserved by commercial airlines. One of the key benefits of GA is its ability to provide access to remote or rural regions that are not well-served by commercial aviation. Small airports and airstrips used by GA aircraft offer vital transportation links for communities that might otherwise be isolated, enabling the flow of goods, services, and people. In regions where road infrastructure is limited or unreliable, general aviation often provides the most efficient and reliable means of transportation, supporting local economies and improving quality of life.The economic impact of general aviation is also significant. In the United States alone, the general aviation industry contributes billions of dollars to the economy annually and supports hundreds of thousands of jobs across various sectors, including aircraft manufacturing, maintenance, pilot training, and air charter services. Small and medium-sized businesses rely heavily on GA to facilitate business travel, enabling them to reach clients, suppliers, and partners in areas not accessible by commercial airlines. This flexibility allows businesses to expand their reach, improve operational efficiency, and remain competitive in a global market.

General aviation is also essential for tourism and recreational activities, driving local economies by attracting tourists to remote or scenic destinations. Many tourist hotspots, such as national parks, island resorts, or adventure destinations, rely on GA aircraft to transport visitors who might not otherwise have access to these areas. The ability of general aviation to connect travelers with unique destinations helps support local hospitality industries, creating jobs and fostering economic development in tourism-dependent regions.

Furthermore, general aviation plays a critical role in humanitarian and emergency services. Medical evacuation flights, disaster relief operations, and search and rescue missions often depend on GA aircraft to quickly reach areas affected by natural disasters, accidents, or medical emergencies. By providing essential services that enhance public safety and well-being, general aviation contributes to the resilience and stability of communities. In addition to its economic contributions, GA's role in enhancing regional connectivity and supporting vital services makes it a key player in fostering economic growth and social development.

What Factors Are Driving the Growth of the General Aviation Market?

Several key factors are driving the growth of the general aviation market, including increasing demand for business and private aviation, advancements in aircraft technology, and the expansion of flight training and recreational aviation. First, the rise in demand for business aviation is a major driver of growth. Companies are increasingly relying on private jets and charter services to enhance flexibility, efficiency, and privacy in corporate travel. Business aviation allows executives to travel directly to meetings, factories, or remote locations without the constraints of commercial flight schedules, saving time and improving productivity. As globalization continues, the need for quick, efficient travel to various parts of the world is fueling demand for business aircraft, including jets and turboprops.Second, the growing interest in private flying and personal aircraft ownership is expanding the general aviation market. Many individuals are seeking the convenience and freedom that private aviation offers, particularly in the wake of the COVID-19 pandemic, which highlighted the limitations and health concerns of commercial air travel. Private pilots and flying clubs are also contributing to the rise in small aircraft purchases, driving demand for single-engine planes, light sport aircraft, and ultralights. The development of more affordable, efficient, and technologically advanced aircraft is making private flying accessible to a larger audience, boosting the overall GA market.

Third, advancements in aviation technology, including electric aircraft, autonomous systems, and modern avionics, are stimulating market growth. The push toward sustainable aviation is leading to the development of electric and hybrid-electric aircraft that promise lower operating costs, quieter operation, and reduced environmental impact. These innovations are attracting both new and seasoned pilots who are interested in adopting greener, more efficient aviation technologies. Additionally, the integration of advanced avionics and safety systems is making flying easier and safer, encouraging more people to pursue pilot training and enter the world of general aviation.

Moreover, the increasing demand for flight training is contributing to the growth of the general aviation market. With a global pilot shortage on the horizon, especially in commercial aviation, flight schools are expanding their programs to meet the demand for trained pilots. Many aspiring commercial pilots begin their careers in general aviation, learning to fly small aircraft before advancing to larger commercial jets. The demand for flight training aircraft, as well as flight instructors and maintenance personnel, is driving the growth of the GA sector, as the need for skilled aviation professionals continues to rise.

Finally, government support and investment in aviation infrastructure are enhancing the growth of the general aviation market. Many countries are investing in the development and modernization of small airports, airstrips, and air traffic control systems to support the expansion of general aviation activities. Additionally, governments are offering incentives and subsidies for the adoption of cleaner aviation technologies, such as electric aircraft, to promote sustainability in the industry. These factors, combined with the increasing interest in aviation as a recreational and professional pursuit, are positioning general aviation for continued growth in the coming years.

In conclusion, the growth of the general aviation market is being driven by rising demand for business and private aviation, advancements in aircraft technology, increased flight training, and government support for aviation infrastructure. As technology continues to evolve and more individuals and businesses recognize the benefits of general aviation, the sector is poised for robust expansion, playing a crucial role in shaping the future of transportation and economic development.

Report Scope

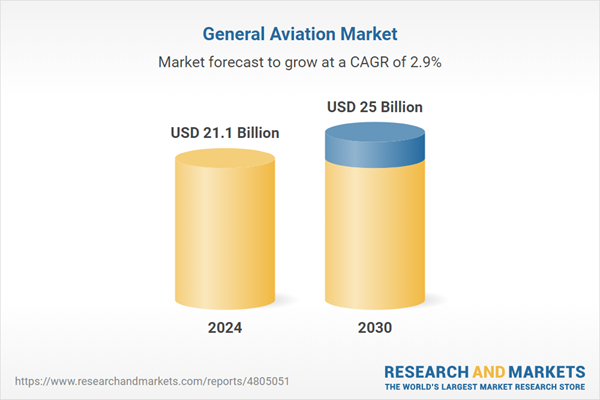

The report analyzes the General Aviation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Business Jets, Helicopters, Turboprops, Piston Fixed Wings).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Business Jets segment, which is expected to reach US$17.1 Billion by 2030 with a CAGR of 2.7%. The Helicopters segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global General Aviation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global General Aviation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global General Aviation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIRBUS SAS, ATR, Boeing Company, The, Bombardier, Inc., Cirrus Aircraft and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 283 companies featured in this General Aviation market report include:

- AIRBUS SAS

- ATR

- Boeing Company, The

- Bombardier, Inc.

- Cirrus Aircraft

- Dassault Aviation SA

- Embraer SA

- Gulfstream Aerospace Corporation

- Lockheed Martin Corporation

- ONE Aviation Corporation

- Pilatus Aircraft Ltd.

- Textron Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AIRBUS SAS

- ATR

- Boeing Company, The

- Bombardier, Inc.

- Cirrus Aircraft

- Dassault Aviation SA

- Embraer SA

- Gulfstream Aerospace Corporation

- Lockheed Martin Corporation

- ONE Aviation Corporation

- Pilatus Aircraft Ltd.

- Textron Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 363 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.1 Billion |

| Forecasted Market Value ( USD | $ 25 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |