Global Gas Sensors Market - Key Trends and Drivers Summarized

Why Are Gas Sensors Critical for Safety and Efficiency Across Industries?

Gas sensors have become essential tools in modern industries due to their ability to detect and measure the presence of gases in the environment, ensuring safety and operational efficiency. But what makes gas sensors so crucial in today's industrial landscape? Gas sensors are used in a wide range of applications, from monitoring air quality in urban areas to detecting toxic gases in industrial settings. They are critical in industries such as oil and gas, manufacturing, automotive, and chemical processing, where the presence of harmful gases like methane, carbon monoxide, and hydrogen sulfide can pose significant risks to worker safety and equipment.In hazardous environments, gas sensors continuously monitor the air for leaks or the buildup of flammable or toxic gases, triggering alarms and automatic safety measures before concentrations reach dangerous levels. This early detection capability not only protects human health and prevents accidents, but it also reduces the risk of costly equipment damage or production downtime. Gas sensors are also widely used in environmental monitoring, helping to detect pollution levels, track greenhouse gas emissions, and ensure compliance with environmental regulations. From improving workplace safety to reducing emissions, gas sensors play an indispensable role in ensuring both operational efficiency and public safety in various industries.

How Is Technology Enhancing the Capabilities of Gas Sensors?

Technological advancements are significantly improving the performance, sensitivity, and versatility of gas sensors, making them more accurate and efficient for a broader range of applications. One of the most significant innovations is the miniaturization of sensors, which has led to the development of highly portable, wearable, and even implantable gas sensors. These smaller devices can be deployed in areas that were previously difficult to monitor, such as tight industrial spaces or personal safety gear, ensuring continuous protection in real-time. Additionally, the advent of nanotechnology has revolutionized gas sensor design, leading to more sensitive detection materials that can sense even trace amounts of gases with higher precision and faster response times.Another key advancement is the integration of gas sensors with wireless connectivity and the Internet of Things (IoT). Smart gas sensors can now communicate in real time with control systems, alerting operators to potential gas hazards or leaks immediately, even if they are miles away from the sensor's location. These connected sensors are used in industries like oil and gas, mining, and manufacturing, where large, remote, or hazardous sites require continuous monitoring. AI-driven analytics are also being integrated with gas sensor data, enabling predictive maintenance and operational optimization. By analyzing gas sensor data, systems can predict equipment failures, optimize process controls, and reduce energy consumption.

Moreover, improvements in sensor materials, such as graphene and other advanced semiconductors, have enhanced the durability and sensitivity of gas sensors, making them more reliable in extreme conditions like high temperatures or corrosive environments. These innovations in miniaturization, IoT integration, and material science are enabling gas sensors to be more effective, versatile, and robust, extending their use across a wider variety of industries and applications.

Why Are Environmental and Safety Concerns Driving the Demand for Gas Sensors?

The increasing focus on environmental protection and workplace safety is significantly driving the demand for gas sensors. With growing concerns about air pollution, climate change, and the need to monitor emissions, gas sensors are essential for tracking the presence of harmful gases in the environment. Governments and regulatory bodies worldwide are imposing stricter regulations on industries to limit the release of pollutants such as carbon dioxide (CO2), methane (CH4), and volatile organic compounds (VOCs). Gas sensors help industries comply with these regulations by continuously monitoring emission levels and ensuring that facilities operate within legal limits. This is particularly important in industries like power generation, waste management, and agriculture, where emissions control is critical for sustainability.In terms of safety, gas sensors are becoming indispensable in workplaces where hazardous gases pose risks to workers' health and safety. In industries such as oil and gas, chemical processing, and mining, workers are often exposed to environments where gas leaks or toxic buildup can occur unexpectedly. Gas sensors provide continuous air quality monitoring, offering early warnings that help prevent accidents such as fires, explosions, or poisoning. The integration of gas sensors in safety protocols is now considered a standard in high-risk industries, where their ability to detect dangerous gases like hydrogen sulfide, ammonia, or carbon monoxide can save lives and prevent costly damage to equipment.

Moreover, as public awareness about indoor air quality (IAQ) grows, especially in the wake of concerns over air pollution and respiratory health, there is an increasing demand for gas sensors in commercial and residential buildings. These sensors monitor air quality by detecting levels of CO2, VOCs, and other pollutants, ensuring healthier indoor environments in schools, offices, and homes. As more organizations and consumers become conscious of air quality and safety, the demand for gas sensors is expected to continue rising, driving innovation and market growth in this space.

What Factors Are Propelling the Growth of the Gas Sensor Market?

The growth in the gas sensor market is driven by several key factors, including technological advancements, increasing safety regulations, and the rising need for environmental monitoring. First, advancements in sensor technology, such as miniaturization, IoT integration, and AI-driven analytics, are making gas sensors more precise, affordable, and widely applicable. These innovations have opened up new markets, particularly in smart cities and smart homes, where gas sensors are used for air quality monitoring and emission control. The ability to deploy sensors across a wide range of environments - both industrial and consumer - has led to greater demand for compact, connected gas sensors that can provide real-time data and alerts.Second, increasing industrial safety regulations are pushing companies to adopt more comprehensive gas monitoring solutions. Regulatory agencies like OSHA, the European Commission, and other national safety bodies are enforcing stricter guidelines for workplace safety, particularly in industries where workers are exposed to hazardous gases. Gas sensors are now a critical component of compliance strategies, helping industries avoid penalties and improve workplace safety standards. As industries aim to enhance safety protocols and reduce the risk of accidents, gas sensors are becoming an integral part of operational safety systems.

Third, the growing emphasis on environmental sustainability and pollution control is boosting the demand for gas sensors in sectors such as manufacturing, transportation, energy, and agriculture. Gas sensors are essential for tracking emissions and ensuring compliance with environmental regulations, particularly as governments worldwide implement stricter targets to reduce greenhouse gas emissions and combat climate change. The use of gas sensors in air quality monitoring systems, both indoors and outdoors, is also expanding as public awareness about the health impacts of pollution rises.

Finally, the increasing deployment of smart city infrastructure, renewable energy projects, and electric vehicles is driving the growth of the gas sensor market. Smart cities rely on gas sensors for air quality management and pollution tracking, while renewable energy facilities, such as hydrogen plants and biogas production units, require precise gas monitoring for safe and efficient operation. As more industries and municipalities prioritize sustainability, the role of gas sensors in ensuring both environmental protection and operational efficiency will continue to expand, positioning the gas sensor market for strong growth in the coming years.

Report Scope

The report analyzes the Gas Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Carbon Dioxide Sensors, Carbon Monoxide Sensors, Oxygen / Lambda Sensors, NOx Sensors, Methyl Mercaptan Sensors, Other Products); End-Use (Industrial, Petrochemical, Automotive, Building Automation & Domestic Appliances, Medical, Environmental, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Carbon Dioxide Sensors segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of 8.7%. The Carbon Monoxide Sensors segment is also set to grow at 8.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $938.3 Million in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alphasense Ltd., Amphenol Corporation, ams AG, City Technology Ltd., Dynament and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Gas Sensors market report include:

- Alphasense Ltd.

- Amphenol Corporation

- ams AG

- City Technology Ltd.

- Dynament

- Figaro Engineering, Inc.

- Membrapor AG

- MSA Safety Incorporated

- Sensirion AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alphasense Ltd.

- Amphenol Corporation

- ams AG

- City Technology Ltd.

- Dynament

- Figaro Engineering, Inc.

- Membrapor AG

- MSA Safety Incorporated

- Sensirion AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

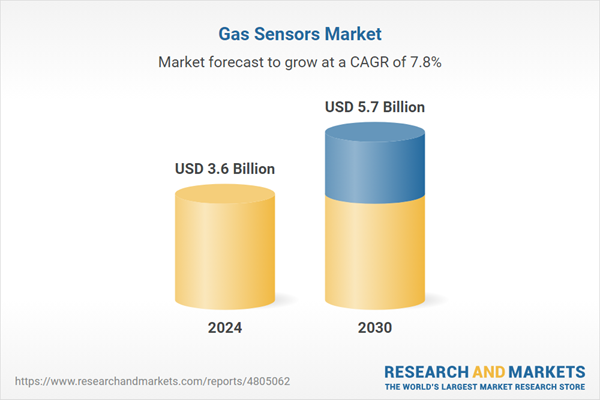

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |