Global Gas Phase Filtration Market - Key Trends and Drivers Summarized

Why Is Gas Phase Filtration Critical in Air Quality Control and Industrial Processes?

Gas phase filtration has become an essential technology for maintaining clean air in industrial processes and controlling indoor air quality in commercial and residential settings. But why is it so critical? Gas phase filtration systems are designed to remove harmful gases, volatile organic compounds (VOCs), odors, and chemical contaminants from the air, preventing them from polluting the environment or impacting human health. Industries such as petrochemicals, electronics manufacturing, pulp and paper, and wastewater treatment rely heavily on these filtration systems to protect sensitive equipment from corrosive gases and to maintain safety standards. In environments like data centers, museums, and hospitals, where air quality is vital, gas phase filtration ensures that airborne contaminants are kept at bay, protecting valuable assets and safeguarding health.This filtration method works by using materials such as activated carbon or chemical adsorbents that capture and neutralize gaseous pollutants through processes like adsorption and chemical reactions. Unlike traditional particle filters that only capture dust and solid particulates, gas phase filtration targets specific molecules, making it indispensable for industries handling hazardous chemicals or producing harmful emissions. As air pollution concerns grow, driven by industrial emissions, urbanization, and stricter environmental regulations, gas phase filtration is becoming increasingly essential in maintaining compliance and ensuring the safety of air in both industrial and public spaces.

How Is Technology Enhancing the Effectiveness of Gas Phase Filtration?

Technological advancements are significantly improving the effectiveness and efficiency of gas phase filtration systems, making them more robust and versatile in handling complex air quality challenges. One of the key innovations is in the development of advanced filter media. Traditional activated carbon filters have been enhanced with chemical impregnation, which increases their ability to adsorb specific gases, including sulfur compounds, ammonia, and VOCs. These new materials can neutralize a broader spectrum of contaminants, providing better protection in industries like oil refining, chemical processing, and semiconductor manufacturing, where air contaminants can cause costly equipment failures or impact product quality.Moreover, nanotechnology is revolutionizing the design of gas phase filters. Nanomaterials, such as nano-porous carbons or metal-organic frameworks (MOFs), offer greater surface area and higher adsorption capacity, allowing for more efficient removal of gases at lower concentrations. These materials also enable faster adsorption rates, meaning that air can be purified more quickly, enhancing operational efficiency in environments where continuous air treatment is required. Sensors and smart monitoring systems are another technological leap forward. These systems can track air quality in real time, measuring the concentration of gases like ozone, formaldehyde, or nitrogen oxides and adjusting the filtration system's performance accordingly. This real-time adaptability ensures that air quality standards are met, and it reduces energy consumption by only engaging the filtration system when necessary. These advancements in filtration media, nanotechnology, and smart monitoring are making gas phase filtration systems more efficient, environmentally friendly, and adaptable to the specific needs of different industries and environments.

Why Is Sustainability and Energy Efficiency Driving the Adoption of Gas Phase Filtration?

As industries increasingly prioritize sustainability and energy efficiency, gas phase filtration is playing an essential role in reducing environmental impact and optimizing resource use. Traditional air purification methods, while effective at removing particulates, often fall short when dealing with gaseous pollutants and chemical vapors. Gas phase filtration provides a targeted approach, capturing and neutralizing harmful gases before they are released into the atmosphere. This is particularly important in industries like waste management, petrochemicals, and energy production, where the release of harmful gases could have severe environmental consequences. By using gas phase filtration, industries can reduce emissions of harmful chemicals such as sulfur dioxide, ammonia, and hydrogen sulfide, aligning with stricter environmental regulations and global efforts to reduce air pollution.Energy efficiency is another driver in the adoption of advanced gas phase filtration systems. New filtration technologies are designed to reduce the energy required to filter and purify air. For instance, low-pressure drop filters allow air to pass through more easily, reducing the energy needed to move air through the system, which is critical in large-scale industrial settings where energy consumption can be high. Moreover, by incorporating smart sensors that adjust the operation of the filtration system based on real-time air quality data, industries can avoid over-purifying the air, thus saving energy and reducing operational costs. These advancements are making gas phase filtration not only an environmentally sound option but also a cost-effective one, as industries can meet sustainability goals while reducing energy expenditures and improving air quality.

What Factors Are Driving the Growth of the Gas Phase Filtration Market?

The growth in the gas phase filtration market is driven by several key factors, including increasing environmental regulations, technological advancements, and growing awareness of indoor air quality concerns. First, stringent environmental regulations are pushing industries to adopt more advanced air filtration solutions to limit the release of hazardous gases and comply with legal standards. Regulatory bodies around the world are implementing stricter emission limits for industries like petrochemicals, power generation, and manufacturing, where harmful gases like sulfur dioxide (SO2), nitrogen oxides (NOx), and volatile organic compounds (VOCs) are byproducts. As industries strive to reduce their carbon footprints and meet these new standards, gas phase filtration systems are becoming a vital part of their air quality management strategies.Second, the rapid technological advancements in filter media, nanotechnology, and smart control systems are making gas phase filtration more efficient and cost-effective. New materials with higher adsorption capacities are enabling the capture of a wider range of gaseous pollutants, and smart sensors are providing real-time monitoring of air quality, allowing systems to adjust performance dynamically. These innovations are not only improving the effectiveness of gas filtration but are also reducing maintenance needs and operational costs, making it easier for industries to adopt these technologies on a large scale.

Third, growing awareness of indoor air quality and its impact on health is driving demand for gas phase filtration systems in commercial and residential settings. Concerns over air pollution and its health impacts are prompting more businesses and institutions, such as hospitals, schools, and office buildings, to invest in advanced filtration systems that target harmful gases, odors, and chemical vapors. This focus on air quality is particularly relevant in urban areas, where air pollution levels are higher, and in industries where indoor air pollutants can harm workers' health and productivity. Additionally, as green building initiatives and sustainability certifications like LEED and WELL gain traction, gas phase filtration is becoming a key component of building designs focused on environmental health and energy efficiency.

Finally, the growing adoption of renewable energy and the expansion of industries like semiconductors, pharmaceuticals, and biotechnology are creating new applications for gas phase filtration. These industries require ultra-clean environments to protect sensitive equipment and processes from contamination by gaseous pollutants. With the global push toward cleaner energy and more advanced manufacturing processes, the demand for gas phase filtration systems is expected to rise steadily, positioning the market for significant growth in the coming years.

Report Scope

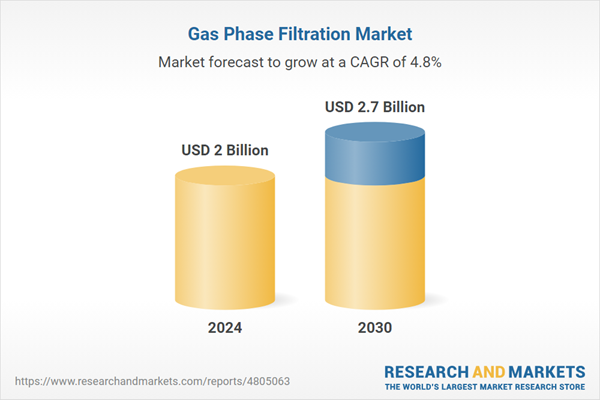

The report analyzes the Gas Phase Filtration market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Packed Bed Filters, Combination Filters); Media (Activated Carbon, Potassium Permanganate, Blend); Application (Corrosion & Toxic Gas Control, Odor Control).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Activated Carbon Media segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of 4.7%. The Potassium Permanganate Media segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $531.1 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $594.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Phase Filtration Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Phase Filtration Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Phase Filtration Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Air Filter Company, Inc., Bry-Air (Asia) Pvt., Ltd., Camfil AG, Circul-Aire Inc., Clarcor Air Filtration Products, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Gas Phase Filtration market report include:

- American Air Filter Company, Inc.

- Bry-Air (Asia) Pvt., Ltd.

- Camfil AG

- Circul-Aire Inc.

- Clarcor Air Filtration Products, Inc.

- Donaldson Co., Inc.

- Freudenberg SE

- Kimberly-Clark Corporation

- ProMark Associates, Inc.

- Purafil, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Air Filter Company, Inc.

- Bry-Air (Asia) Pvt., Ltd.

- Camfil AG

- Circul-Aire Inc.

- Clarcor Air Filtration Products, Inc.

- Donaldson Co., Inc.

- Freudenberg SE

- Kimberly-Clark Corporation

- ProMark Associates, Inc.

- Purafil, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |