Global Gas Equipment Market - Key Trends and Drivers Summarized

Why Is Gas Equipment Essential Across Industries Today?

Gas equipment plays a critical role in a wide array of industries, from energy production and manufacturing to healthcare and food processing. But why is gas equipment so vital in modern industrial operations? The answer lies in its broad functionality and the unique capabilities it provides. Gas equipment encompasses a range of devices, including regulators, valves, pipelines, burners, and gas meters, all designed to control, manage, and utilize gases such as natural gas, oxygen, propane, and nitrogen. In industries like oil and gas, chemical manufacturing, and metalworking, gas equipment is indispensable for processes like heating, welding, and cutting. In healthcare, oxygen delivery systems and anesthesia machines rely on precise gas control for patient care, while in the food industry, gases like nitrogen and carbon dioxide are used for refrigeration and packaging to preserve freshness. These systems ensure that gases are stored, transported, and utilized safely and efficiently. The demand for gas equipment is also driven by the growing need for energy efficiency and emission control, as industries look for ways to minimize waste and comply with environmental regulations. With its ability to provide power, process materials, and facilitate operations across multiple sectors, gas equipment is an essential component of modern industrial infrastructure.How Is Technology Enhancing the Performance and Safety of Gas Equipment?

Technological advancements are revolutionizing the performance, safety, and efficiency of gas equipment across industries. One of the most significant developments is the incorporation of digital monitoring and control systems. These innovations allow for real-time data collection on gas pressure, flow rates, and temperature, enabling operators to make instantaneous adjustments and prevent potential malfunctions or hazardous conditions. In high-risk industries like oil and gas, the ability to remotely monitor gas pipelines and storage systems has significantly improved safety, reducing the risk of leaks or explosions. Furthermore, smart gas meters are becoming more common, providing more accurate and detailed data on gas usage, which helps companies optimize their operations and reduce waste.Another key technological advancement is the improvement in materials used for gas equipment. Modern gas pipelines, valves, and fittings are often made from corrosion-resistant alloys or composite materials that offer greater durability and longer lifespans, even in harsh operating conditions. This reduces maintenance needs and improves safety over the long term. Additionally, advancements in gas detection technology have led to more sensitive and reliable sensors, capable of detecting even the smallest leaks or dangerous gas levels. Automated shut-off systems and alarm protocols are now integral to modern gas equipment, preventing accidents and ensuring compliance with stringent safety regulations. These technological improvements not only enhance the reliability and performance of gas systems but also contribute to safer, more efficient industrial processes.

Why Are Sustainability and Efficiency Driving the Evolution of Gas Equipment?

As industries increasingly focus on sustainability and energy efficiency, the evolution of gas equipment is being shaped by the need to reduce emissions and optimize fuel consumption. Gas equipment manufacturers are responding by developing more eco-friendly and energy-efficient products. For example, modern gas burners and boilers are designed to achieve higher combustion efficiency, which translates to less fuel consumption and fewer emissions of harmful gases like carbon dioxide and nitrogen oxides. This is especially important in sectors such as power generation and industrial manufacturing, where large quantities of gas are consumed. The adoption of cleaner-burning fuels, such as hydrogen and biogas, is also contributing to the development of gas equipment that can handle a variety of fuel types while minimizing environmental impact.Energy-efficient gas control systems, such as advanced regulators and smart valves, allow for more precise control over gas flow, reducing waste and improving overall energy management. Moreover, in applications like industrial heating, waste heat recovery systems are becoming more common, capturing heat that would otherwise be lost and using it to increase overall system efficiency. These innovations align with the broader trend toward decarbonization, as industries strive to lower their carbon footprints in response to regulatory pressures and corporate sustainability goals. Additionally, as more companies adopt renewable energy sources, gas equipment is being integrated into hybrid systems, where renewable energy works alongside gas-powered systems to ensure reliability and sustainability. These advancements in sustainability and efficiency are not only reducing the environmental impact of gas usage but also lowering operational costs for industries reliant on gas equipment.

What Factors Are Fueling the Growth of the Gas Equipment Market?

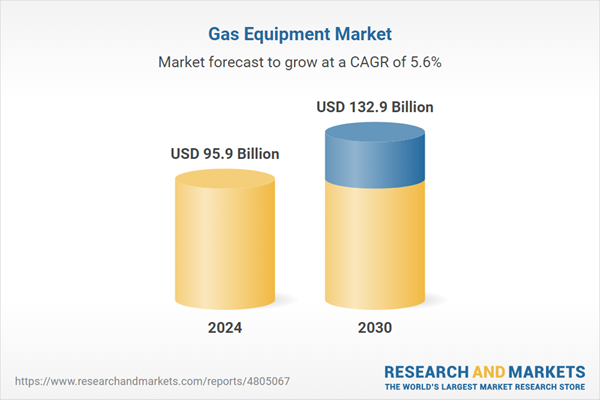

The growth in the gas equipment market is driven by several factors, including technological innovation, increased industrialization, and rising demand for energy-efficient and eco-friendly solutions. First, advancements in digital technology, such as smart meters, remote monitoring systems, and AI-driven predictive maintenance tools, are improving the efficiency and safety of gas equipment. These technologies enable more precise control and real-time monitoring, reducing the risk of gas leaks, optimizing fuel use, and enhancing overall operational efficiency. Second, the rapid industrialization of emerging economies is increasing the demand for gas equipment, particularly in sectors such as power generation, chemicals, and manufacturing. As these industries expand, they require sophisticated gas equipment for a wide range of processes, from energy production to materials processing.Third, the growing focus on environmental sustainability is driving the demand for gas equipment that can minimize emissions and improve energy efficiency. As industries face stricter regulations on carbon emissions and air pollution, there is a strong incentive to invest in cleaner, more efficient gas technologies. This includes the adoption of gas equipment that supports the use of alternative fuels like biogas, hydrogen, and synthetic gases, which offer lower carbon emissions compared to traditional fossil fuels. Additionally, industries are increasingly adopting gas-based systems for combined heat and power (CHP) applications, which significantly improve energy efficiency by capturing and utilizing waste heat. Lastly, the expansion of infrastructure projects in sectors such as transportation, construction, and energy is boosting the demand for gas distribution equipment, including pipelines, compressors, and metering systems. These factors, along with increasing investments in energy infrastructure and sustainability initiatives, are driving the steady growth of the global gas equipment market.

Report Scope

The report analyzes the Gas Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Industrial Gas (Atmospheric Gases, Hydrogen, Acetylene, Helium, Other Industrial Gases); Type (Gas Delivery Systems, Regulators, Purifiers & Filters, Flow Devices, Gas Generating Systems, Cryogenic Products, Gas Detection Systems, Other Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gas Delivery Systems segment, which is expected to reach US$33.9 Billion by 2030 with a CAGR of 6%. The Regulators segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.1 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $30.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Air Products and Chemicals, Inc., Colfax Corporation, GCE Group AB, Itron, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Gas Equipment market report include:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Colfax Corporation

- GCE Group AB

- Itron, Inc.

- Iwatani Corporation

- Linde AG

- Matheson Tri-Gas, Inc.

- Messer Group GmbH

- Praxair, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Colfax Corporation

- GCE Group AB

- Itron, Inc.

- Iwatani Corporation

- Linde AG

- Matheson Tri-Gas, Inc.

- Messer Group GmbH

- Praxair, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 95.9 Billion |

| Forecasted Market Value ( USD | $ 132.9 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |