Global Fusion Splicer Market - Key Trends and Drivers Summarized

How Are Fusion Splicers Revolutionizing Fiber Optic Network Deployment?

Fusion splicers are revolutionizing the deployment and maintenance of fiber optic networks by providing highly precise, low-loss connections between optical fibers. These devices use an electric arc to fuse the ends of two optical fibers together, creating a seamless joint that allows light to pass through with minimal attenuation. This technology is critical for building reliable and high-speed fiber optic networks, which are essential for telecommunications, data centers, broadband internet, and other industries reliant on fast and stable data transmission. Fusion splicing is preferred over mechanical splicing due to its superior performance in terms of low signal loss, durability, and longevity.The rise of 5G, fiber-to-the-home (FTTH) deployments, and expanding data centers has further driven the demand for efficient fiber optic splicing. As these infrastructures require high bandwidth and ultra-low latency, fusion splicers are essential tools for ensuring that fiber optic cables meet these requirements. These devices enable technicians to perform splices in both long-haul and metro networks, contributing to the growing global push for faster and more reliable internet connectivity. Additionally, fusion splicers are being used in various sectors, including medical, defense, and industrial automation, where precise and stable fiber connections are critical for operational success.

What Technological Advancements Are Enhancing the Capabilities of Fusion Splicers?

Several technological advancements are significantly enhancing the capabilities and performance of fusion splicers, making them more efficient, precise, and user-friendly. One of the most notable advancements is the development of automated fusion splicers, which incorporate advanced image processing and AI-based algorithms to improve the alignment of fibers during the splicing process. These intelligent systems can automatically detect and adjust the fibers' position, ensuring optimal alignment and reducing the possibility of human error. As a result, even technicians with limited experience can achieve high-quality splices, making it easier to deploy fiber optic networks rapidly and with high accuracy.Another major advancement is the incorporation of core alignment technology in fusion splicers. Core alignment splicers use multiple cameras and high-precision motors to align the fiber cores with greater accuracy, leading to lower splice losses and more stable connections. This is particularly important in high-capacity networks, such as those used in data centers and long-haul telecommunications, where even slight misalignments can lead to significant signal loss and degradation. Core alignment splicers are now the industry standard for most critical fiber optic installations, providing superior performance compared to older, cladding alignment splicers.

The miniaturization and portability of fusion splicers is another key trend. Modern fusion splicers are becoming more compact, lightweight, and durable, making them easier to use in the field, especially in remote or challenging environments. Battery-operated models with enhanced power efficiency are increasingly common, enabling technicians to perform splicing operations without relying on a constant power supply. This portability is especially valuable in the deployment of fiber-to-the-home (FTTH) networks, where technicians often need to work in various outdoor settings. Additionally, the integration of touchscreen interfaces, real-time data analytics, and cloud connectivity in fusion splicers allows for faster setup, remote monitoring, and improved workflow management, further enhancing the efficiency of fiber optic network installations.

How Are Fusion Splicers Supporting the Expansion of 5G and Fiber Optic Networks?

Fusion splicers are playing a crucial role in supporting the expansion of 5G and fiber optic networks, which require high-performance, reliable, and low-latency connections to handle massive data loads. As 5G networks are deployed globally, they demand fiber optic backbones capable of delivering ultra-high-speed data transmission. Fusion splicers enable technicians to create strong, low-loss fiber connections that ensure the seamless flow of data between network nodes, which is essential for supporting the high bandwidth and low latency needed in 5G applications. Without the precision offered by fusion splicing, the performance and reliability of 5G networks would be significantly compromised.The growing deployment of fiber-to-the-home (FTTH) networks is another area where fusion splicers are vital. FTTH brings high-speed internet directly to individual homes and businesses, which requires the installation of vast amounts of fiber optic cable. Fusion splicing is the preferred method for connecting these fibers due to its ability to minimize signal loss and maintain long-term durability, especially in high-density urban environments. As more countries push for universal broadband access, fusion splicers are becoming indispensable tools for building the fiber infrastructure necessary to meet consumer demand for faster and more reliable internet services.

In addition to telecommunications, the increasing use of fiber optics in data centers and cloud computing infrastructure is also driving demand for fusion splicers. Data centers rely on fiber optic cables to transmit large volumes of data quickly and securely between servers, storage devices, and networks. The precision and low-loss characteristics of fusion splicing ensure that data flows with minimal disruption, which is critical in environments where performance and uptime are paramount. As the demand for cloud services, big data analytics, and edge computing grows, fusion splicers will continue to play a key role in expanding and maintaining the fiber networks that support these technologies.

What's Driving the Growth of the Fusion Splicer Market?

The growth of the fusion splicer market is being driven by several key factors, including the global expansion of high-speed internet, the rollout of 5G networks, and the increasing use of fiber optics in various industries. One of the primary drivers is the rising demand for broadband connectivity, particularly in underserved and rural areas. As governments and telecommunication companies work to bridge the digital divide, there is a growing need for fiber optic networks capable of delivering fast and reliable internet services. Fusion splicers are essential for installing and maintaining these networks, making them a critical tool in the push for universal broadband access.The deployment of 5G networks is another significant factor fueling market growth. 5G technology requires a robust fiber optic infrastructure to support the high-speed, low-latency connections needed for applications such as autonomous vehicles, smart cities, and the Internet of Things (IoT). Fusion splicers enable the creation of high-quality fiber connections that are crucial for the performance and scalability of 5G networks. As more telecom operators invest in 5G infrastructure, the demand for fusion splicers is expected to rise, particularly in regions where 5G deployment is accelerating.

Additionally, the increasing adoption of fiber optics in industries beyond telecommunications, such as healthcare, aerospace, and industrial automation, is driving the growth of the fusion splicer market. In these sectors, fiber optics are used for applications that require high-speed data transmission, precision, and reliability. For example, in the medical field, fiber optics are used in imaging systems and surgical tools, where high-quality splices are necessary to ensure accurate and reliable data transmission. As more industries recognize the benefits of fiber optic technology, the demand for fusion splicers is expanding into new markets, further driving market growth.

What Future Trends Are Shaping the Development of Fusion Splicers?

Several emerging trends are shaping the future development of fusion splicers, including advancements in automation, increased focus on portability, and the integration of smart technologies. One of the most significant trends is the move toward greater automation in fusion splicing. As the demand for high-speed fiber optic networks grows, so does the need for efficient, error-free splicing processes. Automated fusion splicers that incorporate advanced machine learning algorithms and AI-driven features are becoming more common, enabling faster, more accurate splicing with minimal human intervention. This automation reduces the risk of errors and increases the efficiency of fiber optic network installations, particularly in large-scale projects like 5G rollouts and fiber-to-the-home deployments.The push for more portable and rugged fusion splicers is another key trend shaping the industry. As technicians are often required to work in remote, outdoor, or challenging environments, there is a growing demand for fusion splicers that are lightweight, durable, and easy to transport. Newer models are being designed with enhanced portability and battery life, allowing for longer periods of fieldwork without needing a power source. These compact fusion splicers are ideal for telecommunications and broadband deployment in rural areas, where access to infrastructure may be limited. Portability is becoming increasingly important as fiber optic networks expand into more diverse geographic regions, including remote and developing areas.

The integration of smart technologies, such as real-time data analytics and cloud-based connectivity, is another trend shaping the development of fusion splicers. Many modern fusion splicers are now equipped with touchscreen interfaces, Wi-Fi connectivity, and cloud-based software that allow for remote monitoring, diagnostics, and maintenance. These smart features enable technicians to track splice performance, manage workflow, and troubleshoot issues from a centralized platform, improving operational efficiency and reducing downtime. Additionally, some fusion splicers are incorporating augmented reality (AR) tools that guide technicians through the splicing process, making it easier for less experienced users to achieve high-quality results. As smart technologies continue to evolve, fusion splicers are expected to become even more intelligent, efficient, and user-friendly.

As these trends continue to shape the industry, the future of fusion splicers will be defined by greater automation, portability, and the integration of advanced technologies. These innovations will make fusion splicers more versatile and accessible, enabling faster, more accurate fiber optic installations across industries ranging from telecommunications to healthcare and industrial automation.

Report Scope

The report analyzes the Fusion Splicer market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Hardware, Software & Services); Type (Cladding Alignment, Core Alignment); End-Use (Telecommunications, Healthcare, Aerospace & Defense, Automotive, Residential, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$763.4 Million by 2030 with a CAGR of 5.6%. The Software & Services Component segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $209.6 Million in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $251.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fusion Splicer Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fusion Splicer Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fusion Splicer Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3sae Technologies Inc., Aurora Optics, Inc., China Electronics Technology Group Corporation (CETC), Comway Technology LLC, Darkhorsechina (Beijing) Telecom Tech. Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 18 companies featured in this Fusion Splicer market report include:

- 3sae Technologies Inc.

- Aurora Optics, Inc.

- China Electronics Technology Group Corporation (CETC)

- Comway Technology LLC

- Darkhorsechina (Beijing) Telecom Tech. Co., Ltd.

- Deviser Technology Ltd.

- EasySplicer

- Fiber Fox, Inc.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Gao Group Inc.

- Greenlee Communications Ltd.

- ILSINTECH Co., Ltd.

- Inno Instruments Inc.

- Multicom, Inc.

- Nanjing Dvp Oe Tech Co., Ltd.

- Nanjing Jilong Optical Communication Co., Ltd.

- PROMAX Electronica S L

- Shanghai SHINHO Fiber Communication Co., Ltd.

- Signal Fire Technology Co., Ltd.

- Sumitomo Electric Industries Ltd.

- Tianjin Eloik Communication Equipment Technology Co., Ltd.

- Web Group Inc.

- Yamasaki Optical Technology

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3sae Technologies Inc.

- Aurora Optics, Inc.

- China Electronics Technology Group Corporation (CETC)

- Comway Technology LLC

- Darkhorsechina (Beijing) Telecom Tech. Co., Ltd.

- Deviser Technology Ltd.

- EasySplicer

- Fiber Fox, Inc.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Gao Group Inc.

- Greenlee Communications Ltd.

- ILSINTECH Co., Ltd.

- Inno Instruments Inc.

- Multicom, Inc.

- Nanjing Dvp Oe Tech Co., Ltd.

- Nanjing Jilong Optical Communication Co., Ltd.

- PROMAX Electronica S L

- Shanghai SHINHO Fiber Communication Co., Ltd.

- Signal Fire Technology Co., Ltd.

- Sumitomo Electric Industries Ltd.

- Tianjin Eloik Communication Equipment Technology Co., Ltd.

- Web Group Inc.

- Yamasaki Optical Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

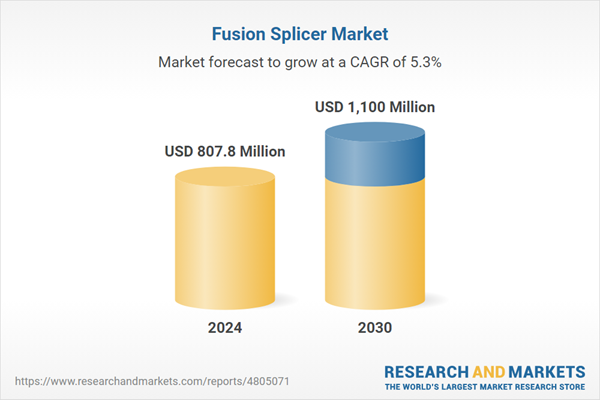

| Estimated Market Value ( USD | $ 807.8 Million |

| Forecasted Market Value ( USD | $ 1100 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |