Global Function-as-a-Service Market - Key Trends and Drivers Summarized

How Is Function-as-a-Service (FaaS) Revolutionizing Cloud Computing and Application Development?

Function-as-a-Service (FaaS) is transforming cloud computing and application development by offering a serverless model that allows developers to build, deploy, and run code without managing the underlying infrastructure. FaaS enables businesses to focus solely on writing and executing functions, or small pieces of code, that perform specific tasks when triggered by events. This serverless architecture eliminates the need for developers to worry about provisioning, scaling, or maintaining servers, as the cloud provider automatically handles all backend operations. Popularized by services like AWS Lambda, Google Cloud Functions, and Microsoft Azure Functions, FaaS offers businesses a highly flexible and scalable way to develop and deploy applications more efficiently.One of the key benefits of FaaS is its event-driven nature, which allows code to be executed in response to specific events such as HTTP requests, file uploads, or database updates. This on-demand execution model significantly reduces costs, as resources are only used when the function is running, rather than requiring continuous server uptime. FaaS also supports rapid iteration and innovation, enabling developers to update individual functions without redeploying the entire application. By decoupling the execution of code from the management of infrastructure, FaaS is revolutionizing how applications are built and scaled, making it easier for businesses to create scalable, responsive, and cost-effective solutions.

What Technological Advancements Are Driving the Growth of Function-as-a-Service?

Technological advancements in cloud infrastructure, event-driven architectures, and automation tools are driving the rapid growth and adoption of Function-as-a-Service. One of the most significant developments is the evolution of cloud computing platforms, which now offer robust support for serverless architectures like FaaS. Cloud providers such as AWS, Google Cloud, and Microsoft Azure have developed sophisticated platforms that can seamlessly manage the backend infrastructure needed to run serverless applications. These platforms automatically scale resources up or down based on demand, allowing businesses to handle varying workloads without having to manually adjust server capacity. The advancement of these platforms has made it easier for organizations to adopt FaaS and reduce their operational overhead.Another important advancement is the integration of event-driven architectures, which are at the core of FaaS. In an event-driven architecture, functions are executed in response to events such as database triggers, file uploads, or API calls. This allows developers to create highly reactive applications that only consume resources when specific actions occur. Modern event-driven systems leverage message queues, pub/sub messaging, and real-time event processing, making FaaS an ideal solution for applications that require high scalability and responsiveness. These technologies have also enhanced the real-time capabilities of FaaS, enabling it to be used in diverse applications like IoT, real-time analytics, and microservices.

Automation tools and frameworks have also played a crucial role in the expansion of FaaS. Continuous integration and continuous deployment (CI/CD) pipelines, along with infrastructure-as-code (IaC) frameworks, have made it easier to deploy and manage FaaS environments. Tools like AWS CloudFormation, Terraform, and Serverless Framework allow developers to define and manage the entire serverless infrastructure using code, automating deployments and scaling. This level of automation reduces the complexity of managing serverless applications, enabling teams to focus more on writing code and less on managing infrastructure. These technological advancements are making FaaS a highly attractive model for businesses looking to scale quickly, reduce costs, and increase their development agility.

How Is Function-as-a-Service Supporting the Growth of Microservices and Agile Development?

Function-as-a-Service (FaaS) is playing a pivotal role in supporting the growth of microservices architectures and agile development methodologies by enabling developers to build highly modular and scalable applications. FaaS aligns perfectly with the microservices model, where applications are broken down into small, independent services that each perform a specific function. In a FaaS environment, each function can be deployed, managed, and scaled independently, allowing for greater flexibility and adaptability in software development. This modular approach makes it easier to update or add new features to an application without affecting the entire system, accelerating development cycles and reducing the risk of system-wide failures.In the context of agile development, FaaS allows teams to move faster by reducing the time and resources spent on infrastructure management. Developers can focus on writing and deploying code in small increments, following agile principles of iterative development and continuous delivery. FaaS services automatically handle the scaling, security, and monitoring of functions, enabling teams to rapidly test and deploy new features or updates. This significantly shortens the development lifecycle, allowing for quicker experimentation, feedback, and iteration. By eliminating infrastructure concerns, FaaS enhances the agility of development teams, empowering them to respond more quickly to changing business needs and user demands.

The ability of FaaS to support dynamic scaling also complements microservices architectures by allowing services to scale independently based on demand. In a traditional monolithic application, scaling often involves replicating entire servers or services, which can be inefficient and costly. With FaaS, only the specific functions experiencing high traffic are scaled, making it a highly efficient solution for applications with varying load patterns. This scalability is particularly beneficial for applications in industries like e-commerce, fintech, and IoT, where demand can fluctuate significantly. By supporting the microservices architecture and agile development, FaaS is enabling organizations to build and manage more resilient, scalable, and efficient applications.

What's Driving the Growth of the Function-as-a-Service Market?

Several factors are driving the growth of the Function-as-a-Service (FaaS) market, including the increasing adoption of cloud-native technologies, the growing demand for cost-effective and scalable solutions, and the rise of event-driven applications. One of the primary drivers is the widespread adoption of cloud computing and cloud-native architectures by businesses of all sizes. As companies move their infrastructure to the cloud, they are seeking ways to optimize performance and reduce operational costs. FaaS offers a serverless model that allows businesses to scale applications automatically without managing infrastructure, making it an attractive solution for companies looking to reduce overhead and improve efficiency.The demand for cost-effective solutions is another major factor fueling the growth of the FaaS market. Traditional server-based models require continuous server provisioning, which can result in wasted resources when applications are idle. In contrast, FaaS operates on a pay-per-use model, where businesses are only charged for the resources consumed during function execution. This usage-based billing is particularly appealing for startups and small businesses, as it allows them to build and deploy applications without significant upfront costs. Even larger enterprises are embracing FaaS to optimize costs for applications with fluctuating workloads, such as e-commerce platforms, financial services, and IoT applications.

The rise of event-driven applications and real-time processing is another significant driver of the FaaS market. Many modern applications require real-time data processing in response to events like user actions, sensor readings, or API requests. FaaS is ideally suited for these scenarios, as it enables the execution of code in response to specific events without the need for pre-provisioned infrastructure. Industries like healthcare, logistics, and smart cities are increasingly adopting event-driven architectures powered by FaaS to handle real-time data streams and automate complex workflows. As the demand for real-time, event-driven applications grows, the FaaS market is expected to expand rapidly, becoming a critical part of the cloud computing ecosystem.

What Future Trends Are Shaping the Development of Function-as-a-Service?

Several emerging trends are shaping the future of Function-as-a-Service (FaaS), including advancements in edge computing, the rise of multi-cloud and hybrid cloud strategies, and the increasing focus on security and compliance in serverless environments. One of the most significant trends is the convergence of FaaS with edge computing. As businesses and industries move toward real-time data processing at the edge, FaaS is being adapted to run functions closer to where data is generated, reducing latency and improving performance. Edge FaaS allows developers to deploy serverless functions on edge devices or edge nodes, enabling faster response times for applications like autonomous vehicles, IoT devices, and smart infrastructure. This trend is expected to drive the adoption of FaaS in industries that require low-latency, real-time data processing.The rise of multi-cloud and hybrid cloud strategies is another key trend shaping the future of FaaS. Many organizations are moving away from relying on a single cloud provider and are instead adopting multi-cloud or hybrid cloud approaches to take advantage of different cloud platforms' strengths. This trend is leading to the development of FaaS platforms that can run seamlessly across multiple cloud environments, allowing businesses to deploy serverless functions on different clouds without being locked into a single provider. Hybrid FaaS solutions are also emerging, enabling businesses to run functions on both on-premises infrastructure and public cloud services. This flexibility is becoming increasingly important as organizations seek to optimize their cloud infrastructure and maintain control over their data.

Security and compliance are becoming top priorities in the development of FaaS, especially as more businesses move critical workloads to serverless environments. While FaaS simplifies infrastructure management, it also introduces new security challenges, such as managing the security of third-party dependencies and ensuring data privacy. To address these concerns, cloud providers are developing enhanced security features for FaaS platforms, including automated security patches, encrypted data storage, and secure access controls. Additionally, compliance with industry regulations such as GDPR, HIPAA, and PCI-DSS is driving the development of FaaS solutions that provide built-in tools for managing security and compliance requirements. As organizations increasingly rely on FaaS for mission-critical applications, the focus on security and compliance will continue to shape the evolution of the technology.

Report Scope

The report analyzes the Function-as-a-Service market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: User Type (Developer-Centric, Operator-Centric); Deployment (Public Cloud, Private Cloud, Hybrid Cloud); Application (Web & Mobile Based, Research & Academic, Other Applications); End-Use (BFSI, Consumer Goods & Retail, Media & Entertainment, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Developer-Centric User segment, which is expected to reach US$52.1 Billion by 2030 with a CAGR of 18.6%. The Operator-Centric User segment is also set to grow at 20% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.6 Billion in 2024, and China, forecasted to grow at an impressive 18.2% CAGR to reach $11.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Function-as-a-Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Function-as-a-Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Function-as-a-Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon Web Services, Inc., Dynatrace LLC, Fiorano Software Ltd., Google LLC, IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Function-as-a-Service market report include:

- Amazon Web Services, Inc.

- Dynatrace LLC

- Fiorano Software Ltd.

- Google LLC

- IBM Corporation

- Infosys Ltd.

- Microsoft Corporation

- Rogue Wave Software, Inc.

- SAP SE

- TIBCO Software, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Web Services, Inc.

- Dynatrace LLC

- Fiorano Software Ltd.

- Google LLC

- IBM Corporation

- Infosys Ltd.

- Microsoft Corporation

- Rogue Wave Software, Inc.

- SAP SE

- TIBCO Software, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

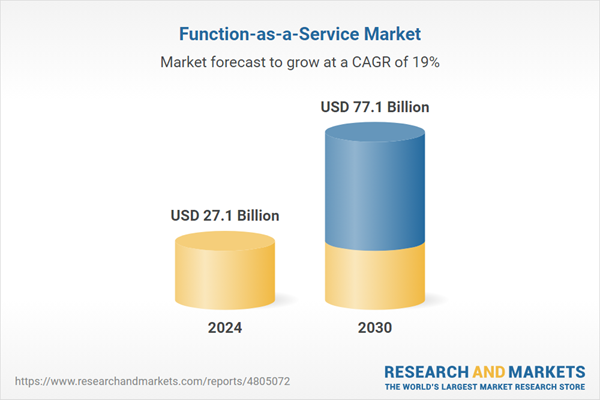

| Estimated Market Value ( USD | $ 27.1 Billion |

| Forecasted Market Value ( USD | $ 77.1 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |