Global Functional Safety Market - Key Trends and Drivers Summarized

How Is Functional Safety Revolutionizing Modern Industry and Automation?

Functional safety is transforming modern industry and automation by ensuring that systems operate correctly in response to inputs, even when equipment or components fail. This concept plays a critical role in industries like automotive, manufacturing, healthcare, energy, and aviation, where malfunctions can lead to hazardous conditions. Functional safety is embedded into the design and operation of systems to detect faults, trigger safety measures, and mitigate risks. It goes beyond traditional safety measures by integrating safety directly into the function of machinery, electronics, and control systems, ensuring that failures or anomalies are managed safely to protect workers, equipment, and the environment.One of the most prominent examples of functional safety is in automotive systems, where advanced driver assistance systems (ADAS), such as automatic braking, lane-keeping assistance, and collision avoidance, rely on built-in safety mechanisms. These systems continuously monitor performance and react to potential hazards without requiring human intervention. The concept of functional safety is outlined in international standards like ISO 26262 for automotive and IEC 61508 for industrial equipment, which define how systems must be designed, implemented, and tested to ensure they operate safely under all conditions. With industries increasingly relying on complex automation, functional safety is becoming a cornerstone of risk management and is driving advancements in smart, safe, and resilient system designs across sectors.

What Technological Advancements Are Improving Functional Safety Systems?

Technological advancements are significantly improving functional safety systems, making them more robust, responsive, and capable of handling the complexities of modern automation and machinery. One of the most important advancements is the use of advanced sensors and real-time monitoring technologies. Modern safety systems are now equipped with a wide array of sensors that continuously monitor critical parameters, such as temperature, pressure, speed, and position. These sensors provide real-time data that allows systems to detect and respond to abnormalities immediately, ensuring that corrective actions, such as shutting down a machine or reducing power output, are taken before a hazard develops.Another key technological advancement is the integration of artificial intelligence (AI) and machine learning into functional safety systems. AI can be used to analyze vast amounts of operational data and predict potential failures before they occur. This predictive capability enhances functional safety by allowing systems to anticipate problems and initiate preventive measures, rather than merely reacting to faults after they happen. AI-driven safety systems can identify patterns and anomalies that may not be detected by traditional safety measures, improving both the accuracy and speed of safety interventions in complex industrial environments.

Additionally, advancements in digital twin technology are improving the development and testing of functional safety systems. A digital twin is a virtual model of a physical system or machine that simulates its behavior in real-time. Using digital twins, engineers can simulate potential failure scenarios and test the functional safety mechanisms of systems without risking damage to actual equipment or endangering personnel. This technology allows for more thorough testing and validation of safety systems in a wide range of conditions, ensuring that they perform as expected in both normal and fault scenarios. These advancements are making functional safety systems smarter, more predictive, and more adaptable, enabling them to better protect people and assets in increasingly automated and high-tech environments.

How Is Functional Safety Supporting the Rise of Automation and Autonomous Systems?

Functional safety is critical in supporting the rise of automation and autonomous systems by ensuring that these technologies can operate safely, even in the face of unexpected faults or external disruptions. As industries such as manufacturing, automotive, and logistics increasingly adopt autonomous systems and robotics, the need for reliable safety measures embedded within these systems has grown significantly. Functional safety plays a key role in the development of autonomous technologies by enabling systems to make safety-critical decisions without human intervention. For example, autonomous vehicles rely on functional safety protocols to detect and respond to hazards, such as sudden obstacles or mechanical malfunctions, ensuring that the vehicle can come to a safe stop or take evasive action to prevent accidents.In the manufacturing sector, the use of collaborative robots (cobots) is becoming more common, allowing humans and robots to work side by side. Functional safety ensures that these robots can safely interact with humans by using sensors and real-time monitoring to detect human presence and adjust movements accordingly. This prevents accidental injuries and allows for smoother and safer collaboration between humans and machines. Functional safety systems ensure that the robots operate within predefined safety parameters, stopping or slowing down their operations if an unsafe condition is detected.

Moreover, functional safety is crucial in industrial automation, where complex processes are often controlled by interconnected systems of machinery, sensors, and software. In these environments, even a minor fault can cause widespread disruptions or pose safety risks. By integrating functional safety into the core of automation systems, industries can ensure that safety-critical functions, such as emergency shutoff mechanisms or containment protocols, are activated immediately in case of a fault. This makes automated processes more resilient and reliable, allowing industries to take full advantage of automation's benefits while maintaining high safety standards. As automation and autonomy continue to grow, functional safety will remain a key enabler in ensuring that these systems operate effectively and safely in all conditions.

What's Driving the Growth of the Functional Safety Market?

Several factors are driving the growth of the functional safety market, including increasing regulatory requirements, the expansion of industrial automation, and growing awareness of safety standards across industries. One of the primary drivers is the tightening of safety regulations in sectors such as automotive, manufacturing, and energy. Governments and regulatory bodies around the world are implementing stricter safety standards to ensure that machinery, vehicles, and industrial systems operate with the highest levels of safety. These regulations, such as ISO 26262 for automotive functional safety or IEC 61511 for process safety in the chemical industry, require companies to design, implement, and maintain systems that can safely manage faults and prevent hazardous incidents.The rapid expansion of industrial automation is another significant factor contributing to the growth of the functional safety market. As industries increasingly automate their production lines, machinery, and processes, the complexity of these systems grows, making it essential to have robust safety mechanisms in place. Functional safety systems are integral to ensuring that automated systems operate reliably and safely, preventing accidents, downtime, or damage to equipment. In highly automated environments like factories, refineries, and power plants, functional safety systems help manage complex interactions between machines and processes, providing real-time responses to potential hazards.

The growth of the automotive sector, particularly the development of electric and autonomous vehicles, is also driving demand for functional safety solutions. As vehicles become more reliant on electronic systems and automation, ensuring the safety of critical functions like braking, steering, and power management is essential. Functional safety standards, such as ISO 26262, are critical in ensuring that automotive systems can manage faults and operate safely under all conditions. As the demand for advanced driver-assistance systems (ADAS), autonomous vehicles, and electric vehicles continues to rise, the need for functional safety in the automotive sector will only increase, driving further market growth.

Additionally, increased awareness of the importance of safety in industries like healthcare, aerospace, and energy is contributing to the expansion of the functional safety market. Companies in these sectors are investing in advanced safety solutions to protect their operations, employees, and the public, further boosting demand for functional safety technologies. As industries continue to adopt more complex, interconnected systems, the role of functional safety will become even more critical in ensuring safe and reliable operations.

What Future Trends Are Shaping the Development of Functional Safety?

Several emerging trends are shaping the future development of functional safety, including the rise of cybersecurity in safety-critical systems, the integration of artificial intelligence (AI) in safety protocols, and the growing use of predictive maintenance and diagnostics. One of the most significant trends is the increasing convergence of functional safety and cybersecurity. As industries become more reliant on connected systems and IoT devices, ensuring the security of safety-critical systems is becoming a top priority. Cyberattacks or security breaches could lead to malfunctions or the disabling of functional safety systems, resulting in hazardous situations. As a result, the integration of cybersecurity measures into functional safety protocols is becoming a critical trend, ensuring that both physical and digital safety threats are mitigated.The use of AI and machine learning in functional safety systems is another key trend shaping the future of the industry. AI can analyze large datasets in real-time to identify patterns and predict potential system failures before they occur. This predictive capability can improve functional safety by allowing systems to respond proactively to potential hazards, rather than simply reacting to faults. AI-driven safety systems can also continuously learn and adapt to new risks, improving their ability to manage complex environments. This trend is particularly important in industries like automotive, where autonomous systems need to make split-second decisions based on real-time data to ensure the safety of passengers and other road users.

Predictive maintenance and diagnostics are also becoming more integrated with functional safety systems. By using sensors and data analytics, functional safety systems can monitor the health of equipment and detect signs of wear or degradation that could lead to failure. This allows for timely maintenance and repair, preventing failures that could compromise safety. Predictive maintenance not only enhances safety but also improves the efficiency and lifespan of equipment, reducing the likelihood of costly downtime or accidents. As industries continue to adopt more advanced technologies, the use of predictive maintenance and diagnostics will become a key component of functional safety systems.

Sustainability is another emerging trend that is influencing the future of functional safety. As industries strive to reduce their environmental impact, functional safety systems are being designed to ensure that equipment and processes operate efficiently and with minimal risk to the environment. This includes integrating safety measures into renewable energy systems, such as wind turbines and solar panels, to ensure safe operation and prevent environmental damage. As industries continue to prioritize sustainability, functional safety will play an increasingly important role in ensuring that systems not only operate safely but also support broader environmental goals.

As these trends continue to evolve, the future of functional safety will be defined by advancements in AI, cybersecurity, predictive maintenance, and sustainability. These innovations will make functional safety systems smarter, more adaptive, and more resilient, helping industries navigate the complexities of modern automation and connected systems while maintaining the highest levels of safety and reliability.

Report Scope

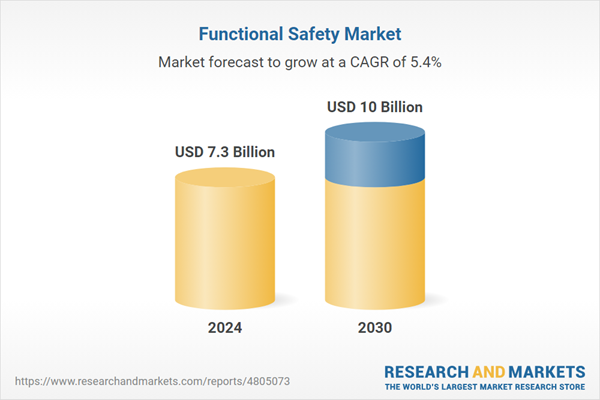

The report analyzes the Functional Safety market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Device (Safety Sensors, Safety Relays, Valves, Actuators, Other Devices); System (Emergency Shutdown System, Fire & Gas Monitoring Control, SCADA, HIPPS, BMS, Turbomachinery Control, DCS).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Safety Sensors segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of 6.5%. The Safety Relays segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Functional Safety Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Functional Safety Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Functional Safety Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Balluff, Inc., BEI Sensors, Bosch Rexroth AG, Emerson Electric Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 21 companies featured in this Functional Safety market report include:

- ABB Ltd.

- Balluff, Inc.

- BEI Sensors

- Bosch Rexroth AG

- Emerson Electric Company

- Endress+Hauser Management AG

- exida.com LLC

- General Electric Company

- HIMA Paul Hildebrandt GmbH

- Honeywell International, Inc.

- Intel Corporation

- Mangan Software Solutions

- Mitsubishi Electric Corporation

- Moore Industries-International, Inc.

- Omron Corporation

- Pepperl+Fuchs GmbH

- Phoenix Contact GmbH & Co. KG

- Pilz GmbH & Co. KG

- Renesas Electronics Corporation

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

- TUV Rheinland AG

- UL LLC (Underwriters Laboratories)

- Yokogawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Balluff, Inc.

- BEI Sensors

- Bosch Rexroth AG

- Emerson Electric Company

- Endress+Hauser Management AG

- exida.com LLC

- General Electric Company

- HIMA Paul Hildebrandt GmbH

- Honeywell International, Inc.

- Intel Corporation

- Mangan Software Solutions

- Mitsubishi Electric Corporation

- Moore Industries-International, Inc.

- Omron Corporation

- Pepperl+Fuchs GmbH

- Phoenix Contact GmbH & Co. KG

- Pilz GmbH & Co. KG

- Renesas Electronics Corporation

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

- TUV Rheinland AG

- UL LLC (Underwriters Laboratories)

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 234 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |