Global Aseptic Sampling Market - Key Trends and Drivers Summarized

Why Is Aseptic Sampling Critical in Modern Manufacturing?

Aseptic sampling has become a vital process in modern manufacturing, particularly in industries where sterility and contamination control are paramount. This technique involves collecting samples from a production process in a manner that prevents contamination, ensuring that the sample accurately reflects the product's quality and sterility. Aseptic sampling is crucial in biopharmaceutical manufacturing, where maintaining sterility throughout the production process is essential for product safety and efficacy. It is also increasingly important in the food and beverage industry, where the demand for high-quality, contamination-free products is growing. By enabling accurate monitoring of critical control points in production, aseptic sampling helps manufacturers maintain compliance with stringent regulatory standards and ensures the consistent quality of their products. The process is integral to quality control, product development, and validation, making it an indispensable tool in maintaining the integrity of manufacturing processes.How Are Technological Innovations Enhancing Aseptic Sampling?

Technological advancements have significantly improved the efficiency and reliability of aseptic sampling, making it more effective and easier to implement in various manufacturing settings. Innovations in single-use technologies have revolutionized the aseptic sampling process, reducing the risk of cross-contamination and simplifying the workflow. These disposable systems eliminate the need for cleaning and sterilization between samples, thereby minimizing the potential for errors and increasing the speed of operations. Automation and digital monitoring have also played a crucial role in advancing aseptic sampling. Automated sampling systems, integrated with real-time data analytics, allow for continuous monitoring and immediate feedback, enabling manufacturers to make timely adjustments to their processes. Additionally, the development of advanced sampling devices, such as closed-loop systems and pre-sterilized sampling bags, has further enhanced the sterility and safety of the sampling process. These technological innovations are driving the adoption of aseptic sampling across industries, ensuring that manufacturers can meet the high standards required in today's market.What Trends Are Driving the Adoption of Aseptic Sampling?

Several key trends are influencing the widespread adoption of aseptic sampling, reflecting the evolving needs of various industries. The biopharmaceutical industry, in particular, has seen a surge in demand for aseptic sampling as it plays a critical role in ensuring the sterility and safety of complex biologic drugs. The shift towards continuous manufacturing processes in biopharma is further driving the need for reliable and efficient sampling methods that can provide real-time data without interrupting production. In the food and beverage sector, the increasing focus on product quality and safety has led to greater reliance on aseptic sampling to prevent contamination and maintain regulatory compliance. The global expansion of manufacturing operations, particularly in emerging markets, is also contributing to the growth of aseptic sampling as companies seek to standardize their processes and meet international quality standards. Furthermore, the rising awareness of contamination risks and the need for stringent quality control measures are pushing industries to adopt more advanced and reliable sampling technologies.What Is Fueling the Expansion of the Aseptic Sampling Market?

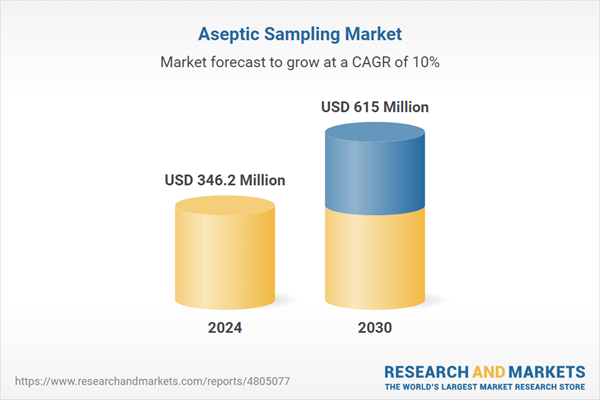

The growth in the aseptic sampling market is fueled by multiple factors that are driving its adoption across various industries. The biopharmaceutical sector's growing reliance on sterile manufacturing processes, especially in the production of biologics and complex drugs, is a key factor propelling demand for aseptic sampling solutions. Technological innovations, such as advancements in single-use systems and automated sampling technologies, are making these processes more efficient and cost-effective, thereby encouraging wider adoption. The increasing emphasis on quality control and strict regulatory compliance in the food and beverage industry is also accelerating market growth, as companies seek reliable methods to prevent contamination and ensure product safety. Moreover, the global expansion of supply chains and the need for standardized processes across different production facilities are contributing to the rising demand for aseptic sampling. The heightened awareness of contamination risks, particularly in the wake of recent global health challenges, is further driving the need for robust aseptic sampling practices. As these factors continue to evolve, the aseptic sampling market is expected to experience significant growth, supported by the ongoing demand for contamination-free manufacturing solutions.Report Scope

The report analyzes the Aseptic Sampling market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Manual Aseptic Sampling, Automatic Aseptic Sampling); Technique (Off-line, At-line, On-line); Application (Upstream, Downstream).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Off-line Technique segment, which is expected to reach US$251.8 Million by 2030 with a CAGR of 9.9%. The At-line Technique segment is also set to grow at 10.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $92.7 Million in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $137.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aseptic Sampling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aseptic Sampling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aseptic Sampling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Compagnie de Saint-Gobain, Danaher Corporation, Flownamics Analytical Instruments, Inc., GEA Group AG, GEMu Gebr. Muller Apparatebau GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Aseptic Sampling market report include:

- Compagnie de Saint-Gobain

- Danaher Corporation

- Flownamics Analytical Instruments, Inc.

- GEA Group AG

- GEMu Gebr. Muller Apparatebau GmbH & Co. KG

- Keofitt A/S

- Lonza Group AG

- Merck KgaA

- Qualitru Sampling Systems.

- Sartorius Stedim Biotech SA

- Thermo Fisher Scientific, Inc.

- Trace Analytics, LLC.

- W. L. Gore & Associates, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Compagnie de Saint-Gobain

- Danaher Corporation

- Flownamics Analytical Instruments, Inc.

- GEA Group AG

- GEMu Gebr. Muller Apparatebau GmbH & Co. KG

- Keofitt A/S

- Lonza Group AG

- Merck KgaA

- Qualitru Sampling Systems.

- Sartorius Stedim Biotech SA

- Thermo Fisher Scientific, Inc.

- Trace Analytics, LLC.

- W. L. Gore & Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 346.2 Million |

| Forecasted Market Value ( USD | $ 615 Million |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |