Global Alternative Finance Market - Key Trends and Drivers Summarized

What Is Fueling the Popularity of Alternative Finance?

Alternative finance is experiencing a surge in popularity, emerging as a vital resource for funding outside conventional financial systems. This dynamic sector includes a variety of financial services such as peer-to-peer (P2P) lending, crowdfunding, invoice trading, and cryptocurrency investments. A key factor driving this trend is the enhanced accessibility and inclusivity that alternative finance offers. Traditional banking often imposes stringent requirements, leaving many individuals and small businesses unable to secure essential capital. In contrast, alternative finance platforms provide more flexible and accessible options, appealing to a broader audience. This democratization of finance is particularly advantageous for startups, entrepreneurs, and small-to-medium enterprises (SMEs) that struggle to obtain funding through traditional means.How Are Technological Breakthroughs Transforming Alternative Finance?

Technological breakthroughs are at the forefront of the alternative finance revolution, making financial transactions more efficient, transparent, and secure. Blockchain technology, for example, has transformed transaction recording and verification, offering a decentralized, tamper-proof ledger that enhances trust and security. Similarly, advancements in artificial intelligence (AI) and machine learning have improved credit risk assessment and fraud detection, enhancing the reliability and user experience of alternative finance platforms. These technologies also enable process automation, reducing operational costs and allowing platforms to offer competitive rates and fees. Furthermore, mobile technology has increased service accessibility, enabling users to manage their finances conveniently via smartphones, which drives further adoption of alternative finance solutions.Which Trends Are Boosting the Expansion of Alternative Finance?

Several key trends are boosting the expansion of alternative finance, reflecting shifts in consumer preferences and market conditions. Growing dissatisfaction with traditional banking services, characterized by high fees, lack of transparency, and slow processing times, is pushing consumers towards more agile and customer-centric alternative finance platforms. The rise of the gig economy, with its increasing number of freelancers and independent contractors, has created a demand for flexible financial solutions tailored to their unique needs. Additionally, the global emphasis on financial inclusion has highlighted the importance of providing underserved populations with access to financial services, a gap that alternative finance effectively addresses. The ongoing digitization of financial services and the increasing comfort with online transactions among consumers have further accelerated the shift towards alternative finance.What Factors Are Driving the Growth of the Alternative Finance Market?

The growth in the alternative finance market is driven by several factors, primarily technological advancements, evolving consumer behaviors, and regulatory support. Innovations in blockchain, AI, and mobile technology have significantly improved the efficiency, security, and accessibility of alternative finance platforms. Changes in consumer behavior, particularly the demand for more flexible, transparent, and customer-centric financial services, have fueled the market. The expansion of gig economy and the increase in freelance work have created a need for financial products that cater to these new working models. Regulatory support and the push for financial inclusion have also been crucial, as governments and regulatory bodies recognize the potential of alternative finance to bridge gaps in the traditional financial system. Strategic partnerships and collaborations between fintech companies and traditional financial institutions are fostering innovation and expanding the reach of alternative finance solutions. These factors collectively ensure a robust growth trajectory for the alternative finance market in the coming years.Report Scope

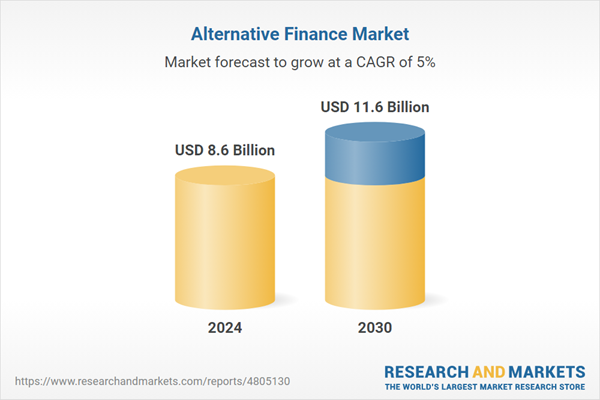

The report analyzes the Alternative Finance market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Crowdinvesting, Crowdfunding).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Crowdinvesting segment, which is expected to reach US$9.7 Billion by 2030 with a CAGR of 4.9%. The Crowdfunding segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alternative Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alternative Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alternative Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accion International, Alden State Bank, AssetMark, AWEpay, Bank of Jinzhou and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 461 companies featured in this Alternative Finance market report include:

- Accion International

- Alden State Bank

- AssetMark

- AWEpay

- Bank of Jinzhou

- Brewin Dolphin Limited

- BTG Pactual

- Coinmen Consultants

- Crowdcube

- Crowdfunder Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accion International

- Alden State Bank

- AssetMark

- AWEpay

- Bank of Jinzhou

- Brewin Dolphin Limited

- BTG Pactual

- Coinmen Consultants

- Crowdcube

- Crowdfunder Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.6 Billion |

| Forecasted Market Value ( USD | $ 11.6 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |