Global Aircraft Seating Market - Key Trends and Drivers Summarized

What Makes Aircraft Seating So Important?

Aircraft seating plays a crucial role in the aviation industry, impacting not only the comfort of passengers but also the overall efficiency and economics of airline operations. Modern aircraft seats are designed with a focus on ergonomics, utilizing advanced materials and innovative designs to ensure maximum comfort during flights, which can range from short domestic trips to long-haul international journeys. Airlines are increasingly prioritizing passenger experience, investing in premium seating options that offer additional legroom, recline features, and enhanced cushioning. These advancements are not merely about comfort but also about safety and compliance with stringent aviation regulations, which dictate the materials and structural integrity of the seats to withstand various stresses during flight.How Are Technological Innovations Shaping The Future Of Aircraft Seating?

Technological innovations are at the forefront of transforming the aircraft seating market. The integration of smart technologies, such as Internet of Things (IoT) and in-flight connectivity, is revolutionizing the passenger experience. Seats are now equipped with touchscreens, charging ports, and even wireless control systems, allowing passengers to adjust their seating position, lighting, and climate settings with ease. Lightweight composite materials are being increasingly used to reduce the overall weight of the aircraft, contributing to fuel efficiency and reduced emissions. Additionally, the development of modular seating designs allows for easier customization and reconfiguration of cabin layouts, providing airlines with the flexibility to meet varying passenger demands and optimize space utilization.What Are The Key Trends Driving The Aircraft Seating Market?

The aircraft seating market is being shaped by several key trends that reflect changing consumer preferences and industry demands. There is a growing emphasis on sustainability, with airlines seeking eco-friendly seating solutions that align with their environmental goals. The use of recycled materials and innovations in biodegradable seat covers are gaining traction. Another significant trend is the customization of aircraft interiors. Airlines are collaborating with seat manufacturers to design bespoke seating arrangements that cater to specific market segments, such as business class, economy plus, and ultra-long-haul flights. The rise of urban air mobility (UAM) and electric aircraft is also opening new avenues for seating solutions tailored to these emerging platforms, which require lightweight, compact, and highly efficient designs.What Factors Are Driving Growth In The Aircraft Seating Market?

The growth in the aircraft seating market is driven by several factors. Firstly, the increasing air passenger traffic globally is necessitating the expansion and modernization of airline fleets, which in turn drives the demand for advanced seating solutions. Technological advancements, such as the integration of smart seating systems and the use of lightweight materials, are also significant growth drivers. Additionally, consumer preferences for enhanced comfort and personalized in-flight experiences are pushing airlines to invest in premium and customizable seating options. The regulatory landscape is another critical factor, with stringent safety standards propelling the adoption of high-quality, compliant seating solutions. Furthermore, the trend towards sustainability in the aviation sector is fostering innovations in eco-friendly seat designs, thereby expanding market opportunities. The rise of new aviation segments, including UAM and electric aircraft, is also contributing to the market's growth by creating demand for innovative and adaptable seating technologies.Report Scope

The report analyzes the Aircraft Seating market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Structure Materials, Cushion Filling Materials, Upholsteries & Seat Covers); Seat Class (Business Class, Economy Class, First Class, Premium Economy Class); End-Use (OEM, Aftermarket, MRO).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Structure Materials segment, which is expected to reach US$3.2 Billion by 2030 with a CAGR of 5.3%. The Cushion Filling Materials segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Seating Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Seating Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Seating Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACRO Aircraft Seating Ltd., Aviointeriors S.P.A, Geven S.P.A, Haeco Americas, Recaro Aircraft Seating GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 17 companies featured in this Aircraft Seating market report include:

- ACRO Aircraft Seating Ltd.

- Aviointeriors S.P.A

- Geven S.P.A

- Haeco Americas

- Recaro Aircraft Seating GmbH & Co. KG

- STELIA Aerospace

- Thompson Aero Seating Ltd.

- Zim Flugsitz GmbH

- Zodiac Aerospace

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACRO Aircraft Seating Ltd.

- Aviointeriors S.P.A

- Geven S.P.A

- Haeco Americas

- Recaro Aircraft Seating GmbH & Co. KG

- STELIA Aerospace

- Thompson Aero Seating Ltd.

- Zim Flugsitz GmbH

- Zodiac Aerospace

Table Information

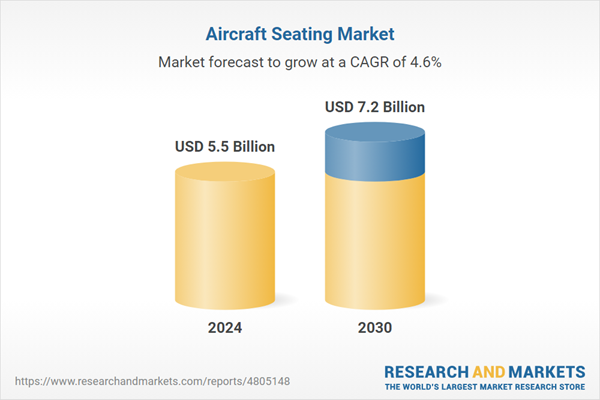

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |