Global Microfinance Market - Key Trends & Drivers Summarized

Microfinance refers to the provision of financial services, including small loans, savings accounts, insurance, and payment systems, to low-income individuals and small businesses that typically lack access to traditional banking services. Microfinance institutions (MFIs) aim to empower economically disadvantaged populations by providing them with the financial resources needed to start or expand small businesses, improve household incomes, and achieve financial independence. Microfinance plays a crucial role in poverty alleviation, economic development, and social inclusion by enabling underserved communities to participate in the formal financial system and build sustainable livelihoods.The development of microfinance has been driven by the recognition of financial inclusion as a key factor in economic development and poverty reduction. Innovations in microfinance models, such as group lending, mobile banking, and digital financial services, have enhanced the accessibility and efficiency of microfinance. Group lending, where small groups of borrowers collectively guarantee each other's loans, has proven effective in mitigating risks and fostering community support. The advent of mobile banking and digital financial platforms has revolutionized microfinance by reducing transaction costs, expanding reach, and improving service delivery. These advancements have enabled MFIs to serve remote and underserved areas more effectively, promoting financial inclusion on a broader scale.

The growth in the microfinance market is driven by several factors. Firstly, the increasing emphasis on financial inclusion and poverty alleviation is boosting the demand for microfinance services. Secondly, advancements in digital technology and mobile banking are enhancing the accessibility and efficiency of microfinance. Thirdly, supportive regulatory frameworks and government initiatives promoting microfinance are driving market growth. Additionally, the rising awareness of the social and economic benefits of microfinance is encouraging investments and partnerships in this sector. Lastly, the expansion of microfinance into new regions and the diversification of services, including microinsurance and micro-savings, are further propelling market growth, ensuring that more individuals and small businesses can access the financial resources they need to thrive.

Report Scope

The report analyzes the Microfinance market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Institution Type (Banks, Non-Banks); End-User (Small Enterprises, Solo Entrepreneurs / Self-Employed, Micro Enterprises).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Small Enterprises End-User segment, which is expected to reach US$201.9 Billion by 2030 with a CAGR of 12.2%. The Solo EntrEpreneurs / Self-employed End-User segment is also set to grow at 14.2% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Microfinance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microfinance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Microfinance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accion International, Al Amana Microfinance, Al-Barakah Microfinance Bank, Annapurna Finance (P) Ltd, Asirvad Microfinance Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 178 companies featured in this Microfinance market report include:

- Accion International

- Al Amana Microfinance

- Al-Barakah Microfinance Bank

- Annapurna Finance (P) Ltd

- Asirvad Microfinance Pvt. Ltd.

- Banco do Nordeste do Brasil S.A.

- Bandhan Bank

- Bank Rakyat Indonesia

- BRAC International

- BSS Microfinance Ltd.

- FINCA International

- Fusion Micro Finance Ltd.

- Grameen Foundation

- IndusInd Bank Limited

- Kiva

- Manappuram Finance Limited.

- Opportunity International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accion International

- Al Amana Microfinance

- Al-Barakah Microfinance Bank

- Annapurna Finance (P) Ltd

- Asirvad Microfinance Pvt. Ltd.

- Banco do Nordeste do Brasil S.A.

- Bandhan Bank

- Bank Rakyat Indonesia

- BRAC International

- BSS Microfinance Ltd.

- FINCA International

- Fusion Micro Finance Ltd.

- Grameen Foundation

- IndusInd Bank Limited

- Kiva

- Manappuram Finance Limited.

- Opportunity International

Table Information

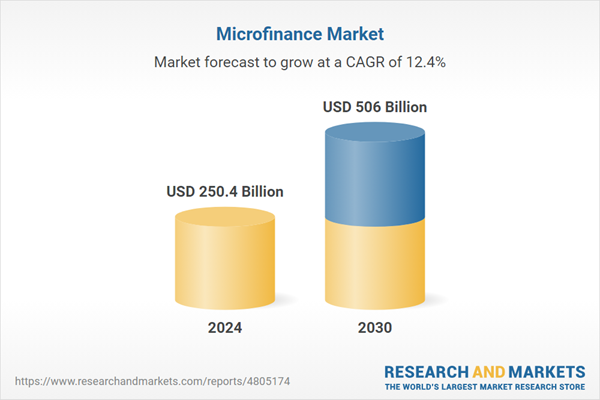

| Report Attribute | Details |

|---|---|

| No. of Pages | 519 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 250.4 Billion |

| Forecasted Market Value ( USD | $ 506 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |