Global Medical Foams Market - Key Trends & Drivers Summarized

What Are Medical Foams and Why Are They Integral to Healthcare Solutions?

Medical foams are specialized materials designed for use in various healthcare applications, including wound care, medical devices, and patient positioning systems. These foams are valued for their unique properties such as high absorbency, cushioning, support, and thermal insulation. Depending on the application, medical foams can be manufactured from polyurethane, silicone, or polystyrene, each offering distinct benefits in terms of flexibility, comfort, and hypoallergenic properties. The critical role of medical foams lies in their ability to enhance patient comfort and care - providing support in bedding and seating, protecting sensitive skin in wound dressings, and ensuring devices are ergonomically designed to reduce pressure points and prevent bedsores. As healthcare providers continue to seek solutions that improve patient outcomes and comfort, the demand for innovative medical foam products grows, driving advancements in foam technologies and applications within the medical sector.How Are Technological Advancements Shaping the Medical Foams Industry?

The medical foams industry is undergoing significant transformation thanks to technological advancements that improve the properties and functionalities of foam products. Innovations in foam fabrication techniques such as reticulation, a process that enhances the porosity of foam, have led to more effective medical dressings that better manage wound exudate and promote healing. Additionally, the development of memory foams infused with gel or other materials provides superior support and comfort for patients, particularly in orthopedic and long-term care settings. Advancements in material science have also enabled the creation of foams with antimicrobial properties, which are crucial in reducing the risk of infections in medical settings. These technological improvements not only extend the applications of medical foams but also enhance their performance, making them indispensable in modern healthcare practices.What Regulatory and Environmental Considerations Are Influencing the Medical Foams Market?

Regulatory and environmental considerations play a pivotal role in shaping the medical foams market, as manufacturers must comply with strict standards regarding the safety and biocompatibility of materials used in medical applications. Regulatory bodies such as the FDA in the United States and the EMA in Europe enforce guidelines that ensure medical foams are safe for direct contact with patients and do not release harmful substances. In addition to regulatory compliance, there is increasing pressure on the industry to adopt more sustainable practices. This includes using eco-friendly materials and processes in the production of medical foams to reduce environmental impact. Manufacturers are responding by developing bio-based foams and incorporating recycling processes that help minimize waste and carbon footprints, aligning product development with environmental sustainability while maintaining the high standards required for medical products.Growth in the Medical Foams Market Is Driven by Several Factors

The growth in the medical foams market is driven by several factors, highlighting the expanding scope of their applications and the evolving needs of the healthcare industry. An aging global population and the rising prevalence of chronic diseases are increasing the demand for medical devices and products that incorporate medical foams for comfort and functionality. Technological advancements that enhance the properties of foams, such as improved breathability, durability, and infection control, are also key contributors to market expansion. Furthermore, the growing focus on patient comfort and the ongoing improvements in healthcare infrastructure worldwide are boosting the use of advanced foam solutions in medical settings. The increasing emphasis on preventive care and the management of chronic conditions at home also drive the demand for medical foam products, as they are used extensively in bedding, seating, and various orthopedic supports. Additionally, regulatory requirements for safer and more effective medical products continue to push innovations in foam technology, ensuring sustained growth and innovation in this vital market.Report Scope

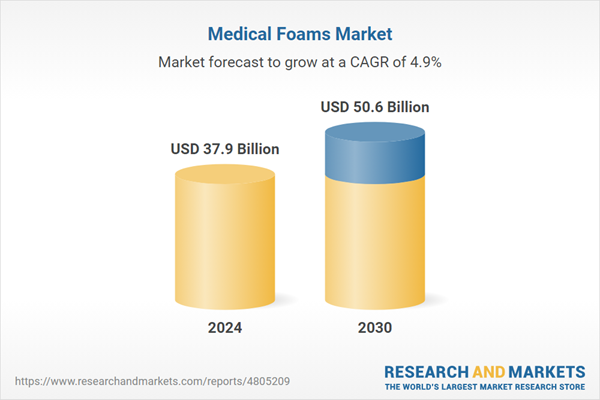

The report analyzes the Medical Foams market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material Type (Polymers, Latex, Metals); Application (Bedding & Cushioning, Medical Packaging, Medical Devices & Components, Prosthetics & Wound Care, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polymers segment, which is expected to reach US$27 Billion by 2030 with a CAGR of 5.7%. The Latex segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.9 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $11.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Foams Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Foams Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Foams Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Absolute Packaging, Allied Aerofoam Products, LLC, Amatech, Inc., Amcon American Converters, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 84 companies featured in this Medical Foams market report include:

- 3M Company

- Absolute Packaging

- Allied Aerofoam Products, LLC

- Amatech, Inc.

- Amcon American Converters, Inc.

- American Excelsior Company

- American Flexible Products, Inc.

- American Foam Products

- American Foam Technologies, Inc.

- Armacell GmbH

- Avery Dennison Corporation

- BASF SE

- Bayer AG

- Clark Foam Products Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Flextech, Inc.

- Foam Products, Inc.

- Foam Sciences

- Foam Techniques Ltd.

- Foamcraft, Inc.

- FoamPartner (Fritz Nauer AG)

- Foamtec Medical

- Future Foam, Inc.

- FXI - Foamex Innovations

- General Plastics Manufacturing Co., Inc.

- Grand Rapids Foam Technologies

- Heubach Corporation

- Huntsman Corporation

- INOAC Corporation

- Intec Foams Ltd.

- Parafix Tapes & Conversions Ltd.

- Polyformes Ltd.

- Recticel NV

- Reilly Foam Corporation

- Rempac Foam, LLC

- Rogers Corporation

- Rogers Foam Corporation

- Rynel, Inc.

- Sekisui Chemical Co., Ltd.

- Technical Foam Services

- The Woodbridge Group®

- Trelleborg AB

- UFP Technologies, Inc.

- Value Foam, Inc.

- Vitacare Medical Products

- Wisconsin Foam Products

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Absolute Packaging

- Allied Aerofoam Products, LLC

- Amatech, Inc.

- Amcon American Converters, Inc.

- American Excelsior Company

- American Flexible Products, Inc.

- American Foam Products

- American Foam Technologies, Inc.

- Armacell GmbH

- Avery Dennison Corporation

- BASF SE

- Bayer AG

- Clark Foam Products Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Flextech, Inc.

- Foam Products, Inc.

- Foam Sciences

- Foam Techniques Ltd.

- Foamcraft, Inc.

- FoamPartner (Fritz Nauer AG)

- Foamtec Medical

- Future Foam, Inc.

- FXI - Foamex Innovations

- General Plastics Manufacturing Co., Inc.

- Grand Rapids Foam Technologies

- Heubach Corporation

- Huntsman Corporation

- INOAC Corporation

- Intec Foams Ltd.

- Parafix Tapes & Conversions Ltd.

- Polyformes Ltd.

- Recticel NV

- Reilly Foam Corporation

- Rempac Foam, LLC

- Rogers Corporation

- Rogers Foam Corporation

- Rynel, Inc.

- Sekisui Chemical Co., Ltd.

- Technical Foam Services

- The Woodbridge Group®

- Trelleborg AB

- UFP Technologies, Inc.

- Value Foam, Inc.

- Vitacare Medical Products

- Wisconsin Foam Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 213 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 37.9 Billion |

| Forecasted Market Value ( USD | $ 50.6 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |