Global Medical Devices Packaging Market - Key Trends & Drivers Summarized

What Is Medical Devices Packaging and Why Is Its Integrity Crucial?

Medical devices packaging encompasses a variety of materials and technologies used to safely encase medical devices for storage, transport, and sterile delivery. This packaging must meet stringent standards to ensure it effectively protects the device from mechanical damage and maintains its sterility from the point of manufacture to the end-use. The significance of medical devices packaging is paramount as it directly impacts the safety and effectiveness of the device, preventing contamination and ensuring functionality upon delivery. With medical devices ranging from simple bandages to complex implantables, the packaging technology used varies widely, including rigid containers, pouches, trays, and clamshells, each designed to address the specific needs of the device it holds. The growing complexity of medical devices, coupled with increasing regulatory scrutiny, drives the need for innovative packaging solutions that offer enhanced protection, are cost-effective, and environmentally sustainable.How Are Advances in Materials and Technology Shaping Medical Device Packaging?

Technological advancements and material innovations are significantly shaping the medical device packaging industry, pushing the boundaries of what's possible in protecting and preserving medical products. New materials that offer enhanced barrier properties, improved durability, and greater clarity are being developed to ensure devices are kept in pristine condition until they reach the end-user. For instance, the use of high-barrier films that protect sensitive devices from moisture, oxygen, and other environmental factors is on the rise. Additionally, smart packaging technologies that incorporate indicators for temperature, humidity, and sterilization status are becoming increasingly common. These technologies not only enhance the safety and integrity of the packaging but also add value by improving supply chain visibility and patient safety through better tracking and management of the device's condition throughout its lifecycle.What Regulatory and Sustainability Challenges Impact Medical Device Packaging?

Regulatory compliance is a major driver in the medical device packaging sector, with stringent standards and guidelines set by authorities such as the FDA and ISO to ensure packaging efficacy and safety. The regulations dictate not only the materials and designs used in packaging but also require thorough validation and documentation processes. These compliance requirements can pose challenges, especially for smaller manufacturers who must navigate complex regulatory landscapes. On the sustainability front, the medical device packaging industry faces increasing pressure to reduce its environmental footprint. This has spurred innovation in developing recyclable and biodegradable packaging options. However, balancing sustainability with the stringent barrier and protective requirements of medical packaging remains a challenging endeavor. The industry is actively seeking new materials and designs that satisfy both environmental and regulatory demands without compromising the package's protective functions.Growth in the Medical Devices Packaging Market Is Driven by Several Factors

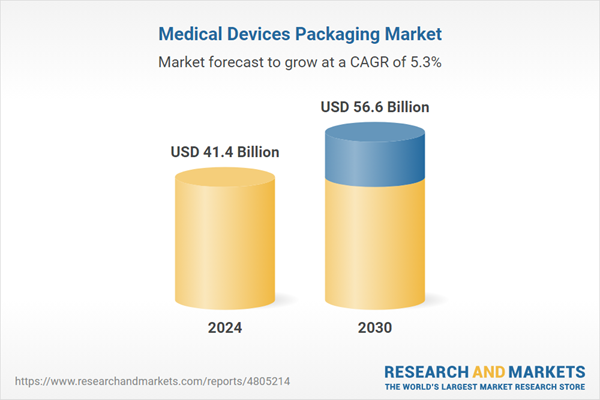

The growth in the medical devices packaging market is driven by several factors, reflecting the increasing complexities and regulatory demands of the healthcare sector. The rising global demand for medical devices, driven by an aging population and increasing healthcare needs, directly correlates with a need for more advanced and reliable packaging solutions. Technological innovations that enhance package safety, improve patient compliance, and incorporate sustainability are key drivers of this growth. Additionally, as global health standards rise and markets expand into emerging regions, there is a growing requirement for packaging that can withstand various logistical challenges and maintain device integrity across diverse environments. Moreover, regulatory pressures for stricter compliance in packaging safety and effectiveness continue to push manufacturers towards innovative solutions that meet these rigorous standards. The focus on reducing hospital-acquired infections also emphasizes the need for effective sterile medical packaging, further driving market expansion. These factors, combined with the ongoing efforts to integrate eco-friendly practices, are shaping a dynamic and growing market, ensuring that medical devices reach patients safely and effectively.Report Scope

The report analyzes the Medical Devices Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Bags & Pouches, Trays, Boxes, Clamshells, Other Types); Application (Equipment & Tools, IVD, Devices, Implants).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bags & Pouches segment, which is expected to reach US$23.4 Billion by 2030 with a CAGR of 6.9%. The Trays segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.8 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $13 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Devices Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Devices Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Devices Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Albea Group, Amcor Ltd., Bemis Co., Inc., Berry Global, Inc., Mitsubishi Chemical Holdings Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Medical Devices Packaging market report include:

- Albea Group

- Amcor Ltd.

- Bemis Co., Inc.

- Berry Global, Inc.

- Mitsubishi Chemical Holdings Corporation

- SteriPack Group

- Technipaq, Inc.

- WestRock Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Albea Group

- Amcor Ltd.

- Bemis Co., Inc.

- Berry Global, Inc.

- Mitsubishi Chemical Holdings Corporation

- SteriPack Group

- Technipaq, Inc.

- WestRock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.4 Billion |

| Forecasted Market Value ( USD | $ 56.6 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |