Global Maple Syrup Market - Key Trends & Drivers Summarized

What Is Maple Syrup and Why Is It a Unique Product in the Global Sweetener Market?

Maple syrup is a natural sweetener derived from the sap of maple trees, primarily produced in regions like Canada and the northeastern United States. Known for its distinct flavor and minimal processing, maple syrup stands out as a premium alternative to refined sugar and artificial sweeteners. The unique production process, which involves tapping trees in the early spring, boiling the sap to reduce water content, and bottling the syrup, makes it a seasonal and region-specific product. As consumers increasingly seek natural, unprocessed foods, maple syrup has gained popularity not only as a topping for pancakes and waffles but also as an ingredient in various culinary and baking applications. Its rich flavor and health benefits, such as antioxidants and lower glycemic index compared to sugar, contribute to its growing appeal in global markets.How Are Changing Consumer Preferences Shaping the Maple Syrup Market?

Shifting consumer preferences towards natural and organic products are driving demand for maple syrup in both established and emerging markets. As health-conscious consumers look for alternatives to refined sugars, maple syrup is often viewed as a healthier and more natural choice. The demand for organic maple syrup has surged, with many consumers willing to pay a premium for products labeled as organic, non-GMO, or sustainably sourced. Additionally, maple syrup is increasingly being incorporated into a variety of food products, including snacks, beverages, and health foods, contributing to its expanding market presence. The trend towards clean label products, where consumers seek fewer and more recognizable ingredients, is also boosting the use of maple syrup as a natural sweetener in processed foods and beverages.What Challenges Are Impacting the Maple Syrup Industry?

Despite its popularity, the maple syrup industry faces several challenges, including climate change, supply chain constraints, and fluctuating production levels. Climate change poses a significant threat to maple syrup production, as warmer winters and shorter tapping seasons can reduce sap yields. This can lead to inconsistent supply and potentially higher prices for consumers. Additionally, the labor-intensive process of tapping and processing maple syrup means that production costs are relatively high compared to other sweeteners. As global demand increases, ensuring sustainable production practices and managing the environmental impact of maple farming are key concernsGrowth in the Maple Syrup Market Is Driven by Several Factors

The growth in the maple syrup market is driven by several factors, including increasing consumer demand for natural and organic sweeteners, rising awareness of the health benefits associated with maple syrup, and the expansion of its use in food and beverage products. As more consumers prioritize clean label and minimally processed foods, the appeal of maple syrup as a natural alternative to sugar continues to grow. Technological advancements in syrup processing and packaging are also helping producers improve efficiency and reduce costs, making maple syrup more accessible in global markets. Additionally, the rising trend of plant-based and vegan diets has fueled demand for natural sweeteners like maple syrup, as it is often used in plant-based recipes. These factors, along with the growing preference for authentic, premium food products, are expected to drive significant growth in the maple syrup market.Report Scope

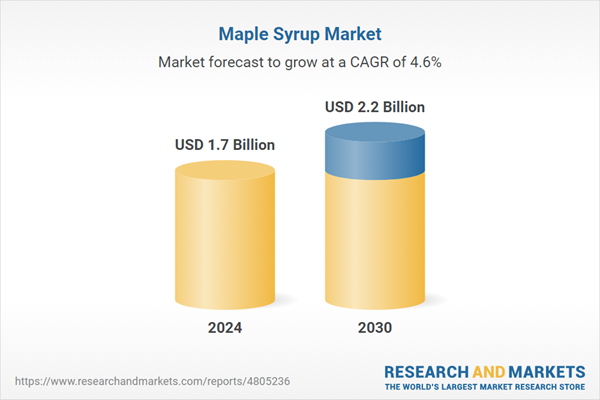

The report analyzes the Maple Syrup market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Conventional, Organic); Type (Sugar Maple, Black Maple, Red Maple); Distribution Channel (Offline, Online).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventionalv segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of 4.1%. The Organic Maple Syrup segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $447 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $475 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Maple Syrup Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Maple Syrup Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Maple Syrup Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4Pure, Acadian Maple Products Limited, Alleghanys Maple Farms Inc., Amber Ridge Maple, Appalaches Nature Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 54 companies featured in this Maple Syrup market report include:

- 4Pure

- Acadian Maple Products Limited

- Alleghanys Maple Farms Inc.

- Amber Ridge Maple

- Appalaches Nature Inc.

- B&G Foods, Inc.

- Bascom Maple Farms, Inc.

- Blackberry Patch, Inc.

- Brown Family Farm, Inc.

- Citadelle Maple Syrup Producers' Cooperative

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 4Pure

- Acadian Maple Products Limited

- Alleghanys Maple Farms Inc.

- Amber Ridge Maple

- Appalaches Nature Inc.

- B&G Foods, Inc.

- Bascom Maple Farms, Inc.

- Blackberry Patch, Inc.

- Brown Family Farm, Inc.

- Citadelle Maple Syrup Producers' Cooperative

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 329 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |