Global Next-Generation Memory Market - Key Trends & Drivers Summarized

What Is Next-Generation Memory and Why Is It Critical for Data Processing?

Next-generation memory refers to advanced memory technologies designed to overcome the limitations of traditional memory systems like DRAM and NAND. These new memory solutions include technologies such as Resistive RAM (ReRAM), Phase-Change Memory (PCM), Magnetoresistive RAM (MRAM), and 3D XPoint. These innovations offer faster data access, higher density, lower power consumption, and greater endurance than conventional memory, making them critical for handling modern data processing demands in applications such as artificial intelligence (AI), big data, machine learning (ML), and the Internet of Things (IoT).The growing need for faster, more reliable, and scalable memory solutions is driving the adoption of next-generation memory technologies. In an era where data generation is exploding, traditional memory architectures struggle to keep up with the performance demands of cloud computing, AI, and edge computing. Next-generation memory provides the necessary speed and efficiency for high-performance computing, allowing enterprises to accelerate data processing, improve energy efficiency, and enhance the performance of next-gen applications like autonomous systems, smart cities, and advanced data analytics.

How Is the Next-Generation Memory Market Evolving?

The next-generation memory market is evolving at a rapid pace, driven by the need for faster, non-volatile, and energy-efficient memory solutions. One of the key trends is the growing adoption of non-volatile memory technologies such as MRAM and ReRAM, which offer the ability to retain data even when power is lost. These technologies are being increasingly used in high-performance computing environments, where data integrity and fast access are critical. MRAM, for example, combines the speed of traditional RAM with non-volatility, making it ideal for applications that require frequent power cycling without losing data.Another major trend is the development of 3D XPoint technology, which provides significantly faster read/write speeds compared to NAND flash memory, while offering much higher durability. This technology is gaining traction in data centers, where the demand for high-speed, high-endurance storage is skyrocketing due to cloud computing and big data analytics. Additionally, the shift toward edge computing is pushing the need for next-gen memory solutions that are capable of handling real-time processing with minimal latency. Edge devices, such as autonomous vehicles and industrial IoT systems, require memory solutions that can quickly process data at the source, without relying on cloud connectivity.

Which Industries Are Driving the Adoption of Next-Generation Memory?

Next-generation memory is being adopted across a wide range of industries, with the IT and data center sectors being at the forefront. Data centers, which host cloud services and big data applications, require memory solutions that can handle massive amounts of data at high speeds while maintaining energy efficiency. Next-gen memory technologies like 3D XPoint and PCM are particularly suited for these environments due to their low latency and high endurance, making them critical for supporting cloud infrastructure and high-performance computing (HPC) tasks.The automotive industry is another major driver of next-generation memory adoption, particularly in the development of autonomous vehicles and advanced driver assistance systems (ADAS). These vehicles require real-time data processing to interpret sensor information and make split-second decisions, making fast, non-volatile memory essential for ensuring performance and safety. Additionally, the consumer electronics sector, especially in the development of smartphones, wearables, and gaming devices, is driving demand for next-generation memory that provides faster performance and longer battery life.

What Are the Key Growth Drivers in the Next-Generation Memory Market?

The growth in the next-generation memory market is driven by several key factors. One of the primary drivers is the increasing demand for high-performance computing and big data analytics, which require faster and more reliable memory solutions. Traditional memory technologies are no longer sufficient to meet the needs of AI, ML, and data-intensive applications, driving the shift towards next-gen memory technologies. Another key driver is the rise of autonomous systems and IoT devices, which require real-time data processing at the edge, necessitating fast, non-volatile memory solutions.Technological advancements in memory architectures, such as the development of MRAM, PCM, and 3D XPoint, are also fueling market growth by providing faster data access and greater endurance compared to conventional memory. The expanding adoption of cloud computing and the increasing need for energy-efficient data centers are further boosting demand for next-gen memory. Additionally, the rise of smart devices, including smartphones, wearables, and connected home appliances, is pushing the market forward as these devices demand memory solutions that offer high-speed performance while minimizing power consumption.

Global Next-Generation Network Market - Key Trends & Drivers Summarized

What Are Next-Generation Networks and Why Are They Transformative?

Next-generation networks (NGN) refer to advanced telecommunication networks that integrate multiple services - including voice, data, and multimedia - into a single, unified infrastructure. Unlike traditional networks, which are siloed by service type, NGNs are designed to be highly flexible, scalable, and efficient. They enable seamless communication across various devices, networks, and platforms, supporting technologies such as 5G, fiber-optic broadband, Internet Protocol (IP) telephony, and cloud computing. NGNs are essential for providing faster, more reliable, and scalable connectivity, supporting the rapid growth of IoT, smart cities, and advanced communication services.NGNs are transformative because they offer a more streamlined, cost-effective way of managing data and communications traffic. By consolidating multiple network services into one infrastructure, service providers can reduce operational costs, improve network management, and offer higher-quality services to users. This approach also enables faster deployment of new technologies and services, from enhanced mobile broadband (5G) to ultra-low latency applications for autonomous systems and industrial automation. NGNs are fundamental for supporting the data-heavy demands of modern digital ecosystems.

How Is the Next-Generation Network Market Evolving?

The next-generation network market is evolving alongside advancements in telecommunications technologies, particularly with the global rollout of 5G. One of the key trends is the shift towards software-defined networking (SDN) and network function virtualization (NFV). These technologies allow network operators to manage and configure their networks using software, rather than relying on traditional hardware-based systems. This approach enhances flexibility, reduces costs, and makes it easier to scale networks in response to growing demand, especially in cloud and IoT environments.Another important trend is the expansion of fiber-optic networks, which provide the high bandwidth needed for NGN infrastructure. Fiber-optic connectivity is becoming more widespread, particularly in urban areas, and is crucial for enabling high-speed internet, seamless video streaming, and advanced applications like augmented reality (AR) and virtual reality (VR). The growing adoption of edge computing is also driving the evolution of NGNs, as it requires networks that can process data closer to the source to reduce latency. NGNs are being adapted to meet the needs of edge computing, which is essential for real-time applications in sectors such as healthcare, manufacturing, and autonomous vehicles.

Which Industries Are Driving the Adoption of Next-Generation Networks?

Next-generation networks are being adopted across a range of industries, with telecommunications being the primary driver. Telecom operators are leading the charge in deploying NGNs to support 5G rollouts and provide customers with faster, more reliable communication services. The media and entertainment industry is another significant adopter, as NGNs enable high-quality video streaming, cloud gaming, and immersive experiences like AR and VR. These industries require high bandwidth, low latency, and seamless connectivity, all of which are provided by NGNs.The healthcare sector is also leveraging NGNs to enable telemedicine, remote diagnostics, and real-time health monitoring. NGNs provide the necessary infrastructure for transmitting large amounts of medical data securely and efficiently. Similarly, the manufacturing sector is adopting NGNs to enable smart factory initiatives, where IoT devices and sensors are used for predictive maintenance, process optimization, and automation. In the public sector, governments are adopting NGNs for smart city projects, which require robust, scalable networks to manage traffic, energy, and public safety systems.

What Are the Key Growth Drivers in the Next-Generation Network Market?

The growth in the next-generation network market is driven by several key factors, starting with the global expansion of 5G networks. The deployment of 5G is driving demand for NGNs that can support high-speed, low-latency communication services. Another critical driver is the increasing adoption of IoT devices, which require robust, scalable networks to support billions of connected devices across industries. NGNs are essential for providing the infrastructure needed for IoT applications, from smart cities to industrial automation.The shift toward cloud computing and edge computing is also fueling demand for NGNs, as these networks provide the high-performance connectivity needed for data processing at the edge. Additionally, the rise of smart cities and digital transformation across industries is contributing to the growth of NGNs. Governments and businesses are investing in next-generation network infrastructure to enable new services, improve operational efficiency, and enhance the quality of life for citizens. Lastly, the growing demand for high-speed broadband and the increasing reliance on digital services are further driving the expansion of the NGN market.

Report Scope

The report analyzes the Next-Generation Memory market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Non-Volatile Memory, Volatile Memory); Wafer Size (200 mm, 300 mm, 450 mm); Application (Enterprise Storage, Consumer Electronics, Automotive, Aerospace & Defense, IT & Telecom, Healthcare, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-volatile Memory segment, which is expected to reach US$58.3 Billion by 2030 with a CAGR of 25.6%. The Volatile Memory segment is also set to grow at 17.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6 Billion in 2024, and China, forecasted to grow at an impressive 22.9% CAGR to reach $11 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Next-Generation Memory Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Next-Generation Memory Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Next-Generation Memory Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avalanche Technology, Blueshift Memory, Crossbar Inc., Everspin Technologies Inc., Honeywell Aerospace Technologies and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 27 companies featured in this Next-Generation Memory market report include:

- Avalanche Technology

- Blueshift Memory

- Crossbar Inc.

- Everspin Technologies Inc.

- Honeywell Aerospace Technologies

- Infineon Technologies AG

- Intel Corporation

- Korea Institute Of Science & Technology Evaluation And Planning (KISTEP)

- Microchip Technology, Inc.

- Micron Technology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avalanche Technology

- Blueshift Memory

- Crossbar Inc.

- Everspin Technologies Inc.

- Honeywell Aerospace Technologies

- Infineon Technologies AG

- Intel Corporation

- Korea Institute Of Science & Technology Evaluation And Planning (KISTEP)

- Microchip Technology, Inc.

- Micron Technology, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

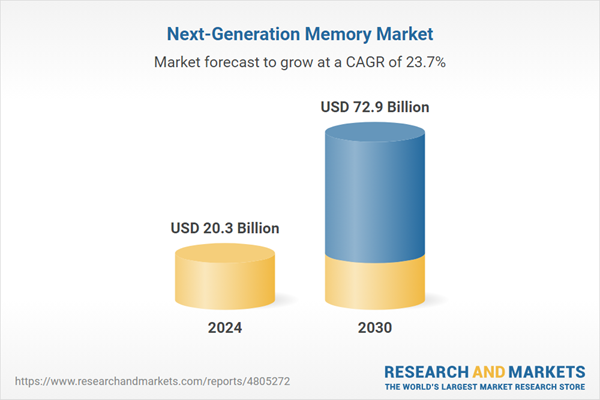

| Estimated Market Value ( USD | $ 20.3 Billion |

| Forecasted Market Value ( USD | $ 72.9 Billion |

| Compound Annual Growth Rate | 23.7% |

| Regions Covered | Global |