Global Next-Generation Data Storage Market - Key Trends & Drivers Summarized

What Is Next-Generation Data Storage and Why Is It Crucial?

Next-generation data storage refers to advanced storage technologies designed to handle the rapidly increasing volume and complexity of data generated by businesses, IoT devices, and digital platforms. These systems include solid-state drives (SSDs), cloud storage, hyper-converged infrastructure (HCI), and storage solutions that leverage artificial intelligence (AI) and machine learning (ML) to optimize data management. Unlike traditional storage systems, next-generation data storage solutions provide higher speeds, greater scalability, and enhanced flexibility, enabling organizations to store, manage, and retrieve data more efficiently.The importance of next-generation data storage lies in its ability to meet the demands of modern data environments. As data generation accelerates with the rise of big data, AI, edge computing, and IoT, organizations need more sophisticated storage solutions that can scale seamlessly while maintaining high performance. Next-generation data storage technologies also provide improved data protection and disaster recovery, which are essential for ensuring business continuity in the face of cyberattacks, hardware failures, or natural disasters. These solutions enable businesses to harness the power of their data, driving innovation and improving decision-making.

How Is the Next-Generation Data Storage Market Advancing?

The next-generation data storage market is advancing rapidly, driven by innovations in storage technology and the increasing reliance on cloud-based infrastructures. One of the key trends in this market is the growing adoption of NVMe (Non-Volatile Memory Express) SSDs, which offer significantly faster data transfer speeds compared to traditional hard drives or SATA SSDs. NVMe SSDs are particularly well-suited for handling high-performance applications like AI, machine learning, and big data analytics, where the speed of data access is critical to overall performance.Another significant trend is the shift toward hybrid cloud storage solutions, which combine on-premise storage with cloud-based systems to provide greater flexibility, scalability, and cost efficiency. This hybrid approach allows businesses to store sensitive or mission-critical data locally while leveraging the cloud for additional storage capacity or less critical workloads. Additionally, the use of AI and machine learning in data storage is becoming more prevalent, as these technologies help optimize storage efficiency, predict potential failures, and automate data management processes.

Which Industries Are Driving the Demand for Next-Generation Data Storage?

Several industries are driving the demand for next-generation data storage solutions, with the IT and telecommunications sectors being among the largest adopters. These industries generate massive volumes of data from network operations, customer interactions, and digital services, requiring scalable and high-performance storage solutions to manage and analyze this information effectively. The healthcare industry is another major adopter, as the shift toward electronic health records (EHRs), telemedicine, and digital imaging generates large amounts of data that need to be securely stored and easily accessible for healthcare providers.The financial services industry also relies heavily on next-generation data storage for managing transactional data, customer records, and compliance-related information. The increasing use of AI and big data analytics in financial services further drives demand for high-speed storage solutions. Additionally, industries like media and entertainment, which deal with large volumes of high-definition video and audio files, are adopting next-generation storage to ensure fast access and efficient data management. The rise of smart manufacturing and Industry 4.0 initiatives is also pushing the adoption of advanced storage technologies in the industrial sector.

What Are the Key Growth Drivers in the Next-Generation Data Storage Market?

The growth in the next-generation data storage market is driven by several factors, beginning with the explosion of data generation across industries. As businesses increasingly rely on data to drive decision-making, innovation, and customer engagement, the need for more advanced storage solutions is growing. Another key driver is the adoption of cloud computing, which has transformed how organizations manage and store data. Cloud-based storage provides scalable, cost-effective solutions that are driving widespread adoption, particularly among small and medium-sized enterprises (SMEs).The rise of artificial intelligence, machine learning, and big data analytics is also fueling demand for next-generation data storage, as these applications require high-speed data access and large storage capacities. Additionally, advancements in SSD technology, including NVMe drives, are providing faster and more reliable storage options that can handle the demands of modern applications. Finally, the increasing need for data security and regulatory compliance is driving investment in advanced storage solutions that offer robust data protection, encryption, and disaster recovery capabilities, ensuring business continuity in the face of data breaches or system failures.

Report Scope

The report analyzes the Next-Generation Data Storage market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Storage Technology (Magnetic Storage, Solid State Storage, Other Storage Technologies); End-Use (Healthcare, BFSI, Retail, Cloud Service Providers, Government, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Magnetic Storage segment, which is expected to reach US$52.3 Billion by 2030 with a CAGR of 5.5%. The Solid State Storage segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.4 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $21.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Next-Generation Data Storage Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Next-Generation Data Storage Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Next-Generation Data Storage Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Dell Technologies, EMC Corporation, Hewlett Packard Enterprise Development LP (HPE), Hitachi Data Systems Corporation, NetApp, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Next-Generation Data Storage market report include:

- Dell Technologies

- EMC Corporation

- Hewlett Packard Enterprise Development LP (HPE)

- Hitachi Data Systems Corporation

- NetApp, Inc.

- Nutanix, Inc.

- Quantum Corporation

- SanDisk Corporation

- Symantec Corporation

- Tintri, Inc.

- Toshiba Corporation

- Vmware, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dell Technologies

- EMC Corporation

- Hewlett Packard Enterprise Development LP (HPE)

- Hitachi Data Systems Corporation

- NetApp, Inc.

- Nutanix, Inc.

- Quantum Corporation

- SanDisk Corporation

- Symantec Corporation

- Tintri, Inc.

- Toshiba Corporation

- Vmware, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

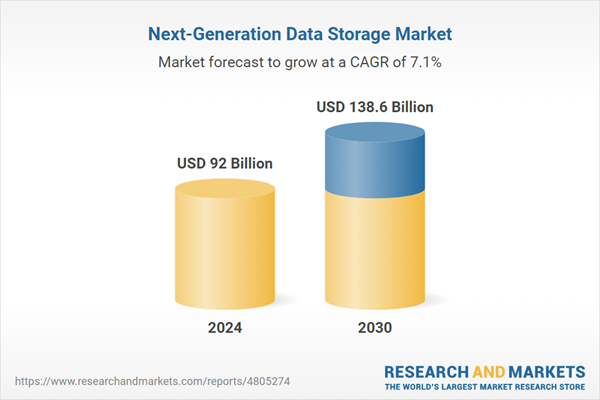

| Estimated Market Value ( USD | $ 92 Billion |

| Forecasted Market Value ( USD | $ 138.6 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |