Global Railway Infrastructure Market - Key Trends and Drivers Summarized

Why Is Railway Infrastructure Critical for Economic Growth and Connectivity?

Railway infrastructure is the backbone of efficient and sustainable transportation networks, playing a critical role in economic growth, trade, and connectivity. Well-developed rail networks enable the efficient movement of goods and people across vast distances, reducing transportation costs, easing road congestion, and lowering environmental impacts compared to road or air transport. In both developed and emerging economies, railways are integral to supporting industries such as manufacturing, agriculture, and mining by providing a reliable means of transporting raw materials and finished goods to markets. Moreover, rail networks facilitate regional integration and global trade, connecting ports, industrial hubs, and urban centers, thereby enhancing economic competitiveness and promoting social cohesion.How Are Technological Advancements Shaping Modern Railway Infrastructure?

Technological advancements are revolutionizing railway infrastructure, making it more efficient, resilient, and adaptable to future demands. The adoption of high-speed rail technology is transforming passenger transportation by reducing travel times and offering a competitive alternative to air travel over medium distances. Additionally, the integration of digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is enabling the development of smart rail networks that optimize operations, maintenance, and safety. For example, predictive maintenance systems use sensors and AI to monitor the condition of tracks, bridges, and tunnels in real-time, allowing for proactive repairs that minimize disruptions. Electrification of rail networks is another significant trend, driven by the need to reduce greenhouse gas emissions and dependence on fossil fuels. These technological advancements are making railway infrastructure more sustainable, reliable, and capable of meeting the growing demands of global transportation.What Are the Key Challenges in Developing and Maintaining Railway Infrastructure?

Despite its critical importance, developing and maintaining railway infrastructure poses several challenges that require careful planning and investment. One of the primary challenges is the high cost of construction and maintenance, which can be a significant barrier, particularly in emerging economies with limited financial resources. Additionally, upgrading aging infrastructure in developed countries is a complex task that involves balancing the need for modernization with the requirement to minimize disruptions to existing services. Land acquisition and environmental concerns also present challenges, as railway projects often involve large-scale land use and can impact local communities and ecosystems. Furthermore, coordinating infrastructure development across regions and countries requires effective governance, collaboration, and alignment of standards and regulations. Addressing these challenges is essential for ensuring the long-term viability and effectiveness of railway infrastructure as a key component of global transportation networks.What Factors Are Driving the Growth in the Railway Infrastructure Market?

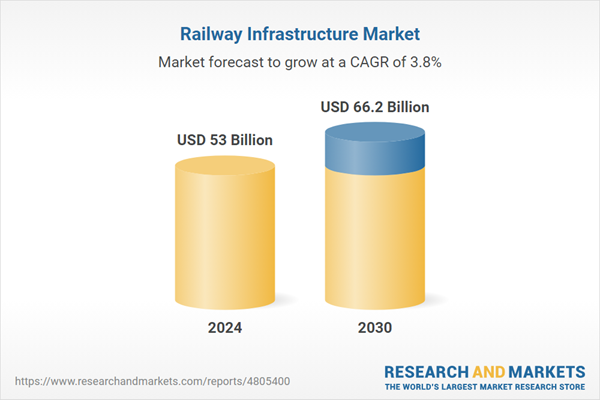

The growth in the Railway Infrastructure market is driven by several factors. The increasing need for efficient and sustainable transportation solutions is a significant driver, as governments and private investors prioritize rail projects to reduce carbon emissions, enhance connectivity, and support economic development. Technological advancements in rail construction, electrification, and digitalization are also propelling market growth by making railways more efficient, reliable, and environmentally friendly. The rising demand for high-speed rail and urban transit systems is further boosting investment in railway infrastructure, particularly in regions experiencing rapid urbanization and population growth. Additionally, the expansion of international trade and the need for seamless logistics networks are contributing to market growth, as countries invest in rail corridors that connect ports, industrial zones, and urban centers. These factors, combined with continuous innovation in rail technology and infrastructure financing, are driving the sustained growth of the Railway Infrastructure market.Report Scope

The report analyzes the Railway Infrastructure market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Infrastructure Type (Rail Network, New Track Investment, Maintenance Investment).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rail Network segment, which is expected to reach US$39.2 Billion by 2030 with a CAGR of 4.1%. The New Track Investment segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.2 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $13.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Railway Infrastructure Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Railway Infrastructure Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Railway Infrastructure Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akebono Brake Industry Co., Ltd., Alstom SA, American Railcar Industries, Inc., Ansaldo STS, Balfour Beatty PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Railway Infrastructure market report include:

- Akebono Brake Industry Co., Ltd.

- Alstom SA

- American Railcar Industries, Inc.

- Ansaldo STS

- Balfour Beatty PLC

- Baoye Group Company Limited

- BLS AG

- Bombardier, Inc.

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A

- Canadian National Railway Company

- Canadian Pacific

- China Railway Construction Corporation Limited

- CIMIC Group Limited

- CSX Corporation

- Daido Signal Co., Ltd.

- Daqin Railway Co., Ltd.

- Delachaux S.A.

- East Japan Railway Company

- Faiveley Transport

- FreightCar America Inc.

- GATX Corporation

- Guodian Nanjing Automation Co., Ltd.

- Hitachi Ltd.

- HollySys Automation Technologies Ltd.

- Hyundai Rotem Company

- Jinxi Axle Company Limited

- Kawasaki Heavy Industries Ltd.

- Ki Holdings Co., Ltd.

- Lem Holding SA

- Midas Holdings Limited

- Mitsubishi Heavy Industries Ltd.

- Nabtesco Corporation

- Nippon Rietec Co., Ltd.

- Nippon Sharyo Ltd.

- Nippon Signal Co., Ltd.

- Nippon Steel & Sumitomo Metal Corporation

- Norfolk Southern Corp.

- SNC-Lavalin Group, Inc.

- The Central Japan Railway Company

- The Greenbrier Companies, Inc.

- The Kinki Sharyo Co., Ltd.

- Trakcja Prkil S.A.

- Trinity Industries, Inc.

- Union Pacific Railroad

- Voestalpine AG

- VTG Aktiengesellschaft

- Wabtec Corporation

- Zhuzhou CRRC Times Electric Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akebono Brake Industry Co., Ltd.

- Alstom SA

- American Railcar Industries, Inc.

- Ansaldo STS

- Balfour Beatty PLC

- Baoye Group Company Limited

- BLS AG

- Bombardier, Inc.

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A

- Canadian National Railway Company

- Canadian Pacific

- China Railway Construction Corporation Limited

- CIMIC Group Limited

- CSX Corporation

- Daido Signal Co., Ltd.

- Daqin Railway Co., Ltd.

- Delachaux S.A.

- East Japan Railway Company

- Faiveley Transport

- FreightCar America Inc.

- GATX Corporation

- Guodian Nanjing Automation Co., Ltd.

- Hitachi Ltd.

- HollySys Automation Technologies Ltd.

- Hyundai Rotem Company

- Jinxi Axle Company Limited

- Kawasaki Heavy Industries Ltd.

- Ki Holdings Co., Ltd.

- Lem Holding SA

- Midas Holdings Limited

- Mitsubishi Heavy Industries Ltd.

- Nabtesco Corporation

- Nippon Rietec Co., Ltd.

- Nippon Sharyo Ltd.

- Nippon Signal Co., Ltd.

- Nippon Steel & Sumitomo Metal Corporation

- Norfolk Southern Corp.

- SNC-Lavalin Group, Inc.

- The Central Japan Railway Company

- The Greenbrier Companies, Inc.

- The Kinki Sharyo Co., Ltd.

- Trakcja Prkil S.A.

- Trinity Industries, Inc.

- Union Pacific Railroad

- Voestalpine AG

- VTG Aktiengesellschaft

- Wabtec Corporation

- Zhuzhou CRRC Times Electric Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 53 Billion |

| Forecasted Market Value ( USD | $ 66.2 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |