Global Propulsion Systems Market - Key Trends and Drivers Summarized

Propulsion Systems: Powering the Future of Transportation and Exploration

Propulsion systems are the mechanisms or devices that generate thrust to move vehicles, vessels, or spacecraft through air, water, or space. These systems are fundamental to all forms of transportation, including aviation, maritime, automotive, and aerospace. The primary function of a propulsion system is to convert energy, typically derived from fuel, into mechanical force that propels a vehicle forward. Propulsion systems can vary widely depending on the type of vehicle and its intended use, ranging from internal combustion engines and jet engines in aircraft, to electric motors in electric vehicles (EVs), and rocket engines in spacecraft. Each type of propulsion system is designed to optimize performance, efficiency, and reliability, depending on the specific requirements of the application, making them a critical component in the development and operation of transportation technologies.How Are Technological Advancements Shaping the Future of Propulsion Systems?

Technological advancements are driving significant innovations in propulsion systems, shaping the future of transportation and exploration. The development of electric propulsion systems, particularly for automotive and aerospace applications, is at the forefront of this transformation, offering a cleaner and more efficient alternative to traditional internal combustion engines. Advances in battery technology, such as higher energy densities and faster charging times, have improved the viability of electric vehicles (EVs), leading to widespread adoption and the gradual phasing out of fossil-fuel-powered vehicles. In the aerospace sector, innovations in hybrid-electric and fully electric propulsion systems are being explored for both aircraft and spacecraft, with the potential to reduce emissions and lower operating costs. Additionally, advancements in rocket propulsion, including reusable rocket technology and more efficient propulsion methods such as ion thrusters and nuclear propulsion, are expanding the possibilities for space exploration. These technological advancements are not only improving the performance and efficiency of propulsion systems but are also paving the way for new modes of transportation and exploration.What Are the Key Applications and Benefits of Propulsion Systems in Modern Transportation?

Propulsion systems are used in a wide range of transportation and exploration applications, offering numerous benefits that enhance performance, efficiency, and sustainability. In the automotive industry, internal combustion engines and electric motors power vehicles of all types, from passenger cars to commercial trucks, enabling the movement of people and goods across vast distances. In aviation, jet engines provide the thrust needed for aircraft to take off, cruise, and land, facilitating global air travel and cargo transport. Maritime propulsion systems, including diesel engines and gas turbines, power ships and submarines, enabling the transport of goods and military operations across the world's oceans. In aerospace, rocket engines propel spacecraft into orbit and beyond, enabling space exploration and satellite deployment. The primary benefits of propulsion systems include reliable and efficient movement, the ability to operate in various environments, and the capacity to support a wide range of transportation and exploration missions. By providing the necessary thrust and power, propulsion systems are integral to the functioning and advancement of modern transportation technologies.What Factors Are Driving the Growth in the Propulsion Systems Market?

The growth in the Propulsion Systems market is driven by several factors. The increasing demand for cleaner and more efficient transportation solutions, particularly in response to environmental concerns and regulatory pressures, is a significant driver, as innovations in electric and hybrid propulsion systems offer a path to reduced emissions and lower operating costs. Technological advancements in battery technology, electric motors, and alternative fuels are also propelling market growth, as these innovations enhance the performance and viability of next-generation propulsion systems. The rising adoption of electric vehicles (EVs) and the development of electric and hybrid aircraft are further boosting demand for advanced propulsion systems, as these technologies become more mainstream. Additionally, the expansion of space exploration activities, both by government agencies and private companies, is contributing to market growth, as new propulsion technologies are required to support ambitious missions beyond Earth's orbit. The growing focus on sustainability and the transition to renewable energy sources are also supporting the adoption of alternative propulsion systems, driving the sustained growth of the Propulsion Systems market.Report Scope

The report analyzes the Propulsion Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Air Breathing Engines, Non-Air Breathing Engines, Electric Propulsion Engines); Application (Aircraft, Spacecraft, Missiles, Unmanned Aerial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Air Breathing Engines segment, which is expected to reach US$245.6 Billion by 2030 with a CAGR of 5.2%. The Non-Air Breathing Engines segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $97.1 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $76.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Propulsion Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Propulsion Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Propulsion Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerojet Rocketdyne Holdings, Inc., General Electric Company, GKN Aerospace, Honeywell International, Inc., Lockheed Martin Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Propulsion Systems market report include:

- Aerojet Rocketdyne Holdings, Inc.

- General Electric Company

- GKN Aerospace

- Honeywell International, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orbital ATK, Inc.

- Raytheon Company

- Rolls-Royce Holdings PLC

- SAFRAN Group

- United Technologies Corporation (UTC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerojet Rocketdyne Holdings, Inc.

- General Electric Company

- GKN Aerospace

- Honeywell International, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orbital ATK, Inc.

- Raytheon Company

- Rolls-Royce Holdings PLC

- SAFRAN Group

- United Technologies Corporation (UTC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

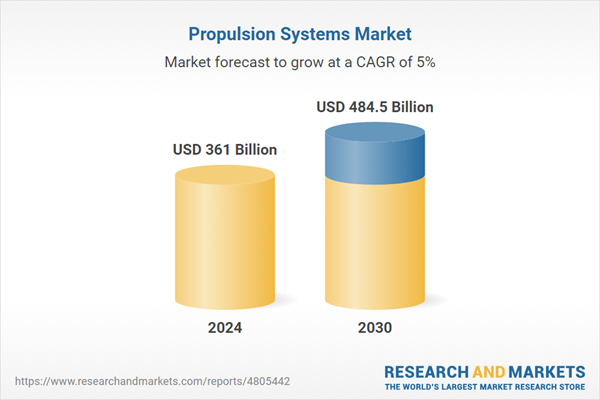

| Estimated Market Value ( USD | $ 361 Billion |

| Forecasted Market Value ( USD | $ 484.5 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |