Global Industrial Analytics Market - Key Trends & Drivers Summarized

Why Is Industrial Analytics Becoming a Critical Asset for Enhancing Operational Efficiency and Decision-Making?

Industrial analytics is becoming a critical asset for enhancing operational efficiency and decision-making due to its ability to transform raw data into actionable insights across complex industrial environments. Leveraging advanced analytics tools, including artificial intelligence (AI), machine learning (ML), and big data technologies, industrial analytics enables organizations to analyze vast amounts of data generated from machinery, sensors, and industrial processes in real-time. This capability allows businesses to gain deep visibility into operations, monitor equipment health, predict maintenance needs, optimize production processes, and identify inefficiencies. By providing a comprehensive view of operations, industrial analytics helps companies reduce downtime, improve asset utilization, and achieve higher levels of productivity.Moreover, the ability of industrial analytics to support data-driven decision-making is driving its adoption across sectors such as manufacturing, energy, transportation, and supply chain management. In manufacturing, for example, analytics can be used to optimize production schedules, enhance quality control, and minimize waste by identifying patterns and trends that are not apparent through traditional analysis methods. In energy and utilities, analytics tools enable companies to monitor energy usage, predict equipment failures, and optimize resource allocation, leading to lower costs and improved efficiency. The use of predictive and prescriptive analytics in supply chain management allows organizations to forecast demand, manage inventory levels, and optimize logistics, ensuring seamless operations and timely delivery. As industries increasingly recognize the value of data as a strategic asset, the demand for industrial analytics solutions that can unlock this value is expected to grow exponentially.

How Are Technological Advancements Transforming the Industrial Analytics Market?

Technological advancements are transforming the industrial analytics market by enabling more sophisticated data processing, real-time insights, and seamless integration with industrial systems. One of the most significant innovations is the development of AI-powered analytics platforms that can analyze complex datasets and generate insights automatically. Machine learning algorithms, for instance, can identify patterns and correlations within data that traditional analytical methods might overlook, making it possible to uncover root causes of inefficiencies or predict future outcomes with high accuracy. These algorithms can continuously learn from new data, improving their predictive capabilities over time. As a result, AI-powered analytics tools are being used for advanced applications such as predictive maintenance, anomaly detection, and process optimization, enabling companies to make proactive decisions and reduce operational risks.Another transformative trend is the integration of Industrial Internet of Things (IIoT) with analytics platforms. IIoT devices and sensors generate large volumes of data in real-time, providing a rich source of information for analytics. The integration of IIoT and analytics allows companies to monitor equipment and processes continuously, detect anomalies early, and optimize operations in real time. For example, IIoT-enabled analytics can monitor the performance of a fleet of machines, compare it to historical data, and identify potential issues before they lead to costly breakdowns. Additionally, cloud computing is playing a crucial role in making industrial analytics more accessible and scalable. Cloud-based analytics platforms enable companies to store and process massive datasets without investing in expensive on-premises infrastructure. They also support remote access and collaboration, making it easier for teams across different locations to share insights and make informed decisions. As these technologies continue to advance, they are making industrial analytics more powerful, flexible, and capable of addressing a broader range of business challenges.

What Role Do Industry 4.0 and Digital Transformation Play in Driving the Adoption of Industrial Analytics?

Industry 4.0 and digital transformation initiatives are playing a pivotal role in driving the adoption of industrial analytics by reshaping how industries operate and compete in the modern economy. Industry 4.0, characterized by the integration of smart technologies such as IIoT, AI, and robotics, aims to create interconnected and intelligent manufacturing ecosystems. Within this context, industrial analytics serves as a key enabler, providing the insights needed to optimize complex processes, enhance operational transparency, and support real-time decision-making. The ability to analyze data from connected devices and systems allows companies to move from reactive to predictive and prescriptive maintenance strategies, optimize production schedules, and reduce operational costs. This is leading to a significant transformation in the way industrial operations are managed, with analytics becoming a cornerstone of smart manufacturing.Digital transformation is also accelerating the adoption of industrial analytics by driving organizations to modernize their technology stack and adopt data-centric strategies. As companies implement digital solutions to automate processes, integrate supply chains, and enhance customer experiences, the volume of data generated across various touchpoints is increasing exponentially. Industrial analytics platforms are being used to harness this data, providing actionable insights that can inform strategic initiatives such as process automation, product innovation, and operational resilience. Furthermore, the shift towards remote operations and the increasing use of digital twins - virtual replicas of physical assets - are creating new opportunities for analytics. Digital twins can simulate different scenarios, predict outcomes, and provide a deeper understanding of system behaviors, all of which are powered by advanced analytics models. As industries continue to embrace digital transformation, the demand for industrial analytics solutions that can support these initiatives is expected to grow, making it a critical component of the Industry 4.0 landscape.

What Factors Are Driving the Growth of the Global Industrial Analytics Market?

The growth in the global industrial analytics market is driven by several factors, including the increasing adoption of IIoT technologies, the growing need for operational efficiency, and the rising emphasis on predictive maintenance. One of the primary growth drivers is the widespread deployment of IIoT devices and sensors, which are generating large volumes of data in industrial environments. These devices provide real-time information on equipment performance, production processes, and environmental conditions, offering a rich source of data for analytics. The ability to analyze this data and extract meaningful insights is helping companies optimize their operations, reduce energy consumption, and improve asset utilization. As a result, industries such as manufacturing, energy, and transportation are investing heavily in analytics solutions that can integrate with IIoT ecosystems and provide a unified view of operations.The increasing need for operational efficiency and cost reduction is another key factor driving the market. Industrial analytics enables companies to identify inefficiencies, reduce waste, and streamline processes, leading to significant cost savings. By leveraging predictive analytics, companies can forecast equipment failures and perform maintenance proactively, minimizing downtime and avoiding costly repairs. This capability is particularly valuable in asset-intensive industries such as oil and gas, mining, and utilities, where equipment failures can have severe financial and safety implications. The use of analytics to optimize supply chain operations is also gaining traction, as it helps companies balance supply and demand, manage inventory levels, and ensure timely deliveries. As organizations strive to remain competitive in an increasingly complex and dynamic market environment, the adoption of industrial analytics solutions that support operational excellence is expected to accelerate.

The growing focus on data-driven decision-making is further contributing to the expansion of the industrial analytics market. Companies are increasingly recognizing the value of leveraging data to gain a competitive edge, drive innovation, and improve business outcomes. Analytics solutions that provide real-time insights into production performance, market trends, and customer preferences are helping organizations make more informed decisions and respond swiftly to changing conditions. The ability to integrate analytics with other enterprise systems such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms is enhancing its value by providing a holistic view of business operations. Moreover, the rise of cloud-based analytics platforms is making it easier for companies of all sizes to access advanced analytics capabilities without the need for significant upfront investment in infrastructure. This accessibility is driving the adoption of analytics solutions among small and medium-sized enterprises (SMEs) as well, contributing to the overall market growth.

Additionally, regulatory requirements and sustainability initiatives are shaping the demand for industrial analytics. Regulations related to emissions, safety, and product quality are prompting companies to implement analytics solutions that ensure compliance and optimize resource use. Analytics tools can monitor environmental conditions, track energy usage, and evaluate the sustainability impact of industrial processes, supporting companies in achieving their environmental, social, and governance (ESG) goals. As governments and regulatory bodies around the world increase the pressure on industries to reduce their environmental footprint, the role of analytics in supporting sustainability initiatives is becoming more prominent. As these factors converge, the global industrial analytics market is poised for robust growth, supported by technological advancements, evolving business needs, and the increasing recognition of data as a strategic asset that can drive competitive advantage and operational excellence across industries.

Report Scope

The report analyzes the Industrial Analytics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Software, Services); Analytics Type (Predictive, Descriptive, Diagnostic, Prescriptive); Vertical (Manufacturing, IT & Telecom, Energy & Utilities, Transportation & Logistics, Retail & Consumer Goods, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$88.8 Billion by 2030 with a CAGR of 17.1%. The Services Component segment is also set to grow at 18.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.1 Billion in 2024, and China, forecasted to grow at an impressive 16.6% CAGR to reach $21.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Analytics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Analytics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Analytics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agt International GmbH, Alteryx, Inc., Bridgei2i Analytics Solutions, Cisco Systems, Inc., General Electric Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Industrial Analytics market report include:

- Agt International GmbH

- Alteryx, Inc.

- Bridgei2i Analytics Solutions

- Cisco Systems, Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP (HPE)

- Hitachi Ltd.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC, Inc.

- SAP SE

- SAS Institute, Inc.

- TIBCO Software, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agt International GmbH

- Alteryx, Inc.

- Bridgei2i Analytics Solutions

- Cisco Systems, Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP (HPE)

- Hitachi Ltd.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC, Inc.

- SAP SE

- SAS Institute, Inc.

- TIBCO Software, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

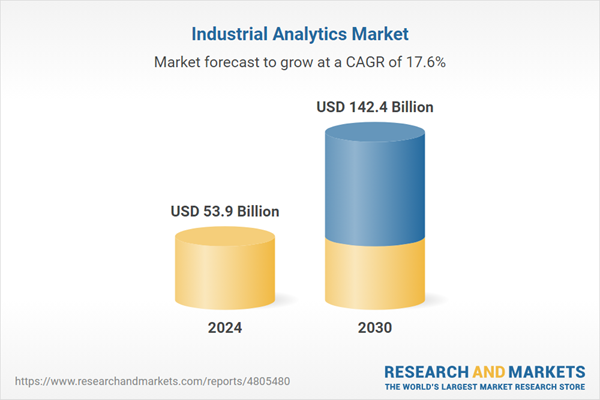

| Estimated Market Value ( USD | $ 53.9 Billion |

| Forecasted Market Value ( USD | $ 142.4 Billion |

| Compound Annual Growth Rate | 17.6% |

| Regions Covered | Global |