Global Industrial Agitators Market - Key Trends & Drivers Summarized

Why Are Industrial Agitators Becoming Essential in Manufacturing and Process Industries?

Industrial agitators have become essential components in manufacturing and process industries due to their critical role in ensuring the efficient mixing and blending of liquids, slurries, and other materials. Agitators are widely used in industries such as chemicals, pharmaceuticals, food and beverage, cosmetics, and water treatment, where precise mixing is crucial for maintaining product quality and consistency. By enabling the homogenization of ingredients, suspension of solids, and the dissolution of gases into liquids, industrial agitators support a wide range of applications, from chemical synthesis and fermentation processes to wastewater treatment and food production. The ability of agitators to control variables such as fluid viscosity, temperature, and mixing speed makes them indispensable for processes that require precision and uniformity.Moreover, industrial agitators play a pivotal role in optimizing process efficiency and reducing production costs. The use of agitators ensures faster mixing times and reduces the energy required for blending operations, contributing to overall process efficiency. The growing trend towards batch production in industries like pharmaceuticals and specialty chemicals is also driving demand for versatile agitator solutions that can handle varying batch sizes and product formulations. Additionally, agitators designed with advanced impeller geometries and optimized mixing patterns can reduce operational issues such as sedimentation and cavitation, leading to improved yield and product quality. As industries continue to focus on maximizing process efficiency, improving product quality, and meeting stringent regulatory standards, the demand for high-performance industrial agitators is expected to grow significantly.

How Are Technological Advancements Transforming the Industrial Agitators Market?

Technological advancements are transforming the industrial agitators market by enhancing the efficiency, versatility, and performance of agitator systems. One of the most significant developments is the introduction of advanced impeller designs and mixing technologies. Modern impellers are engineered using computational fluid dynamics (CFD) simulations to optimize mixing patterns, reduce power consumption, and minimize shear forces. This has led to the development of specialized impellers such as hydrofoil, turbine, and helical designs, which cater to specific applications and mixing requirements. For example, hydrofoil impellers are designed to operate at low power while providing high-flow mixing, making them ideal for blending large volumes of low-viscosity fluids. Turbine impellers, on the other hand, are well-suited for high-shear applications, such as emulsification and dispersion, ensuring thorough mixing of viscous substances. These innovations in impeller design are enhancing the capability of industrial agitators to handle complex mixing tasks while reducing energy consumption and operational costs.Another transformative trend in the industrial agitators market is the integration of automation and digitalization technologies. Smart agitators equipped with sensors, programmable logic controllers (PLCs), and IoT connectivity can monitor key parameters such as speed, torque, temperature, and power consumption in real time. This data can be used to optimize mixing processes, detect anomalies, and enable predictive maintenance. By leveraging machine learning algorithms and AI-based analytics, smart agitators can automatically adjust operating conditions based on process requirements, ensuring consistent mixing quality and reducing human intervention. The use of digital twins, which create virtual replicas of agitator systems, is also gaining traction. Digital twins allow operators to simulate different operating scenarios, evaluate the impact of changes on mixing performance, and optimize agitator configurations before making physical adjustments. As these technologies continue to evolve, they are making industrial agitators more intelligent, reliable, and adaptable to a wide range of applications.

What Role Do Regulatory Compliance and Process Optimization Play in Driving the Adoption of Industrial Agitators?

Regulatory compliance and process optimization are key factors driving the adoption of industrial agitators across various sectors. In industries such as pharmaceuticals, food and beverage, and chemicals, regulatory agencies impose stringent guidelines regarding product quality, safety, and hygiene. Compliance with these standards requires manufacturers to maintain strict control over production processes, including mixing and blending operations. Industrial agitators equipped with precision control systems and sanitary designs help manufacturers meet these regulatory requirements by ensuring that materials are mixed uniformly and free from contamination. For example, in the pharmaceutical industry, agitators must adhere to Good Manufacturing Practices (GMP) and FDA regulations, which mandate the use of hygienic designs, easy-to-clean surfaces, and materials that prevent cross-contamination. The ability of agitators to maintain consistent quality and comply with regulatory standards is a crucial driver of their adoption in regulated industries.Process optimization is another significant driver of the industrial agitators market. Companies are increasingly focused on improving production efficiency, reducing energy consumption, and minimizing waste. Industrial agitators play a critical role in optimizing mixing processes by providing precise control over variables such as mixing speed, impeller position, and shear force. This level of control helps reduce batch times, improve product yield, and minimize operational costs. Moreover, the use of variable frequency drives (VFDs) in agitator systems allows for energy-efficient operation by adjusting motor speed based on real-time process conditions. This capability is particularly valuable in energy-intensive industries, such as chemicals and petrochemicals, where reducing energy consumption is a key priority. As companies seek to optimize their processes and meet sustainability goals, the demand for advanced agitator solutions that support these objectives is expected to grow.

What Factors Are Driving the Growth of the Global Industrial Agitators Market?

The growth in the global industrial agitators market is driven by several factors, including increasing demand for process automation, rising focus on energy efficiency, and the expansion of key end-use industries. One of the primary growth drivers is the growing adoption of automation in process industries. As manufacturers aim to streamline operations and enhance productivity, the integration of automated agitator systems is becoming a key trend. Automated agitators equipped with digital controls and smart features enable precise process management, real-time monitoring, and reduced reliance on manual intervention. This not only enhances mixing consistency and product quality but also allows for more flexible and scalable production processes. The trend towards digital transformation and Industry 4.0 adoption is further boosting the demand for agitator systems that can be integrated with digital platforms and smart manufacturing ecosystems.The rising emphasis on energy efficiency and sustainability is another key factor driving the market. Energy costs account for a significant portion of the operational expenses in industries that rely heavily on mixing and blending operations, such as chemicals, petrochemicals, and food processing. Modern agitators with energy-efficient designs, variable frequency drives, and optimized impeller configurations help reduce power consumption, making them an attractive option for companies looking to minimize their energy footprint. Additionally, the use of renewable energy sources to power industrial processes is creating opportunities for the development of eco-friendly agitator solutions. As companies strive to achieve their sustainability goals and reduce operational costs, the demand for energy-efficient industrial agitators is expected to rise.

The expansion of key end-use industries such as chemicals, pharmaceuticals, and food and beverage is also contributing to the growth of the industrial agitators market. In the chemicals and petrochemicals sector, increasing production of specialty chemicals, polymers, and adhesives is driving the need for advanced mixing solutions that can handle complex formulations and varying viscosities. In the pharmaceutical industry, the demand for high-performance agitators is rising due to the growth in biopharmaceutical production, which requires precise mixing for processes such as cell culture and fermentation. Similarly, the food and beverage industry's focus on product innovation and quality control is boosting demand for agitators that can handle diverse mixing tasks, from emulsification and homogenization to pasteurization and blending. The growing focus on maintaining hygiene and preventing contamination in food production is further driving the adoption of agitators designed with sanitary features.

Moreover, the trend towards customized and application-specific agitator solutions is creating new opportunities for market growth. Service providers are offering tailored agitator designs that cater to the unique requirements of different industries, such as explosion-proof agitators for the oil and gas sector or corrosion-resistant models for the chemical industry. This customization trend, coupled with advancements in materials and coatings that enhance durability and resistance to harsh conditions, is expanding the scope of applications for industrial agitators. As these factors converge, the global industrial agitators market is expected to witness robust growth, driven by technological innovations, evolving process requirements, and the increasing need for efficient and reliable mixing solutions across a range of industries.

Report Scope

The report analyzes the Industrial Agitators market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Mounting (Top-Mounted, Side-Mounted, Bottom-Mounted); End-Use (Chemicals, Paint & Coatings, Mineral, Food & Beverage, Pharmaceuticals, Cosmetics, Other End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Top-Mounted Agitators segment, which is expected to reach US$2 Billion by 2030 with a CAGR of 4.5%. The Side-Mounted Agitators segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $704.6 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $754.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Agitators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Agitators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Agitators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Dynamix Agitators Inc., Ekato Holding GmbH, Mixer Direct, Philadelphia Mixing Solutions, Ltd., Silverson Machines, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Industrial Agitators market report include:

- Dynamix Agitators Inc.

- Ekato Holding GmbH

- Mixer Direct

- Philadelphia Mixing Solutions, Ltd.

- Silverson Machines, Inc.

- Spx Flow Inc.

- Statiflo International Ltd.

- Sulzer Ltd.

- TACMINA CORPORATION

- Xylem, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dynamix Agitators Inc.

- Ekato Holding GmbH

- Mixer Direct

- Philadelphia Mixing Solutions, Ltd.

- Silverson Machines, Inc.

- Spx Flow Inc.

- Statiflo International Ltd.

- Sulzer Ltd.

- TACMINA CORPORATION

- Xylem, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

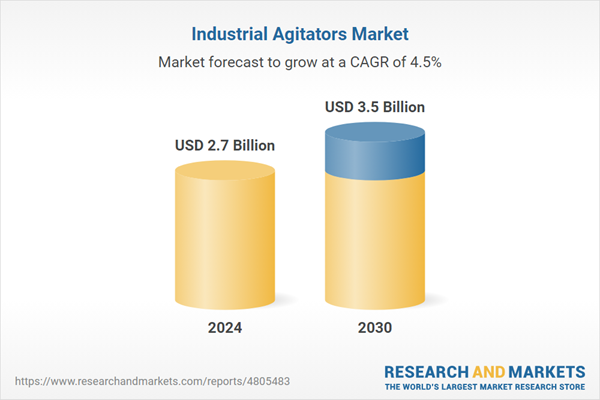

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |