Global Indoor Farming Technology Market - Key Trends & Drivers Summarized

Why Is Indoor Farming Technology Revolutionizing the Agriculture Industry?

Indoor farming technology is revolutionizing the agriculture industry by enabling the production of crops in controlled environments, independent of external weather conditions and seasonal changes. This approach allows for year-round cultivation of a wide variety of fruits, vegetables, and herbs, ensuring consistent supply and superior quality. Indoor farming systems, which include vertical farms, greenhouses, and container farms, utilize advanced technologies such as hydroponics, aeroponics, and aquaponics to grow crops without soil. These techniques, combined with precise control over temperature, humidity, lighting, and nutrient levels, optimize plant growth and significantly increase yield per square meter compared to traditional farming methods. With global populations rising and arable land decreasing, indoor farming technology offers a sustainable solution to meet the growing demand for food while reducing the environmental footprint of agriculture.Moreover, indoor farming technology is playing a crucial role in enhancing food security and minimizing supply chain disruptions. By localizing food production, indoor farms reduce dependence on long supply chains, which are vulnerable to geopolitical tensions, climate change, and transportation bottlenecks. This is particularly beneficial in urban areas, where indoor farms can produce fresh, pesticide-free produce closer to the point of consumption, reducing food miles and ensuring longer shelf life. The growing consumer preference for fresh, locally sourced food is driving investments in indoor farming technologies, as these systems offer a viable way to produce high-quality crops with minimal use of water, land, and fertilizers. As the agriculture industry grapples with the challenges of climate variability and resource scarcity, indoor farming technology is emerging as a transformative force that can redefine how food is grown and distributed globally.

How Are Technological Innovations Expanding the Capabilities of Indoor Farming?

Technological innovations are significantly expanding the capabilities of indoor farming, making it more efficient, scalable, and sustainable. One of the most impactful advancements is the development of energy-efficient LED lighting systems that provide optimal light spectra for different stages of plant growth. These LEDs are designed to mimic natural sunlight, ensuring that plants receive the exact wavelengths needed for photosynthesis while consuming far less energy than traditional lighting systems. The ability to customize light intensity and duration enables growers to manipulate plant growth cycles, improve yields, and enhance the nutritional content of crops. Additionally, advancements in sensor technology and Internet of Things (IoT) devices are enabling real-time monitoring and automation of indoor farming environments. Sensors can track key variables such as soil moisture, pH levels, and air quality, while IoT devices automate irrigation, nutrient delivery, and climate control based on sensor data, reducing labor costs and human error.Another major innovation driving the indoor farming market is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into farm management systems. AI-powered systems can analyze large datasets from sensors, cameras, and historical farm data to optimize crop production strategies and predict potential issues before they arise. For example, machine vision technology can be used to detect early signs of plant diseases or nutrient deficiencies, allowing for timely intervention and reducing crop loss. Vertical farming systems, which utilize multiple layers of crops stacked vertically, are also benefiting from robotic automation technologies that handle tasks such as planting, harvesting, and packaging with precision and speed. Furthermore, developments in hydroponic, aeroponic, and aquaponic growing methods are enabling the cultivation of a wider variety of crops, including leafy greens, herbs, and even staple crops like wheat and rice. These innovations are making indoor farming more adaptable and versatile, opening new possibilities for sustainable food production in regions with harsh climates or limited arable land.

What Role Does Consumer Demand for Fresh and Sustainable Produce Play in the Growth of Indoor Farming Technology?

Consumer demand for fresh and sustainably produced food is a key driver behind the growth of indoor farming technology. As awareness of the environmental impact of traditional agriculture grows, more consumers are seeking food products that are produced using environmentally friendly methods. Indoor farming, with its ability to minimize water usage, reduce pesticide and herbicide applications, and lower transportation emissions, is well-positioned to meet these demands. Consumers are increasingly willing to pay a premium for produce that is free from chemicals, grown locally, and harvested at peak freshness. Indoor farming systems, which allow for precise control over growing conditions, can deliver produce that meets these high standards, offering superior flavor and nutritional value. The shorter supply chain associated with indoor farming also ensures that consumers receive fresher products with a longer shelf life, further enhancing the appeal of indoor-grown food.The trend towards plant-based diets and healthy eating is another factor contributing to the rise of indoor farming technology. As more people incorporate fruits, vegetables, and plant-based foods into their diets, the demand for fresh produce has surged. Indoor farms can grow a variety of leafy greens, microgreens, herbs, and other nutrient-dense foods year-round, catering to health-conscious consumers. The ability to cultivate crops in urban areas and reduce food miles aligns with the growing consumer preference for locally sourced, sustainable food options. Additionally, indoor farming technology supports the production of niche and specialty crops that are difficult to grow in conventional fields, such as exotic herbs and rare plant varieties. This capability allows indoor farms to cater to diverse consumer preferences and dietary requirements, further boosting their market potential. As consumer awareness and demand for sustainable, healthy, and locally produced food continues to grow, indoor farming technology is poised to play a pivotal role in shaping the future of agriculture.

What Factors Are Driving the Growth of the Global Indoor Farming Technology Market?

The growth in the global indoor farming technology market is driven by several factors, including advancements in agricultural technologies, increasing urbanization, and the need for sustainable food production solutions. One of the primary growth drivers is the rapid development of technologies such as automation, artificial intelligence, and precision farming tools, which are enhancing the efficiency and scalability of indoor farming systems. These technologies enable growers to monitor and control all aspects of the growing environment, from light and temperature to humidity and nutrient levels, ensuring optimal conditions for plant growth. As a result, indoor farming systems are achieving higher yields and better quality produce compared to traditional farming methods. The integration of vertical farming techniques, where crops are grown in stacked layers, is also contributing to market growth by maximizing space utilization and reducing the land footprint required for farming.The increasing global trend of urbanization is another key factor driving the demand for indoor farming technology. As more people move to cities, there is a growing need to produce food closer to urban centers to reduce transportation costs and minimize the environmental impact associated with long supply chains. Indoor farming allows for food production in urban areas, where conventional farming is not feasible, providing a sustainable solution to feed growing urban populations. Furthermore, the need to address challenges such as water scarcity, soil degradation, and climate change is pushing governments and private sector investors to support the development of controlled environment agriculture (CEA) systems. Initiatives such as urban agriculture policies, grants, and tax incentives are encouraging the adoption of indoor farming technologies, particularly in regions facing agricultural constraints.

Moreover, the growing focus on food security and supply chain resilience is bolstering the indoor farming technology market. The COVID-19 pandemic highlighted the vulnerabilities of global food supply chains, leading to renewed interest in local food production methods. Indoor farming, with its ability to produce fresh food in close proximity to consumers, has emerged as a viable solution for ensuring food availability and reducing dependency on imports. This has led to increased investment in indoor farming startups and technologies, driving further innovation and market growth. Additionally, the expansion of the organic food market and the rising popularity of plant-based diets are creating new opportunities for indoor farms to supply high-quality, chemical-free produce. As these factors continue to influence the global agricultural landscape, the indoor farming technology market is expected to witness robust growth, driven by technological advancements, urbanization trends, and the need for sustainable food production solutions.

Report Scope

The report analyzes the Indoor Farming Technology market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Growing System (Hydroponics, Aeroponics, Aquaponics, Soil-Based, Hybrid); Facility Type (Glass or Poly Greenhouse, Indoor Vertical Farms, Container Farms, Indoor DWC Systems); Crop Type (Fruits & Vegetables, Herbs & Microgreens, Flowers & Ornamentals, Other Crop Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hydroponics segment, which is expected to reach US$26.2 Billion by 2030 with a CAGR of 6.3%. The Aeroponics segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.4 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $11.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Indoor Farming Technology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Indoor Farming Technology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Indoor Farming Technology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agrilution GmbH, American Hydroponics, Argus Control Systems Ltd., Everlight Electronics Co., Ltd, General Hydroponics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Indoor Farming Technology market report include:

- Agrilution GmbH

- American Hydroponics

- Argus Control Systems Ltd.

- Everlight Electronics Co., Ltd

- General Hydroponics

- Hydrodynamics International, Inc.

- Illumitex, Inc.

- Logiqs B.V.

- LumiGrow, Inc.

- Netafim Ltd.

- Philips Lighting Company

- Richel Group SA

- Vertical Farm Systems Pty Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agrilution GmbH

- American Hydroponics

- Argus Control Systems Ltd.

- Everlight Electronics Co., Ltd

- General Hydroponics

- Hydrodynamics International, Inc.

- Illumitex, Inc.

- Logiqs B.V.

- LumiGrow, Inc.

- Netafim Ltd.

- Philips Lighting Company

- Richel Group SA

- Vertical Farm Systems Pty Ltd.

Table Information

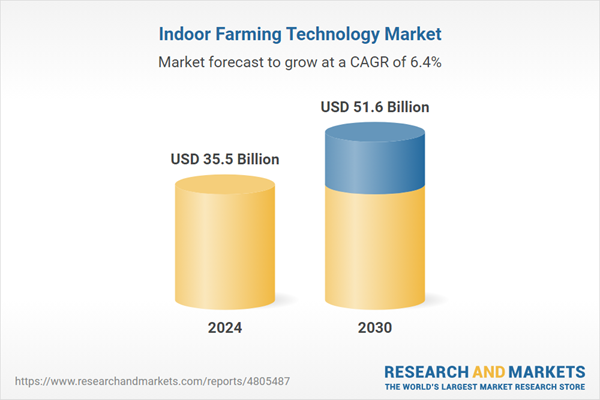

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.5 Billion |

| Forecasted Market Value ( USD | $ 51.6 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |