Global Impact Resistant Glass Market - Key Trends & Drivers Summarized

Why Is Impact Resistant Glass Gaining Importance Across High-Security and Safety-Critical Applications?

Impact resistant glass, also known as safety glass or shatterproof glass, is rapidly gaining traction across industries due to its ability to withstand extreme force and prevent breakage upon impact. This type of glass is engineered to provide enhanced safety and protection in high-risk environments, making it an essential component in applications such as construction, automotive, aerospace, and defense. By incorporating multiple layers of glass and plastic interlayers, impact resistant glass can absorb and dissipate the energy from impacts, minimizing the risk of shattering and maintaining its structural integrity. The growing need for materials that can enhance security, improve occupant safety, and resist environmental hazards such as hurricanes and blasts is driving the adoption of impact resistant glass in both residential and commercial settings.In the construction industry, impact resistant glass is being increasingly used in buildings located in areas prone to natural disasters, such as hurricanes, tornadoes, and earthquakes. In regions like North America and Asia-Pacific, building codes and safety regulations mandate the use of impact resistant glass in windows, doors, and facades to protect occupants and property from flying debris and extreme weather conditions. Similarly, in the automotive industry, impact resistant glass is being adopted to provide additional safety for passengers, reduce the risk of injury in accidents, and enhance the structural strength of vehicles. The demand for impact resistant glass is also rising in the aerospace and defense sectors, where it is used in aircraft windshields, cockpit windows, and military vehicle armor to protect against ballistic impacts and other threats. As industries place a growing emphasis on safety, security, and durability, the demand for impact resistant glass is poised for sustained growth, driven by its ability to offer superior protection and performance across a wide range of applications.

What Technological Advancements Are Shaping the Development and Performance of Impact Resistant Glass?

Technological advancements are playing a pivotal role in enhancing the performance, durability, and versatility of impact resistant glass, making it more suitable for diverse and demanding applications. One of the most significant innovations in this field is the development of advanced lamination technologies and interlayer materials. Traditional impact resistant glass relies on the use of polyvinyl butyral (PVB) interlayers to bond multiple layers of glass together, providing enhanced impact resistance and structural stability. However, recent advancements have led to the introduction of stronger and more resilient interlayer materials, such as ionoplasts and thermoplastic polyurethanes (TPU). These new interlayers offer superior tear resistance, clarity, and flexibility, enabling the production of thinner yet stronger glass that provides the same level of impact resistance with reduced weight. The use of ionoplast interlayers, for example, is allowing manufacturers to produce glass that offers up to five times the tear resistance and 100 times the rigidity of traditional PVB interlayers, making it ideal for high-security and load-bearing applications.Another key technological advancement is the use of chemical strengthening and tempering processes to enhance the properties of impact resistant glass. Chemical strengthening involves the exchange of smaller sodium ions in the glass with larger potassium ions, creating a compressive stress layer on the surface of the glass that significantly increases its strength and resistance to scratches and impacts. This process results in a glass that is up to five times stronger than standard annealed glass and can withstand greater forces without breaking. Additionally, the use of tempering, which involves heating the glass to high temperatures and then rapidly cooling it, enhances the tensile strength of the glass and ensures that it breaks into small, blunt fragments if shattered, reducing the risk of injury. These strengthening techniques are making impact resistant glass more durable and reliable for applications in construction, automotive, and security industries.

The integration of smart technologies and functional coatings is also transforming the impact resistant glass market. Manufacturers are incorporating features such as low-emissivity (Low-E) coatings, UV protection, and sound insulation into impact resistant glass to provide additional benefits beyond safety and security. Low-E coatings, for instance, improve the energy efficiency of buildings by reducing heat transfer through windows, while UV protection helps prevent fading of interior furnishings and reduces the risk of skin damage from prolonged sun exposure. Furthermore, advancements in smart glass technologies, such as electrochromic and photochromic glass, are enabling impact resistant glass to dynamically adjust its transparency in response to external stimuli, enhancing privacy, comfort, and energy efficiency. These innovations are not only optimizing the performance and functionality of impact resistant glass but are also expanding its application possibilities, making it a preferred choice for architects, builders, and automotive manufacturers seeking to incorporate advanced materials into their designs.

How Are Market Dynamics and Regulatory Standards Influencing the Impact Resistant Glass Market?

The impact resistant glass market is influenced by a variety of market dynamics and regulatory standards that are shaping product demand, development, and application across different industries. One of the primary market drivers is the growing emphasis on safety and security in both residential and commercial construction. The increasing occurrence of natural disasters such as hurricanes and tornadoes, coupled with concerns over property damage and occupant safety, is driving the adoption of impact resistant glass in regions prone to extreme weather events. Building codes and safety standards in countries such as the United States and Japan mandate the use of impact resistant glass in certain applications to prevent injuries from flying debris and provide structural support in high-wind situations. These regulations are encouraging builders and developers to integrate impact resistant glass into their projects, creating a stable demand for these products in the construction industry.Regulatory standards related to energy efficiency and environmental sustainability are also playing a critical role in shaping the impact resistant glass market. In many regions, regulations such as the European Union's Energy Performance of Buildings Directive (EPBD) and the U.S. Leadership in Energy and Environmental Design (LEED) certification promote the use of energy-efficient materials in building construction. Impact resistant glass with advanced coatings, such as Low-E and solar control coatings, can help buildings achieve higher energy efficiency ratings by reducing heat transfer and enhancing insulation. The growing focus on sustainable building practices and energy conservation is driving the adoption of impact resistant glass as a multifunctional solution that not only provides safety and security but also contributes to environmental goals. Furthermore, the increasing emphasis on green building certifications and the integration of sustainable materials into construction projects are influencing manufacturers to develop impact resistant glass products that meet stringent environmental standards.

Market dynamics such as competition among manufacturers, technological advancements, and raw material costs are also impacting the impact resistant glass market. The competitive landscape is characterized by the presence of established players and new entrants, each striving to develop innovative products that offer superior performance, aesthetics, and cost-effectiveness. Companies are differentiating themselves through product innovation, investment in research and development, and strategic partnerships with construction firms and automotive manufacturers. The rising cost of raw materials, such as silica and chemicals used in coatings and interlayers, can influence production costs and pricing strategies, making it essential for manufacturers to optimize their supply chains and production processes. Additionally, the market is witnessing increasing demand for customization and tailored solutions, as customers seek impact resistant glass that meets specific requirements in terms of size, shape, thickness, and optical properties. These market dynamics and regulatory standards are shaping the evolution of the impact resistant glass market, influencing product development, pricing strategies, and market positioning.

What Are the Key Growth Drivers Fueling the Expansion of the Impact Resistant Glass Market?

The growth in the global impact resistant glass market is driven by several key factors, including the rising focus on building safety and security, the growing adoption in automotive and transportation applications, and advancements in glass technology. One of the primary growth drivers is the increasing demand for building safety and security solutions, particularly in regions prone to natural disasters and in urban areas with high crime rates. Impact resistant glass is a critical component of hurricane-resistant windows, doors, and curtain walls, providing protection against high winds, flying debris, and forced entry. As urbanization and infrastructure development continue to accelerate globally, the need for safer and more resilient building materials is driving the adoption of impact resistant glass in both new construction and renovation projects. The increasing occurrence of extreme weather events and the rising focus on disaster preparedness are further boosting demand, as property owners and developers seek to safeguard assets and protect occupants.Another significant growth driver is the expanding use of impact resistant glass in the automotive and transportation industries. The automotive industry is increasingly incorporating impact resistant glass into vehicles to enhance passenger safety and structural integrity. Automotive safety standards and regulations, such as the U.S. Federal Motor Vehicle Safety Standards (FMVSS) and the European New Car Assessment Programme (Euro NCAP), require the use of shatterproof glass in windshields and other critical components to minimize the risk of injury in the event of a collision. Additionally, the growing popularity of electric vehicles (EVs) and the need for lightweight materials are driving the adoption of impact resistant glass, which offers a favorable balance between weight reduction and safety performance. In the aerospace sector, impact resistant glass is used in aircraft windows and cockpit glazing to protect against bird strikes and other hazards, supporting the safety and reliability of modern aircraft.

Technological advancements in glass manufacturing and the development of multifunctional impact resistant glass products are also fueling market growth. Innovations such as the introduction of smart glass technologies, enhanced coatings, and advanced interlayer materials are enabling impact resistant glass to deliver additional benefits beyond safety and security. Smart glass technologies, which allow for dynamic control of light transmission and opacity, are gaining popularity in high-end architectural and automotive applications, where they offer improved comfort, privacy, and energy efficiency. The use of advanced coatings, such as anti-reflective, self-cleaning, and UV-resistant coatings, is enhancing the performance and aesthetics of impact resistant glass, making it suitable for a broader range of applications. Moreover, the development of lightweight and high-strength glass solutions is supporting the use of impact resistant glass in industries where weight and durability are critical considerations.

Lastly, the increasing focus on sustainability and energy efficiency in building design is contributing to the expansion of the impact resistant glass market. As building codes and environmental standards evolve, there is a growing demand for materials that can help reduce energy consumption and enhance occupant comfort. Impact resistant glass with Low-E coatings and thermal insulation properties is being used to achieve energy-efficient building envelopes that meet green building certification requirements. The adoption of impact resistant glass in green building projects is being driven by its ability to provide safety, energy savings, and environmental benefits in a single solution. As demand from key sectors such as construction, automotive, and aerospace continues to rise, and as manufacturers innovate to meet evolving market needs, the global impact resistant glass market is expected to witness sustained growth, driven by advancements in technology, expanding applications, and the increasing emphasis on safety and sustainability.

Report Scope

The report analyzes the Impact Resistant Glass market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Interlayer (Polyvinyl Butyral, Ionoplast Polymer, Ethylene Vinyl Acetate, Other Interlayers); End-Use (Construction & Infrastructure, Automotive & Transportation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyvinyl Butyral Interlayer segment, which is expected to reach US$27.9 Billion by 2030 with a CAGR of 7.5%. The Ionoplast Polymer Interlayer segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.8 Billion in 2024, and China, forecasted to grow at an impressive 10.1% CAGR to reach $13.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Impact Resistant Glass Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Impact Resistant Glass Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Impact Resistant Glass Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Glass Co., Ltd., Cardinal Glass Industries, Inc., Cemex S.A.B. de C.V., Central Glass Co., Ltd., China Luoyang Float Glass Group Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Impact Resistant Glass market report include:

- Asahi Glass Co., Ltd.

- Cardinal Glass Industries, Inc.

- Cemex S.A.B. de C.V.

- Central Glass Co., Ltd.

- China Luoyang Float Glass Group Co., Ltd.

- CSG Holding Co. Ltd.

- Euroglas GmbH

- Fuso Glass India Pvt. Ltd

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation

- Gulf Glass Industries

- Jinjing Group

- Nippon Sheet Glass Co., Ltd.

- Qingdao Kangdeli Industrial & Trading Co., Ltd.

- Saint-Gobain Group

- Sangalli Group

- Scheuten Glas Nederland BV

- SCHOTT AG

- Sisecam Group

- Syracuse Glass Company

- Taiwan Glass Industry Corporation

- Trulite Glass & Aluminum Solutions, LLC

- Vitro, S.A.B. de C.V.

- Xinyi Glass Holdings Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Glass Co., Ltd.

- Cardinal Glass Industries, Inc.

- Cemex S.A.B. de C.V.

- Central Glass Co., Ltd.

- China Luoyang Float Glass Group Co., Ltd.

- CSG Holding Co. Ltd.

- Euroglas GmbH

- Fuso Glass India Pvt. Ltd

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation

- Gulf Glass Industries

- Jinjing Group

- Nippon Sheet Glass Co., Ltd.

- Qingdao Kangdeli Industrial & Trading Co., Ltd.

- Saint-Gobain Group

- Sangalli Group

- Scheuten Glas Nederland BV

- SCHOTT AG

- Sisecam Group

- Syracuse Glass Company

- Taiwan Glass Industry Corporation

- Trulite Glass & Aluminum Solutions, LLC

- Vitro, S.A.B. de C.V.

- Xinyi Glass Holdings Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

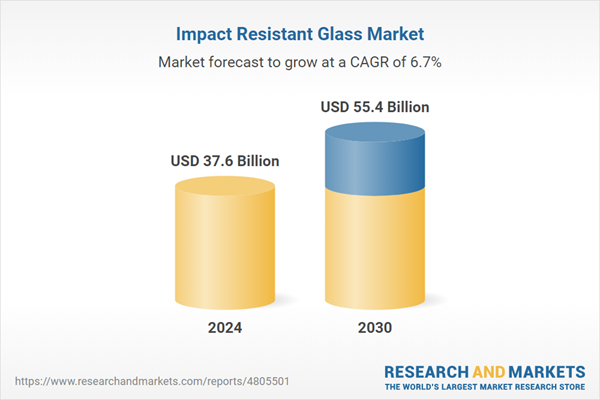

| Estimated Market Value ( USD | $ 37.6 Billion |

| Forecasted Market Value ( USD | $ 55.4 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |