Global Ice Protection Systems Market - Key Trends and Drivers Summarized

Are Ice Protection Systems the Essential Safeguard for Aviation, Wind Energy, and Critical Infrastructure in Extreme Conditions?

Ice protection systems are becoming a crucial component in many industries, but why are they so critical for ensuring the safety and functionality of aircraft, wind turbines, and other critical infrastructure? Ice protection systems are technologies designed to prevent or remove ice buildup on surfaces, such as airplane wings, wind turbine blades, and power lines. Icing can compromise the structural integrity and performance of equipment and vehicles, leading to safety risks, reduced efficiency, and, in extreme cases, catastrophic failure. Ice protection systems mitigate these risks by detecting ice formation and either preventing it through heat, chemicals, or mechanical methods, or by removing ice once it forms.The significance of ice protection systems lies in their ability to ensure operational safety and efficiency in industries where ice accumulation poses serious hazards. In aviation, ice buildup on wings and engines can drastically alter flight dynamics, increasing drag and reducing lift, which compromises aircraft safety. Wind turbines, especially in cold regions, face performance losses due to ice accumulation on blades, which decreases energy output and can damage equipment. Similarly, ice on power lines or offshore platforms can lead to costly outages and structural damage. As industries continue to expand into harsher environments, particularly in aviation, energy, and infrastructure, ice protection systems are becoming indispensable for maintaining safety, reliability, and performance in extreme conditions.

How Have Technological Advancements Improved Ice Protection Systems for Aviation, Energy, and Infrastructure?

Technological advancements have significantly enhanced ice protection systems, making them more efficient, reliable, and adaptable to a wider range of applications, from aviation and wind energy to critical infrastructure. One of the most notable advancements is the development of electrothermal systems, which use embedded heating elements to prevent ice formation on surfaces. In aviation, electrothermal systems are integrated into the wings, engines, and sensors of aircraft, where electric currents generate heat to melt ice as soon as it begins to form. This approach provides real-time protection and can be precisely controlled to target specific areas prone to icing. The use of lightweight, high-efficiency materials for heating elements has made electrothermal systems more effective without adding significant weight to aircraft, which is essential for maintaining fuel efficiency and flight performance.Another key advancement is in the use of chemical de-icing and anti-icing systems, particularly for aviation and wind turbine applications. These systems involve the application of chemical fluids or coatings that either prevent ice from adhering to surfaces or make it easier to remove. In aircraft, anti-icing fluids are applied before takeoff, forming a thin protective layer that prevents ice from bonding to critical surfaces like wings and control surfaces. Similarly, chemical coatings are being developed for wind turbine blades, where they prevent ice from forming or allow ice to be shed more easily during operation. These chemical systems are designed to be environmentally friendly and long-lasting, ensuring that they can be used safely and sustainably in sensitive ecosystems.

For wind energy, advancements in passive and active ice protection systems have significantly improved the efficiency and reliability of wind turbines in cold climates. Passive systems, such as hydrophobic coatings, are designed to repel water and prevent ice buildup naturally by making surfaces less conducive to ice adhesion. These coatings are often applied to wind turbine blades, where they help maintain aerodynamic efficiency by minimizing ice formation. Active systems, on the other hand, use mechanical, thermal, or chemical methods to remove ice once it forms. One such active system involves using blade heating elements that prevent ice from accumulating, ensuring continuous energy production during cold weather. These advancements are critical for wind farms in cold regions, where energy output can drop significantly due to ice-related downtime.

The integration of advanced sensors and monitoring systems has further improved the effectiveness of ice protection systems across industries. In aviation, modern aircraft are equipped with advanced ice detection sensors that provide real-time data on icing conditions, allowing pilots to activate ice protection systems only when necessary, thereby conserving energy and reducing operational costs. These sensors are also being used in wind turbines, where they monitor temperature, humidity, and icing conditions to activate de-icing mechanisms as needed. This sensor-driven approach ensures that ice protection systems are used efficiently, reducing wear and tear on equipment and extending the lifespan of critical components.

In addition to aircraft and wind turbines, ice protection systems have seen advancements in the protection of infrastructure, such as power lines, bridges, and offshore platforms. For example, power lines in cold climates are now equipped with ice-melting systems that use thermal or mechanical methods to prevent ice accumulation, which can lead to power outages or structural damage. One of the key technologies used in this application is the icephobic coating, which makes surfaces slick and resistant to ice formation. This innovation is particularly important for power grids in northern regions, where ice buildup can lead to widespread outages and costly repairs. For offshore oil and gas platforms, where ice buildup poses both operational and safety hazards, advanced heating and mechanical de-icing systems are now used to keep equipment functioning properly in icy conditions.

Drone and unmanned aerial vehicle (UAV) technology has also benefitted from advancements in ice protection systems. Drones operating in cold environments, such as in Arctic exploration or surveillance, require lightweight and efficient anti-icing solutions to maintain flight stability and performance. Innovations in lightweight heating elements and ice-repellent coatings for UAVs have made it possible for drones to operate reliably in icy conditions, opening up new possibilities for exploration, monitoring, and remote inspections in harsh environments.

Another area where ice protection technology has improved is in hybrid systems, which combine multiple ice protection methods to enhance performance and efficiency. For example, a hybrid system might combine electrothermal heating with chemical coatings, providing both active and passive protection against ice buildup. This dual approach ensures that even in the most challenging conditions, ice protection systems can operate continuously without failure. Hybrid systems are particularly useful in aviation, where reliable, redundant ice protection is critical for ensuring flight safety in extreme weather conditions.

Advances in materials science have also contributed to the development of more effective ice protection systems. For example, researchers are exploring the use of graphene-based materials and nanotechnology to create ultra-thin, highly efficient heating elements and coatings. These materials not only improve the efficiency of de-icing systems but also reduce weight and energy consumption, making them ideal for aerospace applications. Similarly, in the wind energy sector, materials scientists are working on new blade designs and coatings that can withstand extreme cold and prevent ice buildup without compromising the structural integrity of the turbine blades.

Why Are Ice Protection Systems Critical for Aviation Safety, Energy Efficiency, and Infrastructure Reliability?

Ice protection systems are critical for aviation safety, energy efficiency, and infrastructure reliability because they prevent the dangerous and costly effects of ice buildup in industries that operate in cold or variable climates. In aviation, ice protection systems are essential for maintaining flight safety. Ice accumulation on an aircraft's wings, engines, or sensors can drastically alter flight dynamics by increasing drag and reducing lift, which can lead to accidents or emergency landings. Aircraft equipped with effective ice protection systems can fly safely through a variety of weather conditions, ensuring the safety of passengers and crew while reducing the risk of in-flight emergencies.In the energy sector, particularly in wind energy, ice protection systems are critical for maintaining efficiency and reliability. Ice buildup on wind turbine blades can lead to significant reductions in energy output by altering the blades' aerodynamics and increasing drag. In extreme cases, ice formation can lead to turbine shutdowns or mechanical damage, resulting in costly repairs and downtime. Ice protection systems, such as blade heating or hydrophobic coatings, ensure that wind turbines can operate efficiently even in freezing temperatures, maximizing energy production and reducing operational costs. This is particularly important as renewable energy sources like wind power become a larger part of the global energy mix, and wind farms are increasingly being built in colder, more remote regions.

For critical infrastructure such as power lines, bridges, and offshore platforms, ice protection systems are essential for ensuring reliability and reducing the risk of costly failures. Power lines in cold climates are particularly vulnerable to ice buildup, which can cause lines to sag or snap under the weight of accumulated ice. This not only leads to power outages but can also pose a safety risk to nearby communities. Ice protection systems that use thermal or mechanical methods to remove ice from power lines ensure that electricity can continue to flow even in the harshest weather conditions. Similarly, bridges and offshore platforms equipped with de-icing systems are protected from structural damage caused by ice, ensuring their long-term stability and safety.

In aviation, ice protection systems also play a key role in maintaining compliance with international safety standards and regulations. Regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) require aircraft to have certified ice protection systems that meet stringent safety requirements. Aircraft manufacturers and operators must ensure that their ice protection systems are effective in a variety of icing conditions to comply with these regulations, which are designed to protect passengers and crew. For this reason, the development and implementation of advanced ice protection technologies are essential for the aviation industry.

Ice protection systems are also important for ensuring the operational continuity of maritime and offshore operations. Ships and offshore platforms operating in polar regions or cold seas often encounter icing conditions that can impair navigation, compromise safety, and disrupt operations. Ice protection systems, such as hull de-icing, propeller anti-icing, and heated deck systems, enable vessels and platforms to function safely and efficiently in icy waters. These systems are particularly crucial for the shipping and oil industries, where operational delays or equipment damage caused by ice can result in significant financial losses.

In drone and UAV operations, ice protection systems are critical for maintaining flight performance and safety in cold environments. Drones are increasingly being used for tasks such as environmental monitoring, infrastructure inspections, and search-and-rescue missions in remote or cold regions. Ice accumulation on drone propellers or sensors can affect their flight stability and reduce operational effectiveness. Ice protection systems, such as lightweight heating elements or ice-repellent coatings, ensure that drones can operate reliably in icy conditions, expanding their usability in challenging environments.

What Factors Are Driving the Growth of the Ice Protection Systems Market?

Several factors are driving the rapid growth of the ice protection systems market, including the expansion of the aviation and wind energy industries, the increased focus on safety and regulatory compliance, and the growing demand for reliable infrastructure in cold regions. One of the primary drivers is the continued growth of the global aviation industry, particularly in regions with harsh winters and variable weather conditions. As airlines expand their routes to include more cold-weather destinations and aircraft manufacturers continue to develop new models, there is a growing need for advanced ice protection systems to ensure safety and compliance with regulatory standards. Aircraft must be equipped with reliable, high-performance ice protection systems to maintain safe operation during flights through icy or freezing conditions.The expansion of the wind energy sector is another significant factor contributing to the growth of the ice protection systems market. As more wind farms are being built in cold climates, including offshore and in mountainous regions, the need for ice protection systems that can prevent ice accumulation on wind turbine blades has become increasingly important. Ice buildup on turbine blades reduces energy output and can cause mechanical damage, leading to costly repairs and downtime. Ice protection systems, such as blade heating or anti-icing coatings, ensure that wind turbines can operate efficiently in cold weather, maximizing energy production and reducing operational costs.

Regulatory requirements and safety standards are also driving the adoption of ice protection systems across industries. In aviation, regulatory bodies like the FAA and EASA mandate that aircraft operating in certain regions or conditions be equipped with certified ice protection systems. These regulations are designed to ensure the safety of passengers and crew by preventing ice-related accidents or incidents. Similarly, in the wind energy sector, operators must comply with regulations that ensure turbines are protected against ice buildup to maintain energy output and operational safety.

The rising focus on infrastructure reliability in cold regions is another factor driving market growth. In regions where cold weather and icing conditions are common, critical infrastructure like power lines, bridges, and offshore platforms must be protected from ice accumulation to ensure their functionality and safety. Ice protection systems that prevent ice buildup on power lines, for example, are essential for maintaining electricity supply during winter storms. Similarly, bridges and offshore platforms equipped with de-icing systems are better able to withstand the harsh conditions of cold climates, reducing the risk of structural damage and costly repairs.

Technological advancements in materials science and sensor technology have also contributed to the growth of the ice protection systems market. The development of lightweight, high-efficiency materials, such as graphene-based heating elements and hydrophobic coatings, has improved the performance of ice protection systems across industries. Additionally, the integration of advanced sensors that can detect icing conditions in real time has made ice protection systems more efficient and responsive, reducing energy consumption and minimizing wear and tear on equipment.

The growing use of drones and UAVs in cold regions for applications such as Arctic exploration, environmental monitoring, and infrastructure inspections has further driven demand for ice protection systems. Drones operating in these environments require lightweight and reliable anti-icing solutions to maintain flight performance and stability. As the use of drones in harsh environments expands, so too does the need for advanced ice protection systems that can ensure safe and reliable operation.

With the expansion of industries like aviation, wind energy, and critical infrastructure in cold climates, along with advancements in ice protection technologies and increasing regulatory requirements, the ice protection systems market is poised for continued growth. As businesses and governments seek reliable, efficient, and compliant solutions for operating in icy conditions, ice protection systems will play an increasingly important role in ensuring safety, performance, and operational continuity across a range of industries.

Report Scope

The report analyzes the Ice Protection Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Electrical, Chemical, Other Technologies); Platform (Commercial Jets, Military Jets, Helicopters).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrical Technology segment, which is expected to reach US$97.3 Billion by 2030 with a CAGR of 5.7%. The Chemical Technology segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $38.7 Billion in 2024, and China, forecasted to grow at an impressive 4.7% CAGR to reach $29.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ice Protection Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ice Protection Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ice Protection Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as B/E Aerospace, Inc., Cav Ice Protection, Inc., Clariant AG, Curtiss-Wright Corporation, Dow, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Ice Protection Systems market report include:

- B/E Aerospace, Inc.

- Cav Ice Protection, Inc.

- Clariant AG

- Curtiss-Wright Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Honeywell International, Inc.

- JBT Corporation

- Meggitt PLC

- United Technologies Corporation (UTC)

- Zodiac Aerospace SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B/E Aerospace, Inc.

- Cav Ice Protection, Inc.

- Clariant AG

- Curtiss-Wright Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Honeywell International, Inc.

- JBT Corporation

- Meggitt PLC

- United Technologies Corporation (UTC)

- Zodiac Aerospace SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

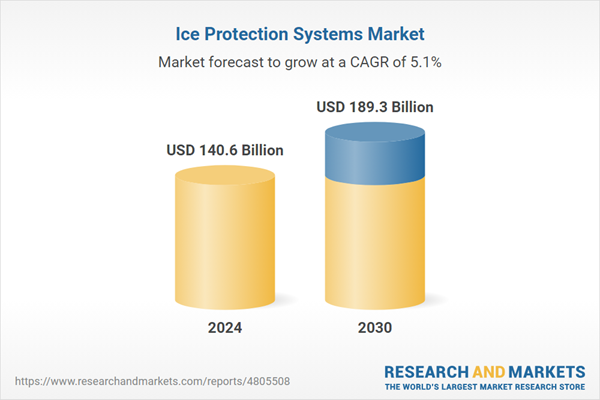

| Estimated Market Value ( USD | $ 140.6 Billion |

| Forecasted Market Value ( USD | $ 189.3 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |