Global Infrastructure as a Service (IaaS) Market - Key Trends and Drivers Summarized

Is Infrastructure as a Service (IaaS) the Backbone of Modern Cloud Computing and Digital Transformation?

Infrastructure as a Service (IaaS) is transforming how businesses manage their IT infrastructure, but why is it so critical for cloud computing, scalability, and digital transformation? IaaS is a cloud computing model that provides virtualized computing resources over the internet, including servers, storage, networking, and virtualization. Rather than investing in and maintaining physical infrastructure on-premises, businesses can rent computing resources from IaaS providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This allows companies to scale their operations, improve flexibility, and reduce capital expenditures by paying only for the resources they use.The significance of IaaS lies in its ability to provide scalable, on-demand infrastructure that supports the growing needs of businesses in a digital-first world. It allows organizations to quickly spin up new environments for development, testing, and production without the time and cost associated with building and maintaining their own data centers. As a foundation for cloud computing, IaaS enables businesses to innovate faster, adopt new technologies, and respond more agilely to market changes. In sectors such as healthcare, finance, and retail, IaaS plays a crucial role in supporting data-intensive applications, disaster recovery, and business continuity efforts. As businesses increasingly embrace digital transformation, IaaS is becoming a critical enabler of growth and innovation.

How Have Technological Advancements Enhanced Infrastructure as a Service for Scalability and Efficiency?

Technological advancements have significantly improved Infrastructure as a Service (IaaS), making it more scalable, cost-effective, and efficient for enterprises of all sizes. One of the key advancements in IaaS is the introduction of containerization technology, such as Docker and Kubernetes. Containers allow applications to run consistently across different computing environments by bundling the application code with all its dependencies. This technology has enabled IaaS providers to offer more efficient resource utilization and faster deployment of applications. With Kubernetes, IaaS platforms can also orchestrate and manage clusters of containers, automating tasks like scaling, load balancing, and failover, thus enhancing the scalability and resilience of cloud-native applications.The use of artificial intelligence (AI) and machine learning (ML) in IaaS platforms has also been transformative. AI-driven automation tools can predict resource demand, optimize infrastructure usage, and even handle routine tasks like scaling or load balancing without manual intervention. These smart systems analyze usage patterns and automatically adjust resources to ensure optimal performance and cost efficiency. For example, predictive analytics can foresee peak traffic times for an e-commerce website and allocate additional virtual machines or storage just before the surge happens. This level of automation has improved the reliability and efficiency of cloud infrastructure, helping businesses avoid downtime and reduce operational costs.

Serverless computing is another major advancement in IaaS. Serverless architecture allows developers to run applications without having to manage or provision servers. Instead, the cloud provider dynamically manages the infrastructure and automatically scales resources based on the application's needs. This eliminates the need for constant infrastructure management, allowing businesses to focus on building and deploying applications more quickly. Serverless computing, such as AWS Lambda or Google Cloud Functions, also ensures that businesses only pay for the actual compute time they use, making it a highly cost-efficient option, particularly for applications with fluctuating workloads.

The integration of edge computing with IaaS is also expanding the capabilities of cloud infrastructure. Edge computing processes data closer to the source of generation - often at remote locations - rather than relying solely on centralized cloud data centers. IaaS providers are now offering edge services that integrate with their cloud platforms, allowing businesses to deploy resources and applications at the edge for faster processing and lower latency. This is particularly useful for industries like manufacturing, autonomous vehicles, and the Internet of Things (IoT), where real-time data processing is essential. By combining IaaS with edge computing, companies can run latency-sensitive applications while maintaining centralized control over their infrastructure.

Advancements in networking technologies, particularly software-defined networking (SDN) and network function virtualization (NFV), have greatly enhanced the flexibility and scalability of IaaS offerings. SDN allows for centralized control over network resources, enabling IaaS platforms to allocate bandwidth, manage traffic flows, and ensure secure connections more efficiently. NFV, on the other hand, replaces traditional hardware-based network devices with software-based virtual instances, which can be deployed on standard servers. This flexibility allows businesses to scale their network resources dynamically as their needs grow, ensuring smooth and secure connectivity for applications hosted in the cloud. These technologies have made it easier for IaaS providers to offer customizable networking solutions to meet the specific needs of their customers.

Another important advancement is the improvement of cloud storage systems, including object storage and block storage. Modern IaaS providers offer highly scalable storage options that can handle vast amounts of unstructured data for applications like big data analytics, artificial intelligence, and machine learning. Technologies like Amazon S3 (Simple Storage Service) and Google Cloud Storage enable companies to store and retrieve large volumes of data with high durability, redundancy, and security. These storage services are integrated with IaaS platforms to offer seamless data access for compute instances, making it easier for businesses to store, analyze, and manage their data in the cloud.

Security enhancements in IaaS have also played a significant role in its adoption by enterprises. Providers have developed sophisticated tools for identity and access management (IAM), data encryption, and compliance monitoring. Multi-factor authentication (MFA), encryption-at-rest, and encryption-in-transit are now standard features, ensuring that data is protected at every stage. Additionally, IaaS platforms have introduced automated security monitoring and threat detection systems powered by AI, which continuously scan for vulnerabilities and respond to potential threats in real time. These advancements have made IaaS a more secure option for businesses handling sensitive data, such as in the financial, healthcare, and government sectors.

Finally, the adoption of hybrid and multi-cloud strategies has been made easier with IaaS advancements. Hybrid cloud solutions allow businesses to integrate their on-premises infrastructure with public and private clouds, providing flexibility and control over where workloads are deployed. Multi-cloud strategies, where businesses use multiple cloud providers to meet different needs, are also supported by IaaS platforms through interoperable APIs, tools, and services. These advancements allow businesses to optimize their infrastructure according to cost, performance, and regulatory requirements, ensuring that they can use the best cloud services for their specific use cases.

Why Is Infrastructure as a Service (IaaS) Critical for Scalability, Flexibility, and Digital Transformation?

Infrastructure as a Service (IaaS) is critical for scalability, flexibility, and digital transformation because it allows businesses to rapidly adjust their IT infrastructure in response to changing needs without the constraints of physical hardware. One of the main reasons IaaS is so important for scalability is its ability to provide on-demand resources that can be scaled up or down based on usage. In traditional on-premises IT environments, scaling infrastructure involves purchasing and installing new servers, storage devices, and networking equipment, a process that is both time-consuming and expensive. With IaaS, businesses can instantly add computing power, storage, and bandwidth as their needs grow, ensuring that they only pay for the resources they use. This flexibility is essential for companies that experience fluctuating demand or seasonal spikes, such as e-commerce businesses or media streaming platforms.IaaS also offers unmatched flexibility in terms of deploying and managing applications. Companies can use virtual machines, containers, or serverless functions to run applications in the cloud, depending on their specific requirements. This flexibility allows businesses to choose the best infrastructure model for their applications, whether they need persistent computing resources for long-running applications or short bursts of compute power for event-driven tasks. Furthermore, IaaS platforms are compatible with a wide range of operating systems, programming languages, and development frameworks, giving developers the freedom to build and deploy applications using the tools they are most comfortable with.

Digital transformation efforts rely heavily on the agility that IaaS provides. As businesses adopt new technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT), they need an IT infrastructure that can support the massive amounts of data generated by these systems. IaaS allows businesses to quickly deploy and scale data processing and storage solutions to handle these workloads, enabling faster innovation and more responsive business models. For example, retailers using AI-driven recommendation engines can quickly scale their infrastructure during high-traffic periods like Black Friday to process customer data in real-time and deliver personalized shopping experiences.

Another reason IaaS is critical for digital transformation is its ability to reduce the time it takes to bring new products and services to market. Traditionally, setting up the infrastructure for a new application or service required purchasing hardware, setting up servers, configuring networks, and ensuring security measures were in place. With IaaS, this process can be completed in a matter of minutes, as businesses can provision the necessary resources through a web-based dashboard or API. This speed allows organizations to test new ideas quickly, iterate on them, and bring them to market without the delays associated with traditional IT infrastructure management.

Disaster recovery and business continuity are other critical areas where IaaS plays an essential role. IaaS platforms provide businesses with the ability to back up their data and applications in geographically diverse regions, ensuring that operations can continue even in the event of a disaster. With features like automated backups, replication, and failover services, businesses can ensure minimal downtime and data loss. For example, a financial services firm using IaaS can replicate its entire infrastructure across multiple regions, ensuring that in the event of a local outage, its operations can seamlessly switch to another data center with little to no disruption. This level of resilience is crucial for industries that require high availability and cannot afford prolonged outages, such as healthcare and finance.

Cost efficiency is another critical benefit of IaaS for businesses undergoing digital transformation. Instead of investing in expensive hardware and maintaining on-premises data centers, companies can shift to an operational expenditure (OPEX) model with IaaS, where they only pay for the resources they consume. This allows businesses to redirect capital to strategic initiatives, such as innovation and growth, rather than being tied up in IT infrastructure costs. IaaS providers also offer pricing models that suit various workloads, including pay-as-you-go, reserved instances, and spot instances, providing flexibility for businesses to optimize their spending based on their specific needs.

What Factors Are Driving the Growth of the Infrastructure as a Service (IaaS) Market?

Several factors are driving the rapid growth of the Infrastructure as a Service (IaaS) market, including the increasing adoption of cloud services, the need for scalable infrastructure, advancements in digital transformation initiatives, and the rise of remote work. One of the primary drivers is the growing demand for cloud services as businesses migrate from traditional on-premises infrastructure to the cloud. Cloud adoption has accelerated across industries as companies seek to improve agility, reduce costs, and gain access to scalable computing resources. IaaS provides the foundational infrastructure for this migration, enabling businesses to easily lift and shift their existing applications to the cloud or build new cloud-native applications.The increasing need for scalability and flexibility is another significant factor contributing to the growth of the IaaS market. Businesses are looking for infrastructure solutions that can quickly adapt to changing demands, especially in industries where workloads fluctuate significantly. IaaS allows companies to scale resources up or down based on demand, making it an ideal solution for applications with variable workloads, such as e-commerce platforms, media streaming services, and online gaming. The ability to scale infrastructure without the constraints of physical hardware gives businesses the flexibility to innovate and expand without the need for costly infrastructure investments.

Advancements in digital transformation initiatives are also driving the growth of the IaaS market. As businesses across all industries embrace technologies like artificial intelligence, machine learning, big data, and the Internet of Things (IoT), they require infrastructure capable of handling the massive data processing and storage needs associated with these technologies. IaaS provides the computing power, storage capacity, and networking resources needed to support these digital initiatives, making it an essential component of modern IT strategies. As more businesses look to harness the power of AI and big data, the demand for IaaS is expected to grow.

The rise of remote work and distributed teams has further accelerated the adoption of IaaS. The COVID-19 pandemic led to a massive shift toward remote work, with businesses needing to provide employees with secure access to company resources from any location. IaaS platforms offer the infrastructure needed to support remote work environments, allowing employees to access virtual desktops, applications, and data securely from anywhere in the world. This trend is expected to continue even as businesses adopt hybrid work models, driving demand for cloud-based infrastructure solutions that enable flexibility and scalability.

Cost efficiency is another key factor contributing to the growth of the IaaS market. Businesses are increasingly moving away from the traditional capital expenditure (CAPEX) model of purchasing and maintaining their own hardware in favor of the operational expenditure (OPEX) model offered by IaaS. This shift allows companies to pay only for the resources they use, reducing upfront costs and making it easier to scale their infrastructure as needed. IaaS also eliminates the need for businesses to invest in expensive data centers, IT staff, and hardware maintenance, making it a cost-effective solution for companies of all sizes.

The growth of hybrid and multi-cloud strategies is also driving the IaaS market. Many businesses are adopting hybrid cloud models that combine on-premises infrastructure with cloud resources to optimize performance, security, and compliance. IaaS provides the flexibility to integrate cloud infrastructure with existing on-premises systems, allowing businesses to manage workloads across multiple environments seamlessly. Multi-cloud strategies, where businesses use multiple cloud providers to meet different needs, are also becoming more common, with IaaS enabling organizations to deploy and manage applications across various cloud platforms efficiently.

With increasing cloud adoption, the need for scalable infrastructure, advancements in digital transformation, and the rise of remote work, the Infrastructure as a Service (IaaS) market is poised for continued growth. As businesses look for more agile, flexible, and cost-effective ways to manage their IT infrastructure, IaaS will play an increasingly important role in enabling innovation, supporting digital transformation, and driving business success across industries.

Report Scope

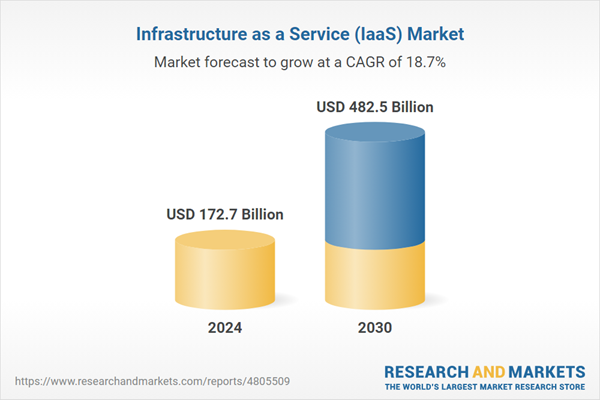

The report analyzes the Infrastructure as a Service (IaaS) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Implementation (Public Cloud, Private Cloud, Hybrid Cloud); End-Use (Large Enterprises, SMEs, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Large Enterprises segment, which is expected to reach US$222.4 Billion by 2030 with a CAGR of 18.4%. The SMEs segment is also set to grow at 20.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $49.8 Billion in 2024, and China, forecasted to grow at an impressive 18.1% CAGR to reach $74.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Infrastructure as a Service (IaaS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Infrastructure as a Service (IaaS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Infrastructure as a Service (IaaS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cisco Systems, Inc., DXC Technology, Fujitsu Ltd., Google LLC, IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 72 companies featured in this Infrastructure as a Service (IaaS) market report include:

- Cisco Systems, Inc.

- DXC Technology

- Fujitsu Ltd.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- ProfitBricks GmbH

- Rackspace

- Vmware, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cisco Systems, Inc.

- DXC Technology

- Fujitsu Ltd.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- ProfitBricks GmbH

- Rackspace

- Vmware, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 209 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 172.7 Billion |

| Forecasted Market Value ( USD | $ 482.5 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | Global |