Global Hydraulic Pumps Market - Key Trends and Drivers Summarized

Are Hydraulic Pumps the Driving Force Behind Modern Industrial and Mobile Equipment?

Hydraulic pumps are essential components in a vast array of industrial and mobile equipment, but why are they so critical to powering and controlling machinery across industries? Hydraulic pumps convert mechanical energy into hydraulic energy by pushing hydraulic fluid into a hydraulic system, creating the necessary pressure to drive actuators, cylinders, motors, and other hydraulic components. These pumps are the heart of hydraulic systems, enabling the smooth, precise, and powerful operation of equipment such as construction machinery, manufacturing tools, agricultural implements, and aircraft.The importance of hydraulic pumps lies in their ability to efficiently generate high levels of force and transmit power through compact systems. By pressurizing hydraulic fluid, these pumps enable machinery to perform tasks that require significant force or precise motion control. From operating heavy construction equipment like excavators to managing the delicate movement of robotic arms in manufacturing, hydraulic pumps are crucial for ensuring that machines can operate with the power and control needed to perform their tasks effectively. Their role is central to countless industrial processes, making them indispensable in modern manufacturing, construction, mining, and more.

How Have Technological Advancements Enhanced Hydraulic Pumps for Greater Efficiency and Durability?

Technological advancements have greatly improved the efficiency, durability, and performance of hydraulic pumps, making them more adaptable to modern industrial demands. One of the key developments is the introduction of variable displacement pumps. Unlike fixed displacement pumps, which provide a constant flow of hydraulic fluid regardless of the load, variable displacement pumps can adjust the flow rate based on the system's requirements. This capability improves energy efficiency by reducing the amount of power consumed when the full hydraulic capacity isn't needed, leading to significant energy savings and reduced operational costs in industries such as manufacturing, construction, and agriculture.Another important advancement is the development of electro-hydraulic pumps, which integrate electric control with hydraulic power. These pumps are designed to offer more precise control over fluid flow and pressure, making them ideal for applications that require high levels of precision, such as automated manufacturing, robotics, and aerospace systems. Electro-hydraulic pumps allow operators to make fine adjustments to the hydraulic system, ensuring smooth operation and reducing the risk of errors. This precision enhances overall system performance, especially in environments where accuracy and reliability are crucial.

Improved materials and sealing technologies have also enhanced the durability of hydraulic pumps. Modern pumps are often constructed from high-strength alloys and composite materials that can withstand extreme pressure and temperature variations. Advanced seals and gaskets, made from materials like polyurethane or Teflon, provide better resistance to wear, corrosion, and leakage. These improvements have led to longer-lasting pumps that require less frequent maintenance, reducing downtime and increasing the overall reliability of hydraulic systems. This durability is particularly important in industries like mining and oil and gas, where pumps must operate continuously in harsh conditions.

Noise reduction technology is another area where hydraulic pumps have seen significant advancement. Traditional hydraulic pumps, particularly gear pumps, can generate significant noise during operation, which is a concern in industries where noise control is important. Modern pump designs incorporate noise-dampening features such as quieter gears, smoother bearings, and more efficient flow paths. These enhancements not only improve the working environment but also extend the life of the pump by reducing vibrations and wear caused by noisy, inefficient components.

The development of smart hydraulic pumps has revolutionized the ability to monitor and control hydraulic systems. Equipped with sensors and digital interfaces, these pumps can provide real-time data on pressure, flow rate, temperature, and operating conditions. This data can be used for predictive maintenance, helping operators identify potential issues before they lead to system failure. Smart pumps also enable remote monitoring and control, allowing adjustments to be made from a distance and improving the overall efficiency of operations. In industries like manufacturing and construction, where downtime can be costly, the ability to monitor pump performance in real-time is a valuable tool for maintaining productivity.

In addition to these advancements, hydraulic pump efficiency has been further improved through the use of energy recovery systems. Some modern hydraulic systems are designed to capture and store energy during periods of low demand or during deceleration phases, such as when machinery is lowering a load or slowing down. This stored energy can then be used to power the pump during high-demand periods, reducing the overall energy consumption of the system. This energy recovery capability is particularly valuable in industries like material handling, where machinery frequently cycles between high and low power requirements.

Why Are Hydraulic Pumps Critical for Powering Industrial, Construction, and Mobile Equipment?

Hydraulic pumps are critical for powering industrial, construction, and mobile equipment because they provide the necessary hydraulic energy that drives various machines, enabling them to perform tasks that require significant force, precision, and control. One of the main advantages of hydraulic pumps is their ability to generate immense power from relatively small and compact units. This makes them ideal for applications where space is limited, yet high force is required. For example, in construction machinery like backhoes, excavators, and cranes, hydraulic pumps provide the force needed to lift heavy loads, operate attachments, and perform precise movements in challenging environments.The precision offered by hydraulic pumps is another reason they are essential across industries. In manufacturing and automation, hydraulic systems are used to control the motion of machinery with great accuracy. Hydraulic pumps enable this precision by delivering consistent fluid pressure and flow to the system, ensuring that actuators and motors perform their tasks smoothly and without error. This is especially important in industries like aerospace or automotive manufacturing, where small deviations in performance can lead to significant quality issues or safety concerns. The fine control provided by hydraulic pumps ensures that machinery operates within tight tolerances, reducing the risk of defects and improving overall product quality.

Hydraulic pumps are also crucial for mobile equipment because of their durability and ability to operate under extreme conditions. Whether in agriculture, construction, mining, or forestry, mobile equipment often operates in harsh environments with heavy dust, dirt, moisture, and temperature fluctuations. Hydraulic pumps are built to withstand these conditions, ensuring reliable performance even in the most demanding settings. Their ability to maintain consistent pressure and flow in adverse conditions makes them indispensable for powering mobile machinery that must perform reliably in the field.

In addition to their durability, hydraulic pumps provide a level of flexibility and versatility that is unmatched by other power transmission systems. Hydraulic pumps can be easily scaled to different sizes and capacities, allowing them to be used in a wide range of equipment, from small tools to large construction machinery. Whether operating a simple hydraulic jack or powering the hydraulic systems in a complex piece of industrial machinery, hydraulic pumps provide the flexibility to meet varying power and control requirements. This adaptability is one of the reasons hydraulic systems are so widely used in industrial and mobile equipment.

Another key advantage of hydraulic pumps is their energy efficiency in industrial and construction applications. Compared to mechanical or electrical systems, hydraulic systems can transmit power more efficiently over longer distances and through complex systems of pipes, hoses, and actuators. Hydraulic pumps enable this by delivering pressurized fluid to remote locations within the system, providing power to multiple actuators or motors simultaneously. This efficiency is particularly valuable in applications such as large-scale construction projects or manufacturing plants, where multiple machines must operate concurrently and in coordination.

Safety is another critical aspect of hydraulic pumps in industrial operations. In many applications, such as lifting, pressing, or moving heavy materials, hydraulic systems offer a higher level of safety than mechanical alternatives. Hydraulic pumps provide controlled and gradual movement, reducing the risk of sudden failures or accidents. In situations where precise control is necessary to protect both equipment and operators, hydraulic systems provide a fail-safe mechanism, often designed to hold their position in the event of power loss. This safety and reliability make hydraulic pumps the preferred choice in industries where maintaining control over heavy or dangerous materials is essential.

What Factors Are Driving the Growth of the Hydraulic Pump Market?

Several factors are driving the rapid growth of the hydraulic pump market, including the increasing demand for construction, industrial automation, and renewable energy projects, as well as advancements in hydraulic technologies. One of the primary drivers is the global infrastructure development boom, particularly in emerging economies. As countries invest in roads, bridges, buildings, and other infrastructure, the demand for hydraulic-powered construction equipment is on the rise. Excavators, cranes, loaders, and other heavy machinery all rely on hydraulic pumps to perform essential tasks, fueling the demand for powerful and reliable hydraulic systems.The growth of automation in manufacturing and other industrial sectors is another key factor driving the hydraulic pump market. As industries increasingly adopt automated and robotic systems to improve efficiency, reduce labor costs, and enhance precision, hydraulic pumps are being integrated into a wide range of machinery. In automated production lines, hydraulic pumps provide the power needed for stamping, pressing, molding, and lifting operations, enabling precise control over complex manufacturing processes. The demand for hydraulic pumps is growing as manufacturers seek to modernize their equipment and increase production efficiency.

The renewable energy sector is also contributing to the expansion of the hydraulic pump market. In hydroelectric power plants, hydraulic pumps are used to manage the flow of water and regulate pressure in turbines, ensuring efficient energy generation. Similarly, hydraulic systems are used in wind turbines to control blade pitch and manage braking systems. As investment in renewable energy continues to grow worldwide, the demand for hydraulic pumps in these applications is expected to rise, providing a new avenue for market growth.

Technological advancements, particularly in energy-efficient and smart hydraulic pumps, are further fueling the growth of the market. As industries seek to reduce energy consumption and minimize operational costs, there is a growing demand for hydraulic pumps that offer improved efficiency and performance. Variable displacement pumps, smart pumps with real-time monitoring capabilities, and pumps with energy recovery systems are becoming increasingly popular across sectors. These technologies help companies optimize hydraulic system performance, reduce energy waste, and lower maintenance costs, driving widespread adoption of advanced hydraulic pumps.

Government regulations related to environmental sustainability and energy efficiency are also influencing the hydraulic pump market. In many regions, stricter emissions standards and energy efficiency regulations are encouraging industries to adopt more efficient and eco-friendly hydraulic systems. Pumps that operate with lower energy consumption, use biodegradable fluids, or offer enhanced safety features are in demand as companies strive to comply with these regulations. The push toward greener, more sustainable industrial practices is expected to continue driving demand for hydraulic pumps that meet these new environmental standards.

With growing investments in infrastructure, automation, and renewable energy, combined with technological advancements in pump efficiency and durability, the hydraulic pump market is poised for significant growth. As industries across the globe continue to prioritize precision, power, and energy efficiency, hydraulic pumps will remain central to the operation of heavy machinery, industrial systems, and advanced automation solutions.

Report Scope

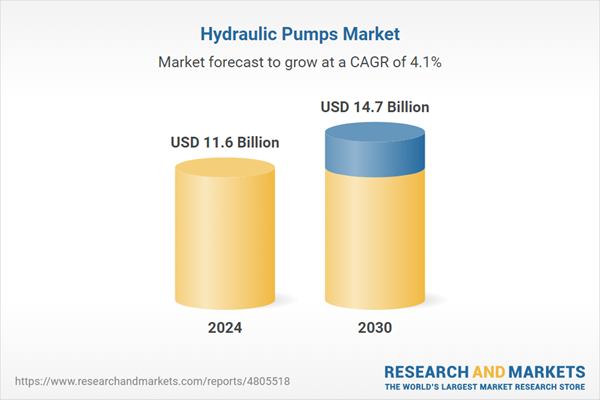

The report analyzes the Hydraulic Pumps market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Gear, Vane, Piston); End-Use (Construction, Mining & Material Handling, Oil & Gas, Agriculture, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gear Pumps segment, which is expected to reach US$7.7 Billion by 2030 with a CAGR of 4.1%. The Vane Pumps segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.1 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $3.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydraulic Pumps Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydraulic Pumps Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydraulic Pumps Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Actuant Corporation, Bailey International LLC, Bosch Rexroth AG, Bucher Hydraulics GmbH, Casappa SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 58 companies featured in this Hydraulic Pumps market report include:

- Actuant Corporation

- Bailey International LLC

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- Casappa SpA

- Dalian Hydraulic Component Co., Ltd.

- Danfoss A/S

- Dynamatic Technologies Ltd.

- Eaton Corporation PLC

- Hydac International GmbH

- Hyva Holding BV (HYVA)

- Parker Hannifin Corporation

- Toshiba Machine Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actuant Corporation

- Bailey International LLC

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- Casappa SpA

- Dalian Hydraulic Component Co., Ltd.

- Danfoss A/S

- Dynamatic Technologies Ltd.

- Eaton Corporation PLC

- Hydac International GmbH

- Hyva Holding BV (HYVA)

- Parker Hannifin Corporation

- Toshiba Machine Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 252 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.6 Billion |

| Forecasted Market Value ( USD | $ 14.7 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |