Global Hydraulic Fluids Market - Key Trends and Drivers Summarized

Are Hydraulic Fluids the Lifeblood of Modern Machinery and Industrial Operations?

Hydraulic fluids are often referred to as the lifeblood of hydraulic systems, but why are they so critical for the smooth operation of heavy machinery and industrial processes? Hydraulic fluids serve multiple purposes in hydraulic systems - they transfer power, lubricate moving parts, dissipate heat, and protect components from wear and corrosion. Whether in construction equipment, manufacturing machinery, aviation, or agricultural tools, hydraulic fluids are essential for ensuring that hydraulic systems function efficiently, smoothly, and reliably.The significance of hydraulic fluids lies in their ability to optimize the performance and longevity of hydraulic equipment. With their role in both power transmission and protection of mechanical parts, hydraulic fluids prevent excessive wear and reduce the risk of system failure. In industries where downtime can result in significant financial losses, such as construction, manufacturing, and mining, the use of high-quality hydraulic fluids is vital for maintaining continuous operations. By acting as both a power medium and a protective agent, hydraulic fluids ensure that industrial systems operate with maximum efficiency and minimum breakdowns.

How Have Technological Advancements Improved Hydraulic Fluids for Better Performance and Sustainability?

Technological advancements have significantly improved the performance, efficiency, and sustainability of hydraulic fluids, making them more capable of handling the demands of modern machinery. One major advancement is the development of synthetic and biodegradable hydraulic fluids. Synthetic hydraulic fluids are designed to perform better in extreme temperature ranges and under high pressure, providing superior thermal stability and oxidation resistance. This results in longer fluid life, reduced wear on system components, and enhanced overall efficiency. Biodegradable hydraulic fluids, often made from renewable resources, offer an environmentally friendly alternative that decomposes more rapidly, reducing the risk of environmental contamination in case of a spill.Another significant technological development is the enhancement of hydraulic fluid additives. Modern hydraulic fluids are formulated with advanced additives that improve their properties, such as anti-wear, anti-foaming, and anti-corrosion features. These additives are crucial in preventing the formation of harmful deposits, reducing air entrapment, and protecting metal surfaces from corrosion. In high-performance industrial settings, these improved hydraulic fluids ensure that equipment operates smoothly, even in harsh environments, while also extending the life of the machinery by reducing friction and wear.

Viscosity control has also seen advancements in hydraulic fluid technology. Modern hydraulic fluids are formulated to maintain optimal viscosity across a wide range of operating temperatures. This is critical because fluctuations in viscosity can lead to a loss of power transmission efficiency or damage to system components. Low-temperature hydraulic fluids now provide improved cold start performance, allowing hydraulic systems to function efficiently in colder environments, while high-temperature formulations ensure stable operation under intense heat. These advancements have expanded the range of applications for hydraulic systems, allowing them to operate in diverse climates and conditions.

The development of fire-resistant hydraulic fluids has added an extra layer of safety in industries such as steel manufacturing, mining, and aviation. Fire-resistant fluids are designed to minimize the risk of fire in high-temperature environments or in areas where flammable materials are present. These fluids, often based on water-glycol or phosphate esters, can operate effectively in environments where traditional petroleum-based fluids might pose a fire hazard. This innovation not only increases operational safety but also ensures compliance with stricter safety regulations in industries where fire risks are a major concern.

In addition to performance enhancements, hydraulic fluid monitoring and filtration technologies have seen significant improvements. Many modern hydraulic systems now integrate real-time monitoring sensors that track the condition of the hydraulic fluid, providing data on contamination levels, temperature, and viscosity. This allows for predictive maintenance, where fluids are changed only when necessary, reducing waste and ensuring that the system continues to operate efficiently. Enhanced filtration systems have also been developed to remove contaminants more effectively, ensuring that hydraulic fluids remain clean and functional for longer periods, thus extending the service life of the equipment.

Why Are Hydraulic Fluids Critical for Power Transmission, Lubrication, and Equipment Longevity?

Hydraulic fluids are critical for power transmission, lubrication, and equipment longevity because they enable hydraulic systems to function with high efficiency, precision, and durability. One of the primary functions of hydraulic fluids is power transmission. In hydraulic systems, the fluid transfers energy from the pump to the actuators, such as cylinders or motors, to create mechanical movement. Without the proper hydraulic fluid, this power transfer would be inefficient or impossible, resulting in a loss of performance and control. High-quality hydraulic fluids ensure that power is transmitted smoothly and consistently, allowing machinery to perform complex tasks with precision.The lubrication properties of hydraulic fluids are equally important. Hydraulic systems consist of many moving parts, such as pumps, valves, and pistons, which generate friction during operation. If not properly lubricated, these parts can wear out quickly, leading to equipment failure and costly repairs. Hydraulic fluids provide a continuous film of lubrication between metal surfaces, reducing friction and wear. This helps extend the life of the equipment, reduce the frequency of maintenance, and improve the overall reliability of hydraulic systems, even under heavy-duty conditions.

Hydraulic fluids also play a crucial role in cooling and dissipating heat generated during system operation. As hydraulic systems operate, they generate heat due to the movement of fluid under pressure and the friction between components. If this heat is not properly managed, it can lead to overheating, system damage, and reduced efficiency. Hydraulic fluids help dissipate heat by carrying it away from critical components and dispersing it through coolers or heat exchangers. In doing so, they prevent thermal degradation of the fluid itself and protect system components from damage caused by excessive heat.

Another critical function of hydraulic fluids is to prevent contamination and corrosion within the system. Hydraulic systems are vulnerable to contamination from particles, water, and other impurities that can enter the system through leaks or external exposure. Contaminants can cause blockages, reduce fluid efficiency, and damage sensitive components. Modern hydraulic fluids are formulated with anti-corrosion and anti-wear additives that help prevent the buildup of contaminants and protect metal surfaces from rust and oxidation. By maintaining cleanliness within the system, hydraulic fluids ensure that equipment operates smoothly and with minimal degradation over time.

Hydraulic fluids also contribute to the overall longevity of equipment. Well-maintained hydraulic fluids reduce the wear and tear on system components by providing consistent lubrication, preventing overheating, and protecting against contamination. This means that hydraulic systems require less frequent repairs and experience fewer breakdowns, translating into lower maintenance costs and longer operational lifespans for industrial machinery. In industries where equipment downtime can lead to significant financial losses, the use of high-performance hydraulic fluids is essential for maintaining productivity and ensuring long-term efficiency.

The versatility of hydraulic fluids makes them indispensable across a wide range of industries. From construction and agriculture to aerospace and manufacturing, hydraulic fluids enable complex machines to operate smoothly and effectively. In environments where precision, power, and durability are critical, hydraulic systems rely on the proper hydraulic fluid to function without fail. Whether lifting heavy loads, powering industrial presses, or enabling the precise movement of robotic arms, hydraulic fluids provide the necessary medium for efficient and reliable operation.

What Factors Are Driving the Growth of the Hydraulic Fluid Market?

Several factors are driving the growth of the hydraulic fluid market, including increasing industrialization, the rise of automation, and advancements in hydraulic system technology. One of the primary drivers is the expanding use of hydraulic systems across industries such as construction, agriculture, and manufacturing. As these sectors continue to grow, the demand for high-quality hydraulic fluids to power machinery, improve efficiency, and reduce downtime is increasing. The global push for infrastructure development, particularly in emerging economies, is fueling the demand for heavy machinery, which in turn drives the need for hydraulic fluids to ensure smooth operation.The rise of automation and the development of more advanced hydraulic systems are also contributing to the growth of the hydraulic fluid market. As industries move toward greater automation, the complexity and precision required in hydraulic systems increase, leading to the need for more specialized fluids. Hydraulic fluids that offer better lubrication, higher pressure-handling capacity, and improved thermal stability are in demand to keep automated systems running efficiently. The use of hydraulic systems in robotics, automated manufacturing lines, and heavy-duty industrial equipment is a key factor in the expanding market for high-performance hydraulic fluids.

Technological advancements in hydraulic fluid formulations are further driving market growth. The development of synthetic and biodegradable fluids has opened up new opportunities for industries that require more environmentally friendly solutions without sacrificing performance. As environmental regulations become more stringent, especially regarding the disposal and management of hydraulic fluids, industries are increasingly adopting biodegradable and eco-friendly fluids. These fluids reduce the environmental impact of hydraulic systems, particularly in industries such as agriculture, forestry, and mining, where spills and leaks can have significant environmental consequences.

The growing emphasis on sustainability and reducing operational costs is another key factor driving the hydraulic fluid market. Hydraulic fluids that offer longer service life, reduced maintenance requirements, and better energy efficiency are highly sought after. Companies are looking for ways to improve their bottom line by extending the life of their machinery and reducing the frequency of fluid changes. High-performance hydraulic fluids with superior anti-wear, anti-oxidation, and thermal stability properties can help achieve these goals, making them attractive to businesses seeking to optimize their operations.

Government regulations and safety standards related to fire hazards and environmental protection are also influencing the hydraulic fluid market. Fire-resistant hydraulic fluids are increasingly in demand in industries where safety is a major concern, such as steel production, aviation, and mining. These fluids help mitigate the risk of fires in high-temperature environments, enhancing operational safety and ensuring compliance with industry-specific regulations. Additionally, regulations aimed at reducing greenhouse gas emissions and improving waste management practices are prompting companies to adopt more environmentally responsible hydraulic fluids.

The increased focus on industrial automation, infrastructure development, and sustainable practices is set to continue driving the hydraulic fluid market. With ongoing advancements in fluid technology and an expanding range of industrial applications, the demand for high-quality hydraulic fluids will remain strong, ensuring the smooth, efficient, and safe operation of hydraulic systems across various sectors.

Report Scope

The report analyzes the Hydraulic Fluids market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Point of Sale (Aftermarket, OEM); Base Oil (Mineral Oil, Synthetic Oil, Bio-Based Oil); End-Use (Construction, Metal & Mining, Agriculture, Oil & Gas, Transportation, Cement Production, Food Processing, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aftermarket Sale segment, which is expected to reach US$7.4 Billion by 2030 with a CAGR of 3.4%. The OEM Sale segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydraulic Fluids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydraulic Fluids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydraulic Fluids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADDINOL Lube Oil GmbH, Amalie Oil Co., Bechem Lubrication Technology, LLC, Bel-Ray Company LLC, BP PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Hydraulic Fluids market report include:

- ADDINOL Lube Oil GmbH

- Amalie Oil Co.

- Bechem Lubrication Technology, LLC

- Bel-Ray Company LLC

- BP PLC

- Chevron Corporation

- Eni SpA

- ExxonMobil Corporation

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- Liqui Moly GmbH

- Morris Lubricants

- Peak Lubricants Pty Ltd

- Penrite Oil

- PetroChina Co., Ltd.

- Phillips 66 Company

- PJSC LUKOIL

- Rock Valley Oil & Chemical Co.

- Royal Dutch Shell PLC

- Sinopec Corp.

- TOTAL SA

- Valvoline, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADDINOL Lube Oil GmbH

- Amalie Oil Co.

- Bechem Lubrication Technology, LLC

- Bel-Ray Company LLC

- BP PLC

- Chevron Corporation

- Eni SpA

- ExxonMobil Corporation

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- Liqui Moly GmbH

- Morris Lubricants

- Peak Lubricants Pty Ltd

- Penrite Oil

- PetroChina Co., Ltd.

- Phillips 66 Company

- PJSC LUKOIL

- Rock Valley Oil & Chemical Co.

- Royal Dutch Shell PLC

- Sinopec Corp.

- TOTAL SA

- Valvoline, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 252 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

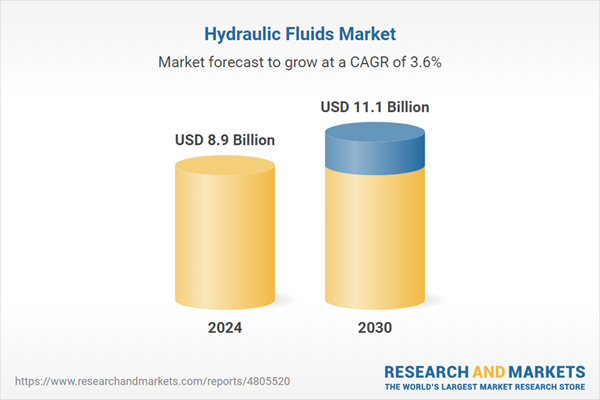

| Estimated Market Value ( USD | $ 8.9 Billion |

| Forecasted Market Value ( USD | $ 11.1 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |