Global High Pressure Seals Market - Key Trends and Drivers Summarized

Are High Pressure Seals the Key to Ensuring Safety and Efficiency in Critical Industrial Applications?

High pressure seals are essential components in modern industries that demand both precision and durability in extreme conditions, but why are these seals so crucial for industrial operations? High pressure seals are designed to withstand the high-pressure environments found in a variety of industries such as oil and gas, chemical processing, power generation, aerospace, and manufacturing. These seals are used to prevent the leakage of fluids, gases, and other materials from equipment that operates under intense pressure. Their ability to maintain integrity under extreme conditions makes them indispensable in applications where safety, efficiency, and reliability are paramount.The appeal of high pressure seals lies in their ability to ensure the smooth and safe operation of critical machinery, especially in environments where failure could result in costly downtime or safety hazards. In oil and gas, for instance, high pressure seals are used in valves, pumps, compressors, and hydraulic systems to prevent leaks and contamination during drilling, refining, and transport. In aerospace, they are vital in hydraulic systems and engines, ensuring that aircraft components function efficiently and safely at high altitudes and speeds. As industries push for more robust, durable, and efficient systems, high pressure seals play an increasingly important role in maintaining the integrity of high-pressure operations across sectors.

How Has Technology Advanced High Pressure Seals?

Technological advancements have greatly improved the performance, durability, and reliability of high pressure seals, making them more adaptable to increasingly demanding industrial applications. One of the most significant advancements in this field is the development of advanced sealing materials. Modern seals are made from materials that are highly resistant to wear, corrosion, and extreme temperatures. These materials include high-performance elastomers, fluoropolymers, PTFE (Polytetrafluoroethylene), and metal-reinforced compounds, which provide superior strength and longevity in harsh environments. The use of these advanced materials allows high pressure seals to withstand extreme pressures and temperatures, making them suitable for applications in industries such as oil and gas, aerospace, and chemical processing.Nanotechnology has also made its way into high pressure seal manufacturing, leading to the creation of nano-engineered sealing materials. These materials have enhanced properties such as increased resistance to friction, wear, and chemical degradation, which prolongs the life of the seals and reduces maintenance requirements. In the oil and gas industry, where seals are exposed to abrasive drilling fluids and extreme pressure, the use of nanomaterials helps extend the operational lifespan of the seals, reducing the risk of equipment failure and downtime.

Another significant advancement in high pressure seal technology is the introduction of dynamic seals that can adapt to fluctuating pressure conditions. Traditional seals are designed to handle consistent pressure, but in many industrial applications, the pressure can vary significantly, which can cause wear or failure in standard seals. Dynamic seals are engineered to adjust to changing pressures, maintaining their integrity and performance even in fluctuating conditions. These seals are particularly valuable in industries like aerospace and automotive, where components experience rapid pressure changes during operation.

Automated monitoring and maintenance technologies have also improved the reliability of high pressure seals. Smart seals equipped with sensors can provide real-time data on seal wear, pressure, temperature, and other operating conditions. This information allows operators to detect potential issues before they lead to failure, enabling predictive maintenance and reducing the risk of unplanned downtime. In industries like chemical processing and power generation, where the failure of a high pressure seal can lead to hazardous situations or costly production halts, these monitoring technologies offer a significant advantage by ensuring the continuous and safe operation of equipment.

Why Are High Pressure Seals Critical for Modern Industrial Operations?

High pressure seals are critical for modern industrial operations because they provide the necessary barrier to prevent leaks and contamination in systems that operate under high pressure. These seals are essential for ensuring the safe and efficient operation of machinery in industries such as oil and gas, aerospace, chemical processing, and manufacturing, where even a small leak can result in costly damage, safety hazards, or environmental contamination. High pressure seals help maintain the integrity of hydraulic systems, pumps, valves, and compressors, ensuring that fluids and gases remain contained within the system, which is vital for maintaining pressure, performance, and safety.In the oil and gas industry, high pressure seals are indispensable in drilling, refining, and transportation processes. These seals are used in equipment like blowout preventers, pumps, and pipelines, where they prevent the escape of high-pressure fluids and gases, ensuring that the extraction and processing of oil and gas are both safe and efficient. A failure in these seals can lead to environmental disasters, equipment damage, and significant financial losses. As the demand for oil and gas extraction moves to deeper and more challenging environments, such as deep-sea drilling and shale gas fracking, the need for highly durable and reliable high pressure seals becomes even more critical.

In the aerospace industry, high pressure seals play a vital role in maintaining the performance and safety of aircraft components, especially in hydraulic systems that control critical flight functions. These systems operate at high pressure, and any failure in the seals could lead to a loss of hydraulic fluid, which can compromise the aircraft's ability to function properly. High pressure seals in aerospace applications must withstand extreme temperature fluctuations, pressure variations, and exposure to aviation fuels and hydraulic fluids, making them essential for the safe operation of both commercial and military aircraft.

In chemical processing plants, high pressure seals are used in pumps, reactors, and valves to prevent the leakage of corrosive chemicals and gases. These seals ensure that chemicals are safely contained, preventing exposure that could lead to worker safety risks or environmental contamination. Additionally, the use of high pressure seals in these environments helps maintain the efficiency of the process by ensuring that pressure levels are sustained, which is critical for the proper functioning of reactors and other equipment. Without high pressure seals, chemical plants would be at greater risk of leaks, which could result in costly production delays or safety incidents.

Moreover, in power generation, high pressure seals are used in turbines, boilers, and heat exchangers, where they play a key role in maintaining pressure and preventing the leakage of steam, gas, or other working fluids. These seals are critical for ensuring that power plants operate efficiently and safely, as any failure could lead to a loss of energy production or damage to the equipment. In nuclear power plants, high pressure seals are especially important for containing radioactive fluids and ensuring the safety of the plant's operations.

Across all these industries, high pressure seals are essential for maintaining the operational efficiency, safety, and environmental compliance of high-pressure systems. Their ability to prevent leaks and contain fluids under extreme conditions makes them an integral component in modern industrial processes, helping industries achieve their goals of safety, performance, and sustainability.

What Factors Are Driving the Growth of the High Pressure Seals Market?

The growth of the high pressure seals market is driven by several key factors, including the increasing demand for high-performance equipment in industries such as oil and gas, chemical processing, aerospace, and power generation, as well as advancements in sealing technologies and materials. One of the primary drivers is the expanding oil and gas industry, particularly the rise of deep-sea drilling and hydraulic fracturing (fracking) operations. These extraction methods require high-pressure equipment to access oil and gas reserves buried deep underground, where pressures and temperatures are extreme. High pressure seals are critical for ensuring that this equipment operates safely and effectively, preventing leaks and maintaining pressure in high-stakes environments.The increasing focus on energy efficiency and sustainability in power generation is another significant factor driving the demand for high pressure seals. Power plants, including nuclear, coal, and gas-fired plants, rely on high pressure systems to generate energy, and the need for efficient, leak-free operation is crucial for reducing energy loss and maximizing output. Additionally, as renewable energy technologies like wind and hydroelectric power continue to grow, the demand for high pressure seals in these applications is also rising. Seals are used in hydraulic systems, turbines, and pumps to ensure the efficient and safe operation of renewable energy infrastructure, contributing to the overall growth of the high pressure seals market.

The rapid expansion of the aerospace and defense sectors is further driving demand for high pressure seals. As aircraft and spacecraft designs become more advanced and require systems that can handle higher pressures and more extreme operating conditions, high pressure seals are becoming increasingly important. In aerospace, seals must endure intense pressure fluctuations, extreme temperatures, and exposure to various fluids. The development of more sophisticated hydraulic and pneumatic systems for both commercial and military aircraft is boosting the need for high pressure seals that can maintain performance and safety under these challenging conditions.

Advancements in materials science and sealing technologies are also contributing to the growth of the high pressure seals market. Innovations in sealing materials, such as advanced elastomers, fluoropolymers, and metal alloys, have improved the durability, temperature resistance, and chemical compatibility of high pressure seals. These new materials allow seals to operate in more extreme environments while reducing wear and extending the operational life of equipment. The introduction of seals with enhanced chemical resistance, for example, has expanded their use in aggressive environments like chemical processing plants, where corrosive fluids and gases are handled. As industries push for more robust and long-lasting sealing solutions, the demand for high-performance materials and advanced seal designs is expected to increase.

Another key factor driving the growth of the high pressure seals market is the increasing emphasis on safety and environmental regulations across industries. Governments and regulatory bodies are imposing stricter guidelines to minimize leaks, emissions, and workplace hazards, particularly in industries like oil and gas, chemical processing, and power generation. High pressure seals play a crucial role in helping companies comply with these regulations by preventing leaks and ensuring the safe containment of hazardous materials. As environmental standards become more stringent, the demand for reliable high pressure seals that can ensure compliance with safety and emissions regulations is expected to grow.

Finally, the rise of automated and connected systems in industrial operations is boosting demand for smart high pressure seals equipped with monitoring capabilities. These seals can provide real-time data on operating conditions, allowing operators to monitor seal performance and schedule maintenance before failure occurs. This predictive maintenance capability is highly valued in industries where unplanned downtime can be costly or dangerous, such as chemical processing and aerospace. As the industrial sector continues to adopt automation and IoT technologies, the integration of smart high pressure seals is expected to drive further growth in the market.

With ongoing advancements in sealing materials, the increasing demand for energy efficiency, and the expansion of high-pressure operations across key industries, the high pressure seals market is poised for significant growth. As industries continue to prioritize operational reliability, safety, and environmental compliance, high pressure seals will remain an essential component in ensuring the smooth and efficient functioning of critical equipment and processes.

Report Scope

The report analyzes the High Pressure Seals market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (EPDM, HNBR, TPU, Metal, Fluoroelastomers, Other Materials); End-Use (Oil & Gas, Manufacturing, Aerospace & Defense, Chemical & Petrochemical, Pharmaceuticals, Power Generation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the EPDM Material segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of 5.3%. The HNBR Material segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Pressure Seals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Pressure Seals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Pressure Seals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aesseal PLC, American High Performance Seals, Inc., Ekato Holding GmbH, Flowserve Corporation, James Walker UK Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 56 companies featured in this High Pressure Seals market report include:

- Aesseal PLC

- American High Performance Seals, Inc.

- Ekato Holding GmbH

- Flowserve Corporation

- James Walker UK Ltd.

- John Crane

- Seal House Ltd.

- SKF Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aesseal PLC

- American High Performance Seals, Inc.

- Ekato Holding GmbH

- Flowserve Corporation

- James Walker UK Ltd.

- John Crane

- Seal House Ltd.

- SKF Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 251 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

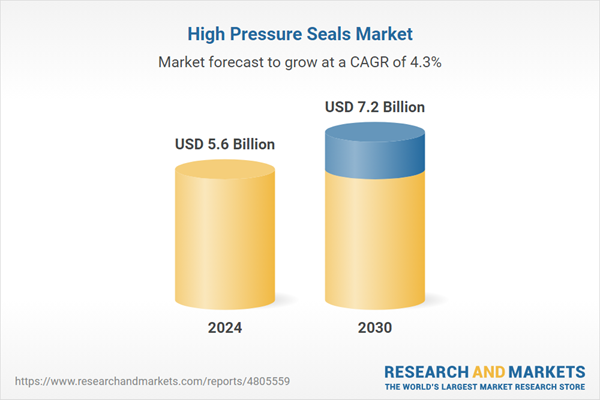

| Estimated Market Value ( USD | $ 5.6 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |