Global High Performance Films Market - Key Trends and Drivers Summarized

Are High Performance Films the Unseen Heroes of Modern Manufacturing and Innovation?

High performance films are revolutionizing industries that require durable, flexible, and highly functional materials, but why are these films so essential? High performance films are advanced polymer films engineered for applications demanding superior strength, heat resistance, chemical resistance, and flexibility. These films are often designed with multiple layers and specialized coatings, offering enhanced barrier properties, optical clarity, and durability. High performance films find use in a wide range of sectors, including packaging, electronics, automotive, aerospace, and construction, where traditional materials may not meet the stringent performance requirements.The appeal of high performance films lies in their ability to provide protection and functionality in extreme conditions without adding significant weight or thickness. They are particularly valuable in industries like electronics, where they act as insulating layers or protective barriers for sensitive components, and in packaging, where they ensure products remain fresh, safe, and visually appealing. In the automotive and aerospace industries, these films contribute to weight reduction while maintaining strength, leading to improved fuel efficiency and performance. As industries continue to innovate and push for more efficient, durable, and sustainable solutions, high performance films are becoming integral to advanced manufacturing and product design.

How Has Technology Advanced High Performance Films?

Technological advancements have significantly enhanced the development and applications of high performance films, making them more versatile and capable of meeting modern industry demands. One of the most notable innovations is the advancement in multilayer film technology. By combining different polymers and materials in multiple layers, high performance films can offer a wide range of properties, such as superior gas and moisture barriers, high tensile strength, and thermal stability. This allows manufacturers to create films that are tailored for specific applications, such as packaging for sensitive electronics, protective coatings for automotive components, or insulation in construction materials. These multilayer films also provide excellent barrier properties, which are critical in food packaging to extend shelf life and preserve freshness.Nanotechnology has also played a key role in advancing high performance films. Incorporating nanomaterials, such as nanoparticles, into the film matrix has significantly improved the mechanical, thermal, and optical properties of these films. For example, nanocomposite films can offer higher strength, better heat resistance, and enhanced barrier properties compared to conventional films. In the electronics industry, nanotechnology enables the production of ultra-thin films that are transparent, conductive, and flexible, which are essential for touchscreens, flexible displays, and solar cells. These films not only improve performance but also open up new possibilities for lightweight, compact, and efficient electronic devices.

Sustainability has become another key focus in the development of high performance films. As industries increasingly prioritize eco-friendly materials and processes, advancements in biodegradable and recyclable films have gained momentum. Bio-based polymers, such as polylactic acid (PLA) and polyethylene furanoate (PEF), are being used to create high performance films that offer similar strength and barrier properties as petroleum-based plastics but with a smaller environmental footprint. Additionally, technologies that allow for the easy separation of different layers in multilayer films are being developed, making it easier to recycle these materials and reduce waste.

The rise of advanced coating and surface treatment technologies has further expanded the applications of high performance films. Coatings can be applied to enhance the surface properties of films, such as improving scratch resistance, UV protection, or anti-glare functionality. In industries like automotive and aerospace, these coatings help protect surfaces from harsh environmental conditions, extend the lifespan of components, and reduce maintenance costs. In packaging, coatings improve printability, enhance clarity, and provide antimicrobial properties, ensuring that products are not only well-protected but also meet safety and hygiene standards. These technological advancements have made high performance films more adaptable, durable, and efficient, driving their use across a broad range of applications.

Why Are High Performance Films Critical for Advanced Manufacturing and Industry?

High performance films are critical for advanced manufacturing and industry because they provide unmatched versatility, durability, and protection in applications that demand high-performance materials. In packaging, for example, high performance films offer superior barrier properties, protecting products from moisture, oxygen, light, and contaminants. This is especially important in food packaging, where these films help extend the shelf life of perishable goods and maintain product quality. The same applies to pharmaceutical packaging, where high performance films protect sensitive medications from environmental factors that could degrade their effectiveness.In the automotive and aerospace industries, high performance films contribute to weight reduction, thermal management, and protection. These industries are under increasing pressure to reduce weight without compromising safety and performance, especially as the automotive sector shifts towards electric vehicles (EVs) and the aerospace industry focuses on improving fuel efficiency. High performance films, which are lightweight yet strong, are used in a variety of components, including interior panels, wiring insulation, and even structural parts. Their ability to withstand extreme temperatures and harsh environmental conditions makes them essential in ensuring the longevity and reliability of vehicles and aircraft.

Electronics is another sector where high performance films play a vital role. In the production of flexible electronics, such as foldable smartphones, touchscreens, and wearable devices, high performance films serve as protective layers and functional components, offering both durability and flexibility. They provide insulation, act as transparent conductive films, and protect delicate components from moisture, dust, and physical damage. As electronics continue to get smaller and more powerful, high performance films will become increasingly important for protecting sensitive components and ensuring device reliability.

Moreover, high performance films are critical in renewable energy technologies, particularly in the solar industry. They are used in the production of photovoltaic panels, where they serve as protective encapsulation layers that shield solar cells from environmental damage while maintaining high levels of transparency to allow light to reach the cells. These films help enhance the efficiency and longevity of solar panels, contributing to the overall growth and sustainability of renewable energy technologies. Across industries, high performance films are indispensable for enabling advanced manufacturing processes, protecting valuable products and components, and improving the overall efficiency and sustainability of modern industry.

What Factors Are Driving the Growth of the High Performance Films Market?

The growth of the high performance films market is driven by several key factors, including the increasing demand for lightweight, durable materials, advancements in packaging technologies, and the push for sustainability in manufacturing. One of the primary drivers is the growing need for high-performance materials that can reduce weight and improve efficiency in industries like automotive, aerospace, and electronics. As manufacturers seek to reduce the environmental impact of their products by improving fuel efficiency and reducing emissions, high performance films are being used to replace heavier, less efficient materials. Their strength, flexibility, and heat resistance make them an ideal choice for applications where both performance and weight are critical.Advancements in packaging technology are also contributing to the rapid growth of the high performance films market. With the increasing demand for longer shelf lives and enhanced product protection, high performance films are being used to create packaging that offers superior barrier properties. In the food and beverage industry, where freshness and safety are paramount, high performance films provide the necessary protection against moisture, oxygen, and light. Similarly, in pharmaceutical packaging, these films ensure that sensitive medications are shielded from environmental factors, preventing degradation and ensuring the safety of the end product. As e-commerce continues to grow, the demand for robust, lightweight packaging materials that can withstand the rigors of shipping is also driving the need for high performance films.

Sustainability is another significant factor driving market growth. With increasing consumer and regulatory pressure to reduce plastic waste and improve recycling, companies are focusing on developing eco-friendly high performance films. Innovations in bio-based polymers and recyclable films are gaining momentum, offering industries an alternative to traditional petroleum-based plastics. These eco-friendly films maintain the high performance required in terms of strength, durability, and barrier protection while offering a smaller environmental footprint. As industries across the globe prioritize sustainable materials, the demand for recyclable and biodegradable high performance films is expected to grow.

Additionally, the expanding use of high performance films in emerging markets is contributing to market growth. In regions such as Asia-Pacific, where rapid industrialization and urbanization are driving demand for advanced materials, high performance films are being adopted in industries ranging from construction and packaging to automotive and electronics. The construction industry, in particular, is seeing increased use of high performance films for insulation, moisture barriers, and protective coatings. These films help improve the energy efficiency of buildings and provide long-lasting protection in extreme environmental conditions. As economies in these regions continue to develop, the demand for high performance films is expected to rise significantly.

Lastly, the growing focus on renewable energy technologies is also driving the demand for high performance films, particularly in the solar and wind energy sectors. High performance films are used to protect and enhance the efficiency of solar panels and wind turbine components, contributing to the overall growth of renewable energy infrastructure. With governments and industries increasingly prioritizing the transition to clean energy, the need for durable, high-performance materials that can withstand harsh environmental conditions is becoming more critical. As a result, the high performance films market is set to experience sustained growth, driven by technological innovation, sustainability initiatives, and the expanding use of advanced materials across a wide range of industries.

Report Scope

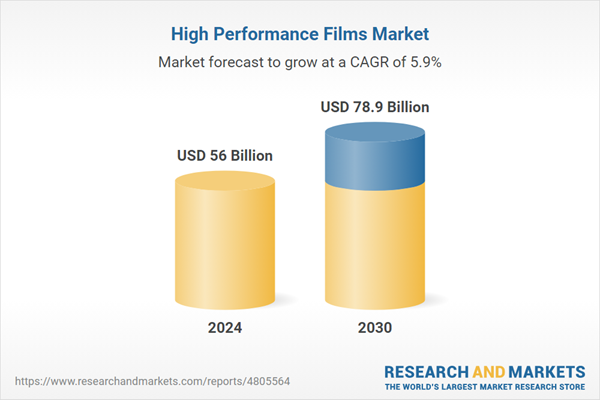

The report analyzes the High Performance Films market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Polyester, Ethyl Vinyl Acetate (EVA), Polyolefin, Fluoropolymers, Polyamide, Other Materials); Type (Barrier Films, Safety & Security Films, Microporous Films, Decorative Films, Other Types); Application (Packaging, Construction, Electrical & Electronics, Automotive, Aerospace, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyester Material segment, which is expected to reach US$35.3 Billion by 2030 with a CAGR of 6.3%. The Ethyl Vinyl Acetate (EVA) Material segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.1 Billion in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $12.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Performance Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Performance Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Performance Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, American Durafilm Co., Inc., Covestro AG, Dow, Inc., DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this High Performance Films market report include:

- 3M Company

- American Durafilm Co., Inc.

- Covestro AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Honeywell International, Inc.

- Sealed Air Corporation

- Solvay SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- American Durafilm Co., Inc.

- Covestro AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Honeywell International, Inc.

- Sealed Air Corporation

- Solvay SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 56 Billion |

| Forecasted Market Value ( USD | $ 78.9 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |