Global Heat Shields Market - Key Trends and Drivers Summarized

Are Heat Shields the Unsung Heroes of High-Performance Engineering?

Heat shields, though often overlooked, are critical components in many of today's most advanced technologies, especially in industries where extreme temperatures are a constant challenge. But what exactly are heat shields, and why are they so essential? Heat shields are designed to protect structures or components from excessive heat generated by friction, combustion, or other thermal processes. They are used across a wide range of industries, from aerospace and automotive to electronics and manufacturing. The primary function of a heat shield is to either absorb, reflect, or dissipate heat, ensuring that sensitive materials or systems beneath remain within safe operational temperatures.In aerospace applications, for instance, heat shields protect spacecraft during reentry into the Earth's atmosphere, where temperatures can soar beyond 1,600°C due to the immense friction between the craft and the atmosphere. Without these protective layers, the spacecraft's structure would melt, compromising the mission and endangering the crew. Similarly, in automotive engines, exhaust systems, and braking systems, heat shields prevent overheating of vital components, improving performance and safety. As industries push the boundaries of speed, efficiency, and performance, the demand for advanced heat shields that can withstand increasingly extreme conditions continues to grow.

How Has Technological Innovation Advanced Heat Shield Design?

The development of heat shields has come a long way, thanks to major advances in materials science and engineering. Early heat shields were primarily made from heavy materials like asbestos or metals, which, while effective at absorbing heat, added significant weight and bulk to the systems they were meant to protect. Today, modern heat shields are lighter, more efficient, and capable of withstanding even higher temperatures due to the use of advanced composites, ceramics, and ablative materials. These materials allow heat shields to either absorb and dissipate heat more effectively or reflect heat away from the protected surface entirely.Ablative heat shields, for example, are commonly used in aerospace applications. These shields are designed to burn away during reentry into the atmosphere, carrying the heat away from the spacecraft as the material vaporizes. This technology has been used in iconic missions such as the Apollo lunar landings and continues to be a key component in modern space exploration, including missions to Mars. Ceramic-based heat shields are another major innovation, particularly in automotive and manufacturing applications. These shields are highly resistant to both heat and corrosion, making them ideal for use in high-temperature environments like turbochargers, braking systems, or industrial furnaces.

Another significant advancement is the development of multi-layer insulation (MLI) systems, which are used primarily in spacecraft to protect against both heat and cold. MLI typically consists of multiple thin layers of reflective materials, such as aluminized plastic, separated by spacers. These systems can reflect up to 99% of incoming thermal radiation, providing an effective barrier in both high-temperature and cryogenic environments. Technological innovation has not only made heat shields more effective but also more adaptable to a wide range of applications, enabling industries to push technological boundaries without risking overheating and thermal failure.

Why Are Heat Shields So Crucial to Today's High-Performance Industries?

The increasing complexity and intensity of modern industrial processes are making heat shields more vital than ever. In the aerospace industry, heat shields are indispensable for ensuring the safety and success of space missions, where they protect spacecraft from the intense heat of atmospheric reentry. Modern rockets, satellites, and space shuttles rely heavily on heat shield technology to prevent catastrophic failures during launch, orbit, and reentry phases. As space exploration expands - both in government programs and the private sector - there is growing demand for advanced, lightweight heat shields capable of withstanding the extreme conditions of deep space and interplanetary travel.The automotive industry also depends on heat shields to improve vehicle performance and longevity. In high-performance vehicles, especially in motorsports, heat shields play a critical role in managing the intense heat generated by combustion engines, exhaust systems, and braking mechanisms. Proper heat management not only ensures that vehicles run more efficiently but also prevents damage to nearby components, such as fuel lines, electrical systems, or the passenger cabin. Additionally, as electric vehicles (EVs) grow in popularity, heat shields are needed to protect sensitive battery packs from thermal stress, especially during fast charging or high-power output scenarios. The role of heat shields in both internal combustion engines and electric vehicles highlights their importance in the evolution of automotive technology.

Manufacturing and industrial sectors are also seeing an increased reliance on heat shields. Industrial furnaces, kilns, and smelters operate at extremely high temperatures, requiring advanced thermal protection systems to safeguard equipment, improve energy efficiency, and ensure worker safety. In electronics, miniaturization and higher power outputs are driving the need for heat shields that can protect components from overheating. This is especially critical in sectors like telecommunications, computing, and renewable energy, where high-performance devices need to operate reliably in high-temperature environments. As industries continue to innovate, heat shields remain an essential technology, enabling the safe and efficient operation of high-performance systems.

What Factors Are Driving the Growth of the Heat Shield Market?

The growth in the heat shield market is driven by several factors, all linked to advancements in technology, changing industry requirements, and the global push for efficiency and safety in extreme environments. One of the key drivers is the rapid development of the aerospace and defense industries. As countries and private enterprises pursue ambitious space exploration projects and advanced military technologies, the demand for high-performance heat shields continues to grow. The rise of space tourism, lunar exploration missions, and plans for Mars colonization are creating new opportunities for heat shield manufacturers to innovate and expand their offerings. The need for lightweight, durable, and high-temperature-resistant materials in these missions is critical to their success, making heat shields a pivotal component of future space travel.Another significant growth factor is the increasing shift toward electric vehicles (EVs) and renewable energy technologies. As EV manufacturers strive to improve battery performance and safety, the role of heat shields in protecting battery systems from overheating becomes even more critical. In addition, solar power plants and wind turbines, which operate in exposed environments, rely on heat shields to protect components from heat, UV radiation, and environmental damage. The push for sustainability and reduced carbon emissions is further encouraging the development of more efficient heat shields that align with the goals of energy-efficient and environmentally friendly technologies.

Advancements in materials science are also propelling market growth. New lightweight materials, such as carbon composites and advanced ceramics, offer improved thermal performance without the weight penalties of traditional heat shield materials. This is particularly important in industries like aerospace and automotive, where reducing weight directly impacts fuel efficiency and performance. In automotive applications, stricter emissions regulations and the need for better fuel economy are pushing manufacturers to adopt heat shields that reduce heat transfer to critical components, thus improving overall engine efficiency and longevity.

Lastly, the growth of high-performance electronics and telecommunications systems is contributing to the demand for advanced heat management solutions. As devices become more powerful and compact, the challenge of managing heat dissipation becomes more pronounced. Heat shields play a key role in ensuring that sensitive components in computers, smartphones, data centers, and telecom infrastructure remain cool and functional under high workloads. Together, these factors are driving a robust market for heat shields, ensuring that they will remain integral to the continued advancement of technology across a wide range of industries.

Report Scope

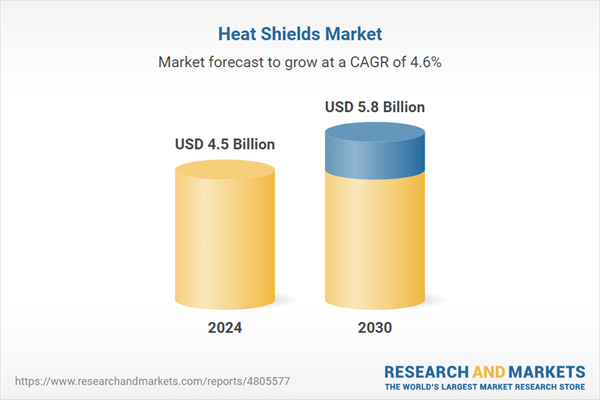

The report analyzes the Heat Shields market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Non-Metallic, Metallic); End-Use (Automotive, Aircraft, Defense / Firearms).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Metallic Material segment, which is expected to reach US$4.3 Billion by 2030 with a CAGR of 4.6%. The Metallic Material segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heat Shields Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heat Shields Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heat Shields Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autoneum Holding Ltd., Dana Holding Corporation, ElringKlinger AG, Lydall Inc., Morgan Advanced Materials PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Heat Shields market report include:

- Autoneum Holding Ltd.

- Dana Holding Corporation

- ElringKlinger AG

- Lydall Inc.

- Morgan Advanced Materials PLC

- Ugn Inc.

- Zircotec Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autoneum Holding Ltd.

- Dana Holding Corporation

- ElringKlinger AG

- Lydall Inc.

- Morgan Advanced Materials PLC

- Ugn Inc.

- Zircotec Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 5.8 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |