Global Lighting as a Service (LaaS) Market - Key Trends & Drivers Summarized

Why Is Lighting as a Service (LaaS) Gaining Traction in the Market?

Lighting as a Service (LaaS) is an innovative business model that offers lighting solutions through a subscription-based service rather than a traditional purchase. This model is gaining traction in the market due to its potential to reduce upfront costs, improve energy efficiency, and simplify maintenance for businesses and municipalities. Under LaaS agreements, service providers install, maintain, and upgrade lighting systems, while customers pay a recurring fee for the use of the lighting service. The appeal of LaaS lies in its ability to offer state-of-the-art lighting solutions without the need for significant capital investment, making it particularly attractive to companies looking to upgrade their lighting systems to more energy-efficient options. As sustainability becomes a higher priority for businesses and governments, LaaS is emerging as a viable and cost-effective solution for reducing energy consumption and carbon emissions.How Are Technological Innovations Driving the Adoption of LaaS?

Technological innovations are at the heart of the growing adoption of LaaS, as advancements in LED lighting, smart lighting systems, and IoT (Internet of Things) integration are making these services more attractive to customers. The transition from traditional lighting to LED technology is a key driver, as LEDs offer significant energy savings, longer lifespans, and lower maintenance costs. The integration of smart lighting controls and sensors within LaaS solutions allows for automated lighting adjustments based on occupancy, daylight levels, and energy usage, further enhancing efficiency and cost savings. Additionally, the use of IoT platforms enables real-time monitoring and management of lighting systems, providing service providers with the data needed to optimize performance and proactively address maintenance issues. These technological advancements are making LaaS an increasingly attractive option for businesses and municipalities looking to modernize their lighting infrastructure.What Market Trends Are Shaping the Demand for LaaS?

The demand for LaaS is being shaped by several key market trends, including the growing focus on energy efficiency, the push for sustainability, and the shift towards service-based business models. As energy costs continue to rise and environmental regulations become more stringent, businesses are seeking ways to reduce their energy consumption and carbon footprint, making LaaS an appealing solution. The trend towards outsourcing non-core business functions is also contributing to the growth of LaaS, as companies look to streamline operations and focus on their primary activities. Additionally, the increasing adoption of smart building technologies is driving demand for LaaS, as integrated lighting systems that can be controlled and optimized remotely are becoming more desirable. The rise of circular economy principles, where resources are used more efficiently and products are kept in use for longer, is further supporting the growth of LaaS, as it aligns with the goals of reducing waste and maximizing the lifespan of lighting systems.What Is Driving the Growth in the Lighting as a Service Market?

The growth in the Lighting as a Service (LaaS) market is driven by several factors. The increasing focus on energy efficiency and the need to comply with environmental regulations are major drivers, as businesses and municipalities seek to reduce energy consumption and carbon emissions. Technological advancements in LED lighting, smart controls, and IoT integration are making LaaS solutions more attractive and cost-effective, further driving adoption. The shift towards service-based business models, where customers pay for the use of a service rather than owning the product, is also contributing to the growth of LaaS, as it offers a flexible and scalable solution for modernizing lighting infrastructure. Additionally, the trend towards sustainability and the circular economy is supporting the market, as LaaS aligns with the principles of reducing waste and maximizing resource efficiency. The expansion of LaaS into new markets, including emerging economies where energy efficiency is a growing concern, is creating new opportunities for service providers and driving market growth.Report Scope

The report analyzes the Lighting as a Service market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Software, Luminaries & Controls, Services); Installation (Outdoor, Indoor); End-Use (Commercial, Industrial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$12.8 Billion by 2030 with a CAGR of 39.2%. The Luminaries & Controls Component segment is also set to grow at 43.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 37% CAGR to reach $4.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Lighting as a Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Lighting as a Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Lighting as a Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cree, Inc., Future Energy Solutions, GE Lighting, Igor Inc., Italtel SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Lighting as a Service market report include:

- Cree, Inc.

- Future Energy Solutions

- GE Lighting

- Igor Inc.

- Italtel SpA

- Koninklijke Philips NV

- Lunera Lighting, Inc.

- Rcg Lighthouse

- SIB Lighting

- Zumtobel Group AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cree, Inc.

- Future Energy Solutions

- GE Lighting

- Igor Inc.

- Italtel SpA

- Koninklijke Philips NV

- Lunera Lighting, Inc.

- Rcg Lighthouse

- SIB Lighting

- Zumtobel Group AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

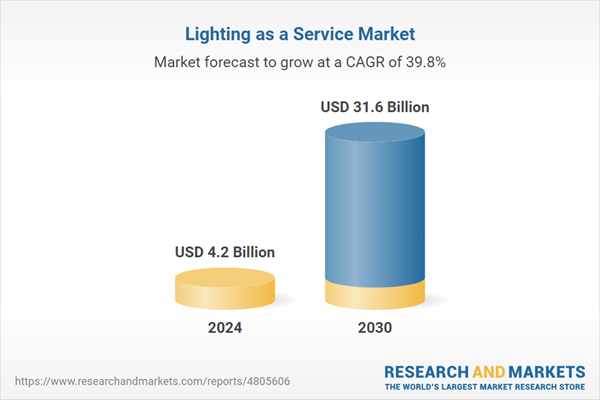

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 31.6 Billion |

| Compound Annual Growth Rate | 39.8% |

| Regions Covered | Global |