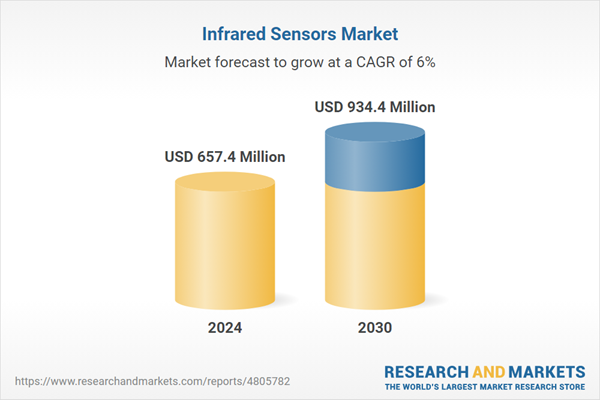

Global Infrared Sensors Market - Key Trends & Drivers Summarized

What Are the Core Technologies Behind Infrared Sensors?

Infrared sensors operate primarily by detecting and measuring the infrared radiation emitted by objects, differentiating them based on temperature and material characteristics. These sensors leverage various technologies, including thermopiles, bolometers, and pyroelectric detectors, each suited for specific applications ranging from industrial temperature monitoring to motion detection in security systems. Advancements in semiconductor technology have led to significant improvements in the sensitivity and range of infrared sensors, making them highly effective for passive infrared (PIR) sensing in both commercial and residential settings. The integration of microelectromechanical systems (MEMS) has further miniaturized these sensors, enhancing their deployment in compact devices such as smartphones and wearables, where space is at a premium but functionality cannot be compromised.How Is Market Demand Shaping Innovations in Infrared Sensor Applications?

The demand for infrared sensors is heavily influenced by their expanding role in critical and everyday applications. In the automotive industry, these sensors are integral to advanced driver-assistance systems (ADAS), providing vital data for obstacle detection and collision avoidance systems. Healthcare has seen innovative uses of infrared sensors in monitoring devices that non-invasively measure body temperature and blood flow. The rise of smart homes and the Internet of Things (IoT) has further broadened the scope of applications, with infrared sensors now commonly found in home automation systems for energy management and security. Each application not only drives demand but also pushes the boundaries of what these sensors can do, fostering continuous innovation in both the technology and its uses.What Challenges and Innovations Are Influencing the IR Sensor Industry?

The infrared sensor industry faces several technical challenges that drive ongoing innovation. One of the primary challenges is the need for enhanced sensitivity and selectivity in environments with fluctuating temperatures and varying levels of infrared interference. Innovations such as tunable spectral sensitivity and advanced filtering techniques have been developed to address these issues. Another challenge is the integration of sensors into increasingly smaller and interconnected devices, which requires continuous advancements in sensor design and manufacturing processes. Companies are also focusing on developing low-power solutions to extend the battery life of portable and wearable devices that use IR sensors, which is crucial for consumer acceptance and market growth.Growth in the Infrared Sensors Market Is Driven by Several Factors…

The growth in the infrared sensors market is driven by several factors, including significant advancements in related technologies and their integration into a wide range of applications. The increasing adoption of automation across various sectors, such as manufacturing, automotive, and healthcare, requires reliable and precise sensors, boosting the demand for infrared solutions. Consumer behavior, particularly the shift towards smarter, energy-efficient homes and devices, also propels the growth of this market. Economical factors, such as the reduction in the cost of sensor manufacturing due to improved production techniques and the scaling of operations, have made these devices more accessible and affordable. Additionally, regulatory pressures for safety and energy efficiency standards across industries serve as catalysts for increased adoption of IR sensor-based systems. These growth drivers collectively ensure a robust expansion trajectory for the infrared sensors market, reflecting its critical role in modern technology landscapes.Report Scope

The report analyzes the Infrared Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Pyroelectric, Thermopile, Microbolometers, InGaAs, MCT); End-Use (Commercial, Healthcare, Automotive, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pyroelectric Technology segment, which is expected to reach US$390.2 Million by 2030 with a CAGR of 6.9%. The Thermopile Technology segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $171.1 Million in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $218.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Infrared Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Infrared Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Infrared Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as DRS Technologies, Inc., Excelitas Technologies Corporation, FLIR Systems, Inc., General Dynamics Mission Systems, Inc., Hamamatsu Photonics KK and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Infrared Sensors market report include:

- DRS Technologies, Inc.

- Excelitas Technologies Corporation

- FLIR Systems, Inc.

- General Dynamics Mission Systems, Inc.

- Hamamatsu Photonics KK

- L-3 Communications Holdings, Inc.

- MicroStrategy, Inc.

- Murata Manufacturing Co., Ltd.

- Nippon Avionics Co., Ltd.

- Omron Corporation

- Raytheon Company

- Sofradir Group

- Testo SE & Co. KGaA

- Texas Instruments, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- DRS Technologies, Inc.

- Excelitas Technologies Corporation

- FLIR Systems, Inc.

- General Dynamics Mission Systems, Inc.

- Hamamatsu Photonics KK

- L-3 Communications Holdings, Inc.

- MicroStrategy, Inc.

- Murata Manufacturing Co., Ltd.

- Nippon Avionics Co., Ltd.

- Omron Corporation

- Raytheon Company

- Sofradir Group

- Testo SE & Co. KGaA

- Texas Instruments, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 657.4 Million |

| Forecasted Market Value ( USD | $ 934.4 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |