Global Optical Sensors Market - Key Trends & Drivers Summarized

How Are Optical Sensors Enhancing Detection and Sensing Capabilities Across Industries?

Optical sensors are crucial in modern technology, enabling accurate detection and measurement of light, color, and other optical properties in a wide range of applications. These sensors convert light into electrical signals to measure various parameters, such as distance, temperature, pressure, and chemical composition, offering high sensitivity and precision. Optical sensors are widely used in industries such as automotive, aerospace, healthcare, environmental monitoring, and consumer electronics. In automotive applications, they play a critical role in advanced driver assistance systems (ADAS) and autonomous driving by providing real-time data for navigation and obstacle detection. In healthcare, optical sensors enable non-invasive monitoring of vital signs, such as heart rate and blood oxygen levels, while in industrial settings, they are used for process control, quality inspection, and environmental monitoring. The growing demand for real-time data and the need for more precise and efficient sensing solutions are driving the adoption of optical sensors across multiple sectors.What Trends Are Driving the Optical Sensors Market?

Several trends are shaping the optical sensors market, particularly the growing demand for sensors in consumer electronics, automotive safety systems, and industrial automation. One of the most significant trends is the increasing use of optical sensors in smartphones and wearable devices for applications such as facial recognition, gesture control, and health monitoring. The rise of autonomous vehicles and advanced driver assistance systems (ADAS) is another key trend, as optical sensors are essential for enabling features like lane detection, collision avoidance, and object recognition. In industrial applications, the trend toward automation and smart manufacturing is driving demand for optical sensors that can provide real-time data for process optimization and quality control. Additionally, the growing focus on environmental monitoring and sustainability is fueling the adoption of optical sensors in applications such as air quality monitoring, water pollution detection, and energy management systems.How Is Technology Enhancing Optical Sensors?

Technological advancements are significantly improving the performance and versatility of optical sensors, making them more accurate, reliable, and energy-efficient. Innovations in photodetector materials, such as graphene and other nanomaterials, are enhancing the sensitivity and response time of optical sensors, enabling them to detect smaller changes in light or environmental conditions. The integration of optical sensors with wireless communication technologies, such as IoT, is allowing for real-time, remote monitoring and control of sensor data, expanding the range of applications in smart cities, agriculture, and industrial automation. Miniaturization is another key advancement, enabling the development of smaller, more compact sensors that can be integrated into portable and wearable devices. Additionally, the use of machine learning and AI algorithms in optical sensing systems is improving data processing and analysis, allowing for more accurate predictions and decision-making in complex environments.What Is Driving the Growth in the Optical Sensors Market?

The growth in the optical sensors market is driven by several factors, including the increasing demand for sensors in consumer electronics, automotive safety systems, and industrial automation. The widespread adoption of smartphones, smartwatches, and other wearable devices is fueling demand for optical sensors that enable features such as biometric identification, health monitoring, and gesture recognition. The rise of autonomous vehicles and ADAS systems is also contributing to market growth, as optical sensors are essential for real-time navigation, object detection, and collision avoidance. The trend toward smart manufacturing and automation in industries such as automotive, electronics, and aerospace is driving demand for optical sensors that provide real-time data for process optimization and quality control. Additionally, the increasing focus on environmental monitoring and sustainability is supporting the adoption of optical sensors in applications such as air and water quality monitoring, further driving market growth.Report Scope

The report analyzes the Optical Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Aerospace & Defense, Consumer Electronics, Utilities, Oil & Gas, Medical, Construction, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aerospace & Defense End-Use segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of 16.1%. The Consumer Electronics End-Use segment is also set to grow at 10.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $784.1 Million in 2024, and China, forecasted to grow at an impressive 18.8% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alphasense Ltd., ams AG, Analog Devices, Inc., Fairchild Semiconductor International Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Optical Sensors market report include:

- ABB Ltd.

- Alphasense Ltd.

- ams AG

- Analog Devices, Inc.

- Fairchild Semiconductor International Inc.

- Fotech Solutions Ltd.

- Hamamatsu Photonics KK

- OptaSense

- Oxsensis Ltd.

- Rjc Enterprises, LLC.

- Rohm Semiconductors

- Silixa Ltd.

- STMicroelectronics

- Teledyne DALSA, Inc.

- Texas Instruments, Inc.

- Vishay Intertechnology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alphasense Ltd.

- ams AG

- Analog Devices, Inc.

- Fairchild Semiconductor International Inc.

- Fotech Solutions Ltd.

- Hamamatsu Photonics KK

- OptaSense

- Oxsensis Ltd.

- Rjc Enterprises, LLC.

- Rohm Semiconductors

- Silixa Ltd.

- STMicroelectronics

- Teledyne DALSA, Inc.

- Texas Instruments, Inc.

- Vishay Intertechnology, Inc.

Table Information

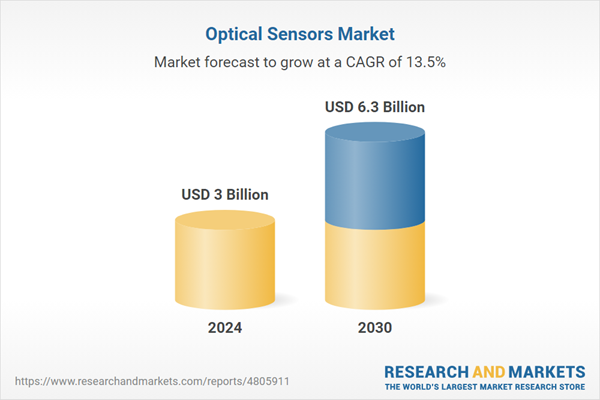

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 6.3 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | Global |