Global NVH Testing Market - Key Trends & Drivers Summarized

What Is NVH Testing, and Why Is It Critical in Product Development?

NVH (Noise, Vibration, and Harshness) testing refers to the process of measuring and analyzing noise, vibration, and harshness characteristics in various products, particularly in the automotive, aerospace, and industrial sectors. NVH testing helps manufacturers improve product quality by identifying and mitigating unwanted noise and vibrations that could impact performance, safety, and consumer satisfaction. It is especially critical in the automotive industry, where minimizing cabin noise and vibrations is essential for improving the overall driving experience. With the shift toward electric vehicles (EVs), where noise signatures differ from traditional combustion engines, NVH testing is playing an even more important role in ensuring that vehicles meet the expectations of modern consumers.How Are Technological Advancements Enhancing NVH Testing Solutions?

Technological innovations in NVH testing are transforming how manufacturers approach product development and quality control. Modern NVH testing solutions are increasingly adopting advanced software and simulation tools that allow for faster and more accurate analysis of noise and vibration issues. Additionally, the use of artificial intelligence (AI) and machine learning is enabling predictive maintenance and real-time analysis, helping manufacturers address potential NVH problems early in the design process. Portable and wireless NVH testing devices are also gaining traction, providing greater flexibility and ease of use in various industrial environments. These advancements are leading to more efficient and precise testing procedures, improving product quality while reducing development time and costs.How Are Industry Shifts Impacting the Demand for NVH Testing?

The transition to electric vehicles (EVs) and hybrid vehicles is significantly reshaping the NVH testing landscape. With electric motors being quieter than traditional internal combustion engines, other sources of noise, such as wind and road noise, are becoming more prominent, necessitating advanced NVH testing. Additionally, the aerospace industry is increasingly focusing on passenger comfort, driving demand for NVH testing to minimize noise and vibration during flight. The growing emphasis on product quality and regulatory standards across industries is also pushing manufacturers to invest in comprehensive NVH testing solutions. As consumers continue to prioritize comfort and performance, the demand for precise NVH testing across automotive, aerospace, and industrial applications is on the rise.Growth in the NVH Testing Market Is Driven by Several Factors

Growth in the NVH testing market is driven by several factors, including advancements in testing technologies, the increasing adoption of electric vehicles, and rising consumer expectations for product quality. Technological innovations such as AI-driven testing, simulation tools, and wireless testing devices are enabling manufacturers to perform more accurate and efficient NVH analyses. The shift toward electric and hybrid vehicles is creating new challenges and opportunities in NVH testing, as manufacturers work to address unique noise and vibration issues associated with these technologies. Additionally, stringent regulations for vehicle noise emissions and industrial product safety are propelling demand for advanced NVH testing solutions. As industries such as automotive and aerospace continue to prioritize performance and comfort, the NVH testing market is expected to see sustained growth.Report Scope

The report analyzes the NVH Testing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Hardware, Software); Application (Environmental Noise, Building Acoustics, Product Vibration, Telecom Testing, Other Applications); End-Use (Automotive & Transportation, Aerospace & Defense, Industrial Equipment, Power Generation, Consumer Electronics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the NVH Testing Hardware segment, which is expected to reach US$3 Billion by 2030 with a CAGR of 5.7%. The NVH Testing Software segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $737 Million in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $581.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global NVH Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global NVH Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global NVH Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Dynamics (Anthony Best Dynamics Limited), Benstone Instruments Inc., Bruel & Kjaer Sound & Vibration Measurement A/S, Data Physics Corp., Dewesoft d.o.o. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this NVH Testing market report include:

- AB Dynamics (Anthony Best Dynamics Limited)

- Benstone Instruments Inc.

- Bruel & Kjaer Sound & Vibration Measurement A/S

- Data Physics Corp.

- Dewesoft d.o.o.

- ECON Technologies Co., Ltd.

- ESI Group

- Granulab (M) Sdn Bhd

- HEAD acoustics GmbH

- Honeywell International, Inc.

- imc Test & Measurement GmbH

- Imv Corporation

- King Design

- Kistler Group

- M+P International, Inc.

- National Instruments Corporation

- OROS Group

- PCB Piezotronics, Inc.

- Polytec GmbH

- Prosig Ltd.

- Siemens PLM Software

- Signal.X Technologies LLC.

- Thermotron Inc.

- VTI Instruments Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Dynamics (Anthony Best Dynamics Limited)

- Benstone Instruments Inc.

- Bruel & Kjaer Sound & Vibration Measurement A/S

- Data Physics Corp.

- Dewesoft d.o.o.

- ECON Technologies Co., Ltd.

- ESI Group

- Granulab (M) Sdn Bhd

- HEAD acoustics GmbH

- Honeywell International, Inc.

- imc Test & Measurement GmbH

- Imv Corporation

- King Design

- Kistler Group

- M+P International, Inc.

- National Instruments Corporation

- OROS Group

- PCB Piezotronics, Inc.

- Polytec GmbH

- Prosig Ltd.

- Siemens PLM Software

- Signal.X Technologies LLC.

- Thermotron Inc.

- VTI Instruments Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

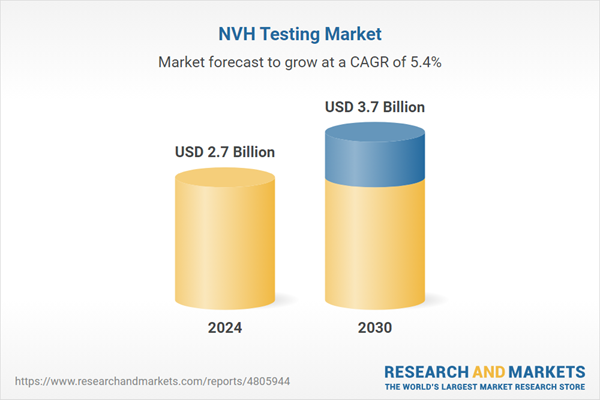

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |