Global Small Drones Market - Key Trends and Drivers Summarized

Why Are Small Drones Gaining Popularity Across Diverse Sectors?

Small drones, also known as unmanned aerial vehicles (UAVs), have rapidly gained popularity across diverse sectors, including agriculture, surveillance, logistics, and entertainment. Their compact size, versatility, and ability to perform tasks that are either too dangerous, time-consuming, or expensive for humans have made them indispensable tools. In agriculture, for instance, small drones are increasingly being used for precision farming, crop monitoring, and pesticide spraying, which enhances yield and reduces labor costs. In surveillance and law enforcement, these drones provide critical aerial perspectives for monitoring large areas, crowd control, and emergency response. In logistics, companies are exploring small drones for last-mile delivery solutions to overcome traffic congestion and reduce delivery times, especially in urban environments. The entertainment and media industry also utilizes small drones for filming, photography, and live broadcasting, leveraging their ability to capture unique aerial shots that would otherwise be impossible or cost-prohibitive.How Are Technological Innovations Driving the Adoption of Small Drones?

Technological innovations have been pivotal in driving the adoption of small drones. Modern small drones are equipped with advanced sensors, high-resolution cameras, AI-based object recognition, and collision avoidance systems, which enhance their operational safety and efficiency. Additionally, improvements in battery technology have led to longer flight times and greater range, addressing a significant limitation in early drone models. The integration of GPS and real-time data transmission capabilities enables accurate navigation and better mission planning, expanding the use cases for these drones. The development of swarm drone technology, where multiple drones operate in coordination to perform tasks, is creating new opportunities in areas such as disaster management, search and rescue missions, and military operations. These technological advancements are not only enhancing drone capabilities but are also reducing costs, making them more accessible to small and medium-sized enterprises (SMEs).Which Market Segments Are Leading the Adoption of Small Drones?

Types include fixed-wing, rotary-wing, and hybrid drones, with rotary-wing drones dominating the market due to their ability to hover, take off, and land vertically, making them ideal for surveillance, photography, and urban delivery. Applications span from aerial photography and mapping to inspection, surveillance, and delivery services, with the aerial photography and mapping segment holding the largest market share owing to the widespread adoption in media, construction, and agriculture sectors. End-users range from government and defense agencies to commercial enterprises, with the commercial segment witnessing the fastest growth due to the rising use of drones in logistics, agriculture, and infrastructure monitoring. Geographically, North America leads the market due to the early adoption of drone technology and supportive regulations, while Asia-Pacific is emerging as a high-growth region driven by increased investments in smart city initiatives and infrastructure development.What Are the Key Drivers of Growth in the Small Drone Market?

The growth in the small drone market is driven by several factors, including technological advancements in drone autonomy, AI-based capabilities, and improved battery life, which enhance operational efficiency and expand potential applications. The increasing adoption of small drones in commercial sectors such as agriculture, logistics, and media is driving market demand. The rising use of drones in surveillance, public safety, and disaster management is expanding the market's reach. The development of cost-effective, lightweight, and high-endurance drones is propelling market growth among SMEs and individual users. Additionally, the easing of regulations on commercial drone operations, the emergence of Drone-as-a-Service (DaaS) models, and the growing investments in drone startups and research and development (R&D) are further supporting market expansion.Report Scope

The report analyzes the Small Drones market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Defense, Civil & Commercial, Homeland Security, Consumer); Payload (Electronic Intelligence Payloads, CBRN Sensors, Cameras, UAV Radar).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Defense Application segment, which is expected to reach US$33.1 Billion by 2030 with a CAGR of 15.7%. The Civil & Commercial Application segment is also set to grow at 16.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.4 Billion in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $19.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Small Drones Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Small Drones Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Small Drones Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3D Robotics, Inc. (3DR), Aeronautics, AeroVironment, Inc., Boeing Company, The, DJI and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Small Drones market report include:

- 3D Robotics, Inc. (3DR)

- Aeronautics

- AeroVironment, Inc.

- Boeing Company, The

- DJI

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- Microdrones GmbH

- Northrop Grumman Corporation

- Parrot Drones SAS

- Raytheon Company

- SAAB AB

- Textron Inc.

- Thales Group

- Turkish Aerospace Industries, Inc. (TAI)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3D Robotics, Inc. (3DR)

- Aeronautics

- AeroVironment, Inc.

- Boeing Company, The

- DJI

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- Microdrones GmbH

- Northrop Grumman Corporation

- Parrot Drones SAS

- Raytheon Company

- SAAB AB

- Textron Inc.

- Thales Group

- Turkish Aerospace Industries, Inc. (TAI)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

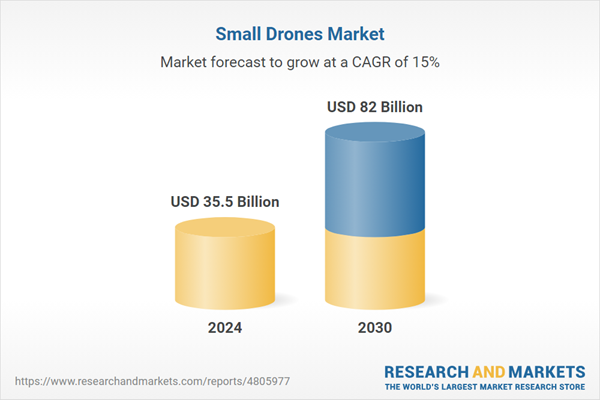

| Estimated Market Value ( USD | $ 35.5 Billion |

| Forecasted Market Value ( USD | $ 82 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |