Global Procurement as-a-Service Market - Key Trends and Drivers Summarized

Why Is Procurement as-a-Service Gaining Traction in Modern Enterprises?

Procurement as-a-Service (PaaS) is gaining significant traction among modern enterprises as it offers a flexible, scalable, and cost-effective approach to managing procurement functions. Unlike traditional procurement models, PaaS allows organizations to outsource specific procurement processes or the entire procurement function to specialized service providers, thereby enhancing efficiency, reducing costs, and improving supplier relationships. The demand for PaaS is being driven by the need for strategic sourcing, category management, spend analytics, and supplier risk management. As companies strive to optimize their supply chain operations and achieve better value from their procurement spend, PaaS is emerging as a preferred solution across various sectors, including manufacturing, healthcare, retail, and IT.How Are Technological Innovations Shaping the Future of Procurement as-a-Service?

Technological innovations are significantly shaping the future of Procurement as-a-Service by enabling data-driven decision-making, transparency, and agility. The integration of artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) into procurement platforms is transforming spend analytics, contract management, and supplier performance evaluation. The rise of digital procurement marketplaces and cloud-based procurement solutions is enhancing collaboration, reducing procurement cycle times, and minimizing manual interventions. Additionally, the adoption of blockchain technology is revolutionizing procurement by ensuring secure, transparent, and immutable transactions, thereby mitigating risks associated with supplier fraud and non-compliance. The development of cognitive procurement platforms with predictive analytics and autonomous decision-making capabilities is further driving the PaaS market, allowing organizations to forecast demand, optimize inventory, and negotiate better supplier terms.Which Market Segments Are Leading the Adoption of Procurement as-a-Service?

Components of PaaS include strategic sourcing, spend management, category management, supplier management, and contract management, with strategic sourcing and spend management being the most widely adopted due to their impact on cost reduction and efficiency. Organization sizes range from small and medium-sized enterprises (SMEs) to large enterprises, with large enterprises being the primary adopters due to their complex procurement needs and focus on supplier risk management. End-users of PaaS span sectors such as manufacturing, healthcare, retail, BFSI, and IT, with manufacturing and IT being the largest segments due to their focus on optimizing procurement processes and achieving cost efficiencies. Geographically, North America and Europe are the leading markets for Procurement as-a-Service due to high digital adoption rates and mature supply chain ecosystems, while Asia-Pacific is emerging as a high-growth region driven by increasing investments in digital procurement, supply chain optimization, and risk management.What Are the Key Drivers of Growth in the Procurement as-a-Service Market?

The growth in the Procurement as-a-Service market is driven by several factors, including the rising need for cost optimization and process efficiency, advancements in AI and machine learning for predictive procurement analytics, and the increasing adoption of cloud-based and digital procurement solutions. The development of cognitive and autonomous procurement platforms with capabilities for spend visibility, supplier risk management, and contract optimization is driving market adoption among manufacturing, healthcare, and IT sectors. The focus on enhancing transparency, collaboration, and agility in procurement processes is expanding the market reach among SMEs, large enterprises, and government agencies. The growing emphasis on sustainable and ethical sourcing practices, supplier diversity, and inclusive procurement strategies is creating new opportunities for market growth. Additionally, the increasing investments in R&D for blockchain-enabled procurement platforms, secure transactions, and AI-driven decision-making tools are further supporting market expansion.Report Scope

The report analyzes the Procurement as-a-Service market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Strategic Sourcing, Category Management, Transactions Management, Contract Management, Other Components); Organization Size (Large Enterprises, SMEs); Vertical (IT & Telecom, Manufacturing, Retail, BFSI, Healthcare, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Strategic Sourcing segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of 10%. The Category Management segment is also set to grow at 9.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Procurement as-a-Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Procurement as-a-Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Procurement as-a-Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cobite, Covendis, Diversifood Associates, Enlighta Inc., Field Nation, LLC. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Procurement as-a-Service market report include:

- Cobite

- Covendis

- Diversifood Associates

- Enlighta Inc.

- Field Nation, LLC.

- GCommerce

- Sastrify

- SimplifyVMS

- StrategiCom Inc.

- Tender Support

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cobite

- Covendis

- Diversifood Associates

- Enlighta Inc.

- Field Nation, LLC.

- GCommerce

- Sastrify

- SimplifyVMS

- StrategiCom Inc.

- Tender Support

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

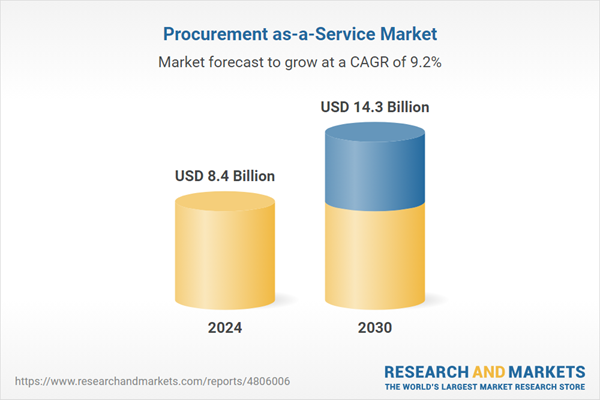

| Estimated Market Value ( USD | $ 8.4 Billion |

| Forecasted Market Value ( USD | $ 14.3 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |