Global Satellite Payloads Market - Key Trends and Drivers Summarized

Satellite Payloads: How Are They Shaping the Future of Global Connectivity?

Satellite payloads are essential components in modern satellite systems, playing a critical role in communications, navigation, Earth observation, and space exploration. The rapid proliferation of satellite constellations, such as Starlink and OneWeb, has significantly increased the demand for advanced payloads, particularly in the communication sector. These payloads, which carry the specific instruments and technologies required for mission objectives, are evolving with technological advancements, such as high-throughput satellites (HTS) and software-defined payloads. HTS payloads, for example, have revolutionized data transmission capabilities by enhancing bandwidth efficiency and reducing latency, which is essential for high-speed internet and remote communication services. Meanwhile, the emergence of software-defined payloads enables flexible and reconfigurable satellite operations, adapting to mission changes and offering significant cost advantages.What Innovations Are Transforming the Satellite Payload Industry?

The satellite payload industry is experiencing a wave of innovation, driven by the miniaturization of electronics, artificial intelligence (AI) integration, and the development of optical and quantum communication payloads. Miniaturization is enabling the deployment of smaller satellites, such as CubeSats and smallsats, with highly sophisticated payload capabilities, which is lowering launch costs and broadening market access. Additionally, AI-powered payloads are enhancing satellite autonomy, enabling real-time data processing, decision-making, and fault detection, which is critical for defense, surveillance, and commercial applications. On another front, optical communication payloads are garnering attention for their ability to offer ultra-high data transfer rates through laser communication, while quantum communication payloads are exploring secure data transmission methods, paving the way for future-proof, secure satellite networks.What Market Opportunities Are Emerging in Satellite Payloads?

The growth in satellite-based Earth observation and remote sensing is opening new market opportunities for payload manufacturers. With an increasing focus on climate change, disaster management, and agricultural monitoring, there is a growing demand for advanced imaging payloads such as hyperspectral, multispectral, and synthetic aperture radar (SAR) systems. The evolving needs for global navigation satellite systems (GNSS) are also driving investments in new types of navigation payloads that provide higher accuracy, reliability, and signal integrity. Moreover, the collaboration between government agencies and private companies is fueling the development of payloads that cater to a wide range of applications, from defense to commercial, expanding the payload market's potential.What Are the Key Drivers of Growth in the Satellite Payload Market?

The growth in the satellite payload market is driven by several factors, including technological advancements, rising investments in satellite constellations, and increased demand for real-time data services. The expansion of global satellite broadband services, particularly in remote and underserved regions, is propelling the need for advanced communication payloads. Additionally, the demand for earth observation payloads is on the rise due to their applications in climate monitoring, agricultural management, and urban planning. Increased defense spending globally also stimulates demand for high-resolution surveillance and reconnaissance payloads. Regulatory encouragement for sustainable and debris-free space activities is pushing the market towards innovation in propellant-free and reconfigurable payloads, enhancing market dynamics. As space exploration missions expand, the need for versatile, durable, and high-performance payloads continues to drive the satellite payload market forward.Report Scope

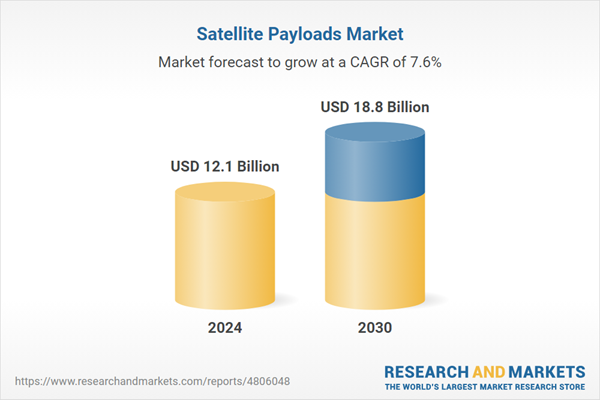

The report analyzes the Satellite Payloads market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Orbit Type (LEO, MEO, GEO); Payload Type (Communication, Imaging, Navigation); End-Use (Commercial, Civil, Military).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LEO Satellite segment, which is expected to reach US$9 Billion by 2030 with a CAGR of 7.4%. The MEO Satellite segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Satellite Payloads Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Satellite Payloads Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Satellite Payloads Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ayecka Communication Systems, Ltd., Dhruva Space Private Limited, Honeywell International, Inc., Kencoa Aerospace Corporation, Lockheed Martin Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Satellite Payloads market report include:

- Ayecka Communication Systems, Ltd.

- Dhruva Space Private Limited

- Honeywell International, Inc.

- Kencoa Aerospace Corporation

- Lockheed Martin Corporation

- Lucix Corporation

- Mobile Health Management Services, Inc.

- Momentus

- NEC Space Technologies Ltd.

- Orbital Express Launch Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ayecka Communication Systems, Ltd.

- Dhruva Space Private Limited

- Honeywell International, Inc.

- Kencoa Aerospace Corporation

- Lockheed Martin Corporation

- Lucix Corporation

- Mobile Health Management Services, Inc.

- Momentus

- NEC Space Technologies Ltd.

- Orbital Express Launch Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 18.8 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |