Global Solid-State and Other Energy-Efficient Lighting Market - Key Trends and Drivers Summarized

Why Is Solid-State Lighting Becoming the Go-To Solution for Energy Efficiency?

Solid-state lighting (SSL), including Light Emitting Diodes (LEDs) and Organic LEDs (OLEDs), is rapidly becoming the preferred choice for energy-efficient and sustainable lighting solutions. Unlike traditional incandescent and fluorescent lights, SSL technologies offer longer lifespans, reduced energy consumption, and lower maintenance costs, making them ideal for residential, commercial, and industrial applications. The growing demand for sustainable lighting, driven by stringent energy regulations, rising electricity costs, and environmental concerns, is spurring the adoption of SSL across various sectors. The versatility of SSL in providing customizable lighting solutions with enhanced color rendering, dimming capabilities, and minimal heat emission is further supporting its growth, especially in smart city projects, automotive lighting, and indoor horticulture.How Are Technological Advancements Enhancing Energy-Efficient Lighting Solutions?

Technological advancements are significantly enhancing the capabilities and applications of solid-state and other energy-efficient lighting solutions, enabling more intelligent, adaptive, and aesthetically pleasing designs. Innovations in smart lighting systems that integrate SSL with IoT, AI, and automation platforms are transforming lighting from mere illumination to an integral part of smart building infrastructure. The development of human-centric and adaptive lighting solutions that adjust brightness and color temperature based on circadian rhythms is gaining traction, especially in healthcare, education, and office environments. Moreover, advancements in OLED technology, micro-LEDs, and quantum dot LEDs are pushing the boundaries of energy efficiency, color purity, and design flexibility, expanding the application scope of SSL in displays, signage, and wearable devices.Which Market Segments Are Leading the Growth of the Energy-Efficient Lighting Industry?

Types of energy-efficient lighting include LEDs, OLEDs, compact fluorescent lamps (CFLs), and high-intensity discharge (HID) lamps, with LEDs holding the largest market share due to their superior energy efficiency, cost-effectiveness, and versatility. Applications of energy-efficient lighting span indoor and outdoor lighting, automotive, horticulture, and entertainment, with indoor lighting being the dominant segment due to the high demand for residential, commercial, and industrial lighting solutions. End-use sectors comprise residential, commercial, industrial, automotive, and healthcare, with commercial buildings leading the market due to the growing focus on energy savings and green building certifications. Geographically, Asia-Pacific is the largest market for energy-efficient lighting, driven by rapid urbanization, infrastructure development, and government incentives for energy conservation, while North America and Europe are also significant markets due to strong policy support and technological innovation.What Are the Key Drivers of Growth in the Solid-State and Other Energy-Efficient Lighting Market?

The growth in the solid-state and other energy-efficient lighting market is driven by several factors, including the rising demand for energy-efficient lighting solutions, technological advancements in smart lighting and SSL technologies, and the increasing focus on reducing carbon footprint and energy consumption. The need to enhance lighting quality, reduce operational costs, and comply with energy efficiency regulations is driving the adoption of SSL across various applications. Technological innovations in human-centric lighting, adaptive lighting systems, and OLED and micro-LED technologies are expanding the scope and versatility of energy-efficient lighting solutions, supporting market growth. The expansion of energy-efficient lighting applications in automotive, healthcare, horticulture, and smart city projects, coupled with the growing emphasis on sustainability and digital transformation, is creating new opportunities for market players. Additionally, the focus on developing cost-effective, durable, and intelligent lighting solutions for diverse environments is further propelling the growth of the energy-efficient lighting market.Report Scope

The report analyzes the Solid-State and Other Energy-Efficient Lighting market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Solid-State, HID, Other Technologies); Installation Type (New, Retrofit); Application (General Lighting, Automotive Lighting, Medical Lighting, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solid-State Technology segment, which is expected to reach US$144.1 Billion by 2030 with a CAGR of 5%. The HID Technology segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $50.5 Billion in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $38.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Solid-State and Other Energy-Efficient Lighting Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Solid-State and Other Energy-Efficient Lighting Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Solid-State and Other Energy-Efficient Lighting Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acuity Brands Lighting Inc., Advanced Lighting Technologies, Inc. (ADLT), Aixtron SE, Bridgelux, Inc, Bright Light Systems Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 54 companies featured in this Solid-State and Other Energy-Efficient Lighting market report include:

- Acuity Brands Lighting Inc.

- Advanced Lighting Technologies, Inc. (ADLT)

- Aixtron SE

- Bridgelux, Inc

- Bright Light Systems Inc.

- Cree, Inc.

- Energy Focus, Inc.

- General Electric Company

- Intematix Corporation

- LED Engin, Inc.

- Nichia Corporation

- Osram Licht AG

- Royal Philips Electronics N.V.

- Seoul Semiconductor Co., Ltd.

- TCP International Holdings Ltd.

- Toyoda Gosei Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acuity Brands Lighting Inc.

- Advanced Lighting Technologies, Inc. (ADLT)

- Aixtron SE

- Bridgelux, Inc

- Bright Light Systems Inc.

- Cree, Inc.

- Energy Focus, Inc.

- General Electric Company

- Intematix Corporation

- LED Engin, Inc.

- Nichia Corporation

- Osram Licht AG

- Royal Philips Electronics N.V.

- Seoul Semiconductor Co., Ltd.

- TCP International Holdings Ltd.

- Toyoda Gosei Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

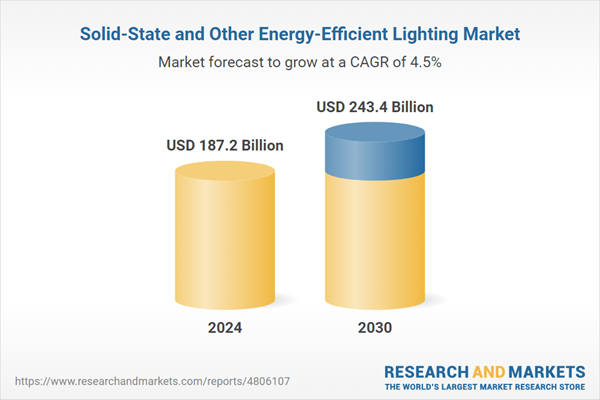

| Estimated Market Value ( USD | $ 187.2 Billion |

| Forecasted Market Value ( USD | $ 243.4 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |