Global Solid State Drives (SSD) Market - Key Trends and Drivers Summarized

Why Are Solid State Drives (SSD) Becoming the Preferred Choice for Data Storage Solutions?

Solid State Drives (SSD) have become the preferred choice for data storage solutions due to their superior performance, durability, and efficiency compared to traditional Hard Disk Drives (HDD). Unlike HDDs, SSDs use NAND flash memory to store data, resulting in faster read/write speeds, lower latency, and reduced power consumption. These advantages make SSDs ideal for a wide range of applications, including data centers, cloud computing, gaming, and consumer electronics. With the increasing demand for high-performance computing, big data analytics, and artificial intelligence (AI), the adoption of SSDs is growing across various sectors. The shift towards digital transformation, coupled with the need for reliable and secure data storage, is further driving the SSD market.How Are Technological Advancements Enhancing the Solid State Drive Market?

Technological advancements in NAND flash memory, DRAM integration, and storage interfaces are significantly enhancing the capabilities and performance of Solid State Drives. The development of 3D NAND, Quad-Level Cell (QLC), and Penta-Level Cell (PLC) technologies is increasing storage density and reducing costs, making SSDs more accessible for both consumer and enterprise applications. The introduction of Non-Volatile Memory Express (NVMe) and Peripheral Component Interconnect Express (PCIe) interfaces is further boosting data transfer speeds and reducing latency, providing faster access to data and improved system performance. Moreover, the emergence of encrypted and secure SSDs is addressing cybersecurity concerns, expanding the application scope of SSDs in financial services, healthcare, and government sectors. These technological advancements are driving the growth of the SSD market across various end-use markets.Which Market Segments Are Leading the Growth of the Solid State Drive Industry?

Types of SSDs include SATA SSDs, NVMe SSDs, and SAS SSDs, with NVMe SSDs holding the largest market share due to their superior speed and performance. Interfaces are categorized into SATA, PCIe, and SAS, with PCIe being the dominant segment due to its high data transfer rates and low latency. Applications of SSDs span data centers, laptops, desktops, gaming consoles, and enterprise storage, with data centers being the leading segment due to the high demand for high-performance storage solutions in cloud computing and big data analytics. Geographically, North America and Asia-Pacific are the largest markets for SSDs, driven by strong demand from data centers, cloud service providers, and consumer electronics, while Europe is also a significant market due to its focus on digitalization and cybersecurity.What Are the Key Drivers of Growth in the Solid State Drive Market?

The growth in the solid state drive market is driven by several factors, including the increasing demand for high-performance data storage solutions, technological advancements in NAND flash memory and storage interfaces, and the rising focus on enhancing read/write speed and durability. The need to support high-speed data processing, reduce latency, and improve system efficiency is driving the demand for SSDs across various applications. Technological innovations in NVMe, PCIe, and 3D NAND SSDs are enhancing the speed, capacity, and reliability of SSDs, supporting market growth. The expansion of SSD applications in data centers, cloud computing, and gaming consoles, coupled with the growing emphasis on digital transformation and data security, is creating new opportunities for market players. Additionally, the focus on developing cost-effective and high-volume SSD manufacturing techniques is further propelling the growth of the solid state drive market.Report Scope

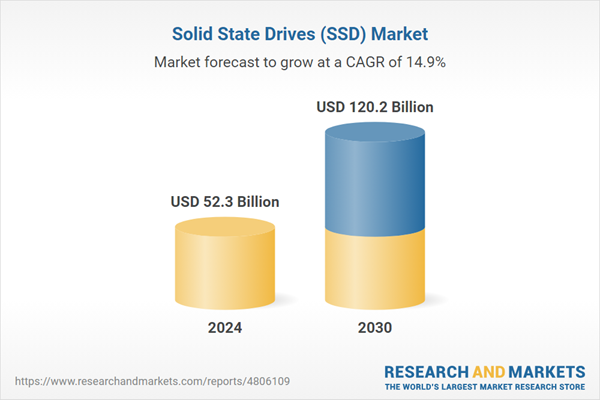

The report analyzes the Solid State Drives (SSD) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Interface (SATA, SAS, PCIe); Technology (TLC, MLC, SLC); End-Use (Client, Enterprise).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SATA Interface segment, which is expected to reach US$57.6 Billion by 2030 with a CAGR of 15.6%. The SAS Interface segment is also set to grow at 14.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.4 Billion in 2024, and China, forecasted to grow at an impressive 13.7% CAGR to reach $18 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Solid State Drives (SSD) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Solid State Drives (SSD) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Solid State Drives (SSD) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADATA Technology Co., Ltd., BiTMICRO Networks, Inc., Intel Corporation, Kingston Technology Europe Co LLP, LITE-ON Technology Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Solid State Drives (SSD) market report include:

- ADATA Technology Co., Ltd.

- BiTMICRO Networks, Inc.

- Intel Corporation

- Kingston Technology Europe Co LLP

- LITE-ON Technology Corporation

- Micron Technology, Inc.

- Microsemi Corporation

- Samsung Electronics Co., Ltd.

- Seagate Technology LLC

- SK Hynix, Inc.

- Toshiba Corporation

- Viking Technologes

- Western Digital Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADATA Technology Co., Ltd.

- BiTMICRO Networks, Inc.

- Intel Corporation

- Kingston Technology Europe Co LLP

- LITE-ON Technology Corporation

- Micron Technology, Inc.

- Microsemi Corporation

- Samsung Electronics Co., Ltd.

- Seagate Technology LLC

- SK Hynix, Inc.

- Toshiba Corporation

- Viking Technologes

- Western Digital Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 52.3 Billion |

| Forecasted Market Value ( USD | $ 120.2 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |