Global Turbocompressor Market - Key Trends & Drivers Summarized

What Makes Turbocompressors Integral to Modern Industries?

Turbocompressors have emerged as indispensable assets across a range of industrial applications due to their ability to compress gases efficiently, enabling smooth processes in sectors such as oil and gas, petrochemicals, power generation, and wastewater treatment. These machines leverage centrifugal or axial flow designs to achieve high compression ratios, offering advantages such as reliability, minimal vibration, and higher energy efficiency compared to their reciprocating counterparts. In the oil and gas sector, turbocompressors play a pivotal role in gas transportation through pipelines, liquefied natural gas (LNG) production, and enhanced oil recovery. In chemical manufacturing, they are essential for processing and compressing various gases under stringent conditions. Additionally, they are central to the energy transition narrative, supporting the storage and utilization of hydrogen, a key element of clean energy strategies globally. With industries increasingly leaning toward decarbonization, turbocompressors are adapting to handle new energy-efficient gases and working under more complex operational requirements.How Are Technological Innovations Shaping Turbocompressor Applications?

Advancements in turbocompressor technologies are significantly reshaping their utility and appeal. Innovations such as high-speed magnetic bearings, advanced aerodynamic designs, and optimized blade geometries have revolutionized their operational efficiency and reduced lifecycle costs. Magnetic bearing systems have eliminated the need for lubrication, improving reliability and reducing maintenance. Digital integration is also becoming a hallmark feature, with IoT-enabled monitoring and predictive maintenance technologies allowing operators to oversee real-time performance metrics, minimize downtime, and extend equipment lifespan. Furthermore, hybrid systems combining turbocompressors with renewable energy sources are creating new possibilities for energy-efficient operations. Industries such as hydrogen production and carbon capture storage (CCS) are benefiting from these advancements, as turbocompressors enable the effective handling of high-pressure environments and unique gas properties. With sustainability goals driving energy-efficient and environmentally friendly processes, these technological leaps are ensuring turbocompressors stay relevant in evolving industrial landscapes.Why Are New End-Use Applications Expanding the Turbocompressor Market?

The versatility of turbocompressors is leading to their adoption in diverse and emerging applications. In the wastewater treatment industry, turbocompressors are crucial for aeration processes, ensuring oxygen is efficiently supplied to biological treatments. The growth of decentralized and smaller wastewater plants has spurred demand for compact and energy-efficient turbocompressors. Additionally, the rise of LNG as a transitional energy source is driving demand for turbocompressors designed for extreme cryogenic environments. In power generation, turbocompressors are being integrated into combined cycle plants and energy recovery systems, where their ability to efficiently compress and expand gases optimizes energy production and reduces waste. Beyond traditional sectors, industries such as aerospace are exploring turbocompressors for propulsion systems, while the semiconductor sector uses them for contamination-free gas delivery in cleanrooms. The rapid industrialization of developing economies is further broadening the scope of applications, with increasing investments in petrochemical complexes, power infrastructure, and advanced manufacturing facilities boosting turbocompressor installations worldwide.What Drives the Growing Demand for Turbocompressors Globally?

Growth in the global turbocompressor market is driven by several factors, including the increasing adoption of energy-efficient technologies, rising industrialization in emerging economies, and the demand for clean and sustainable energy solutions. Technological advancements such as the integration of digital monitoring systems and IoT-enabled analytics are addressing the operational challenges associated with turbocompressors, making them more user-friendly and adaptable. The shift toward LNG as a cleaner fuel alternative has created substantial demand for turbocompressors in liquefaction, storage, and transportation processes. Additionally, the hydrogen economy, gaining traction as a key decarbonization strategy, relies heavily on turbocompressors for efficient gas compression and storage solutions. Consumer preferences for automation and reduced operational costs are further accelerating the adoption of advanced turbocompressors in industries such as oil and gas, wastewater treatment, and power generation. As industries strive to meet stricter environmental regulations, the need for low-emission, high-performance turbocompressors continues to drive innovation and market expansion. Finally, the global focus on infrastructure development, particularly in regions like Asia-Pacific and the Middle East, is spurring investments in advanced turbocompressor technologies to support robust industrial growth.Report Scope

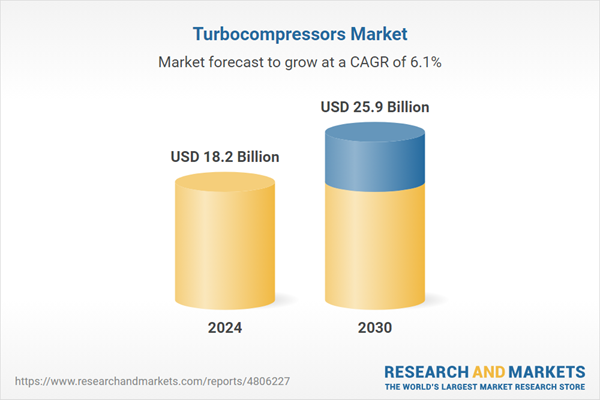

The report analyzes the Turbocompressors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Centrifugal Turbocompressors, Axial Turbocompressors); Stage (Single Stage Turbocompressors, Multi-Stage Turbocompressors); Application (Oil & Gas Application, Power Generation Application, Chemical Application, Water & Wastewater Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Centrifugal Turbocompressors segment, which is expected to reach US$18.1 Billion by 2030 with a CAGR of 5.7%. The Axial Turbocompressors segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.5 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $6.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Turbocompressors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Turbocompressors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Turbocompressors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB SKF, Atlas Copco AB, Baker Hughes Company, Continental AG, Elliott Group Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 62 companies featured in this Turbocompressors market report include:

- AB SKF

- Atlas Copco AB

- Baker Hughes Company

- Continental AG

- Elliott Group Ltd.

- ExxonMobil Corporation

- General Electric Company

- Howden Compressors Ltd.

- Ingersoll-Rand PLC

- Kawasaki Heavy Industries, Ltd.

- Kobe Steel Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Sulzer Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB SKF

- Atlas Copco AB

- Baker Hughes Company

- Continental AG

- Elliott Group Ltd.

- ExxonMobil Corporation

- General Electric Company

- Howden Compressors Ltd.

- Ingersoll-Rand PLC

- Kawasaki Heavy Industries, Ltd.

- Kobe Steel Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Sulzer Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 534 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.2 Billion |

| Forecasted Market Value ( USD | $ 25.9 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |