Global Trade Surveillance Systems Market - Key Trends & Drivers Summarized

What are Trade Surveillance Systems and Why are They Essential?

Trade Surveillance Systems (TSS) are specialized software solutions designed to monitor and analyze trading activities in financial markets to detect and prevent market abuse, fraud, and non-compliance with regulatory requirements. These systems are integral for financial institutions, including banks, brokerage firms, and exchanges, to ensure market integrity and protect investors. TSS solutions utilize advanced algorithms and machine learning to identify suspicious trading patterns, insider trading, and market manipulation. The necessity of TSS has grown significantly with the increasing complexity and volume of trades, driven by the proliferation of electronic trading platforms and high-frequency trading.How Do Trade Surveillance Systems Enhance Market Integrity?

Trade Surveillance Systems enhance market integrity by providing real-time monitoring and analysis of trading activities across multiple markets and asset classes. They enable financial institutions to maintain compliance with stringent regulatory standards by automating the detection of potentially illicit activities. With capabilities such as pattern recognition, anomaly detection, and predictive analytics, TSS can quickly flag irregular trades for further investigation. This proactive approach helps in mitigating risks and preventing financial crimes before they escalate. Furthermore, TSS platforms often include comprehensive reporting tools, which aid in regulatory reporting and audits, ensuring transparency and accountability in trading operations.Why is the Adoption of Trade Surveillance Systems Increasing?

The adoption of Trade Surveillance Systems is increasing due to several critical factors. The global regulatory landscape is becoming more stringent, with regulatory bodies like the SEC, FINRA, and ESMA imposing stricter compliance requirements. Financial institutions must ensure that their trading activities are transparent and compliant, driving the demand for advanced TSS solutions. Additionally, the rise in sophisticated trading strategies and high-frequency trading has heightened the risk of market abuse, necessitating robust surveillance mechanisms. The advancement in technology, particularly in artificial intelligence and machine learning, has made TSS more effective and efficient in detecting complex trading anomalies. Moreover, the growing awareness and emphasis on ethical trading practices and investor protection further bolster the adoption of TSS.What Factors are Driving the Growth of the Trade Surveillance Systems Market?

The growth in the Trade Surveillance Systems market is driven by several factors. Increasing regulatory scrutiny and the need for compliance are primary drivers, as financial institutions seek to avoid hefty fines and reputational damage. Technological advancements, particularly in AI and machine learning, are enhancing the capabilities of TSS, making them more accurate and efficient in identifying market abuses. The rise in electronic trading and high-frequency trading necessitates robust surveillance to manage the associated risks. Additionally, the global expansion of financial markets and cross-border trading activities increase the complexity and volume of trades, further fueling the demand for TSS. The heightened focus on ethical trading and the need to ensure market integrity also contribute to the market's growth. Lastly, the growing instances of financial fraud and market manipulation underscore the importance of implementing advanced surveillance systems to protect market participants and maintain trust in financial markets.Report Scope

The report analyzes the Trade Surveillance Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (On-Premise, Cloud).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$4.9 Billion by 2030 with a CAGR of a 18.5%. The Services Component segment is also set to grow at 23% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $732.5 Million in 2024, and China, forecasted to grow at an impressive 18.8% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Trade Surveillance Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Trade Surveillance Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Trade Surveillance Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACA Compliance Group, Aquis Technologies, b-next holding AG, Cinnober Financial Technology AB, FIS and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Trade Surveillance Systems market report include:

- ACA Compliance Group

- Aquis Technologies

- b-next holding AG

- Cinnober Financial Technology AB

- FIS

- Nasdaq

- NICE Systems Ltd.

- Onemarketdata

- Scila AB

- Sia S.P.A.

- Software AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACA Compliance Group

- Aquis Technologies

- b-next holding AG

- Cinnober Financial Technology AB

- FIS

- Nasdaq

- NICE Systems Ltd.

- Onemarketdata

- Scila AB

- Sia S.P.A.

- Software AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

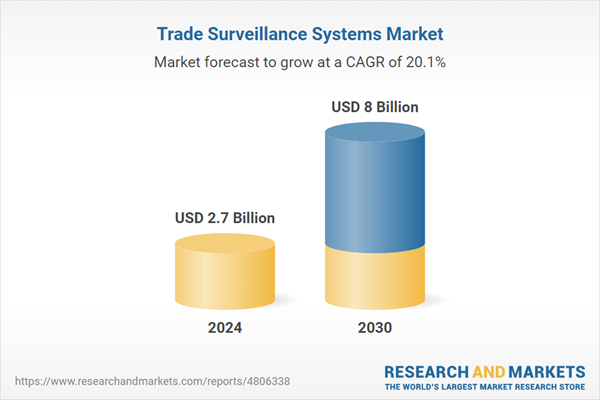

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Global |