Global Vehicle Cameras Market - Key Trends & Growth Drivers Explored

Why Are Vehicle Cameras Transforming the Automotive Industry?

Vehicle cameras have become an integral component in the automotive industry, driving the development of safer, smarter, and more connected vehicles. But what exactly makes these cameras so revolutionary? Vehicle cameras are optical devices installed in various positions around a vehicle to capture visual information for multiple applications, such as enhancing driver awareness, improving safety, and enabling advanced driver assistance systems (ADAS). These cameras can be mounted on the windshield, rearview mirror, side mirrors, or even within the vehicle's body, depending on their intended purpose. They play a crucial role in features like rear-view parking assistance, lane departure warning, traffic sign recognition, and automated emergency braking. The growing emphasis on safety and convenience has led to the widespread adoption of vehicle cameras, making them standard components in both commercial and passenger vehicles. As automakers and technology companies continue to innovate, vehicle cameras are becoming more sophisticated, integrating artificial intelligence (AI) and machine learning algorithms to process visual data and provide real-time insights that enhance driving performance.The surge in demand for vehicle cameras is also driven by the rise of autonomous and semi-autonomous vehicles, which rely heavily on camera-based vision systems to navigate and interpret their surroundings. These cameras work in conjunction with other sensors, such as LiDAR and radar, to create a comprehensive view of the environment, enabling the vehicle to detect obstacles, pedestrians, and road conditions. As the automotive industry moves towards higher levels of autonomy, the role of vehicle cameras is expanding, from basic rear-view functions to complex object detection and tracking. Furthermore, the integration of in-cabin cameras for monitoring driver behavior and ensuring compliance with safety regulations has added a new dimension to the vehicle camera market. In-cabin cameras are being used to monitor driver alertness, detect distracted or impaired driving, and even provide personalized comfort features based on facial recognition. This technological evolution has positioned vehicle cameras as essential components in the push towards safer, more efficient, and intelligent transportation systems.

How Are Technological Advancements Elevating the Capabilities of Vehicle Cameras?

The vehicle camera market has experienced significant technological advancements that have enhanced the functionality, image quality, and versatility of these devices. But what are the key innovations driving these developments? One of the most significant advancements is the transition from standard definition (SD) to high-definition (HD) and ultra-high-definition (UHD) cameras. Modern vehicle cameras now offer resolutions up to 4K, providing sharper, clearer images that enable more accurate detection and recognition of objects, even in low-light conditions. This improvement in image quality is crucial for applications like night vision, pedestrian detection, and automatic parking, where precision is paramount. The incorporation of wide dynamic range (WDR) and high dynamic range (HDR) technologies has further enhanced the ability of vehicle cameras to handle varying lighting conditions, such as shadows, bright sunlight, or oncoming headlights, ensuring that critical visual information is not lost.Another key innovation is the integration of AI and machine learning algorithms into vehicle camera systems. These technologies enable cameras to perform advanced functions such as object classification, lane detection, and traffic sign recognition with greater accuracy and speed. AI-powered cameras can process vast amounts of visual data in real-time, allowing vehicles to respond quickly to changing road conditions and potential hazards. Additionally, the development of surround-view and 360-degree camera systems has revolutionized parking assistance and low-speed maneuvering, providing drivers with a comprehensive, bird's-eye view of the vehicle's surroundings. These systems stitch together images from multiple cameras placed around the vehicle to eliminate blind spots and help drivers navigate tight spaces with confidence. Innovations in camera lens design, such as the use of fisheye and aspherical lenses, have also improved the field of view and reduced distortion, making it easier to capture a wider area without compromising image quality. These technological advancements have collectively elevated the capabilities of vehicle cameras, enabling them to support a growing range of safety and driver assistance applications.

What Market Trends Are Driving the Adoption of Vehicle Cameras Across Automotive Segments?

Several emerging market trends are shaping the adoption of vehicle cameras across different automotive segments, reflecting the evolving needs of consumers and manufacturers. One of the most prominent trends is the increasing focus on vehicle safety and regulatory compliance. As road safety becomes a top priority for governments and automotive manufacturers worldwide, the demand for safety-enhancing features, such as ADAS and driver monitoring systems (DMS), has surged. Vehicle cameras play a pivotal role in these systems by providing the visual input needed to detect and respond to potential hazards. Regulatory bodies in regions such as Europe and North America have introduced stringent safety regulations that mandate the inclusion of specific camera-based technologies, such as rear-view cameras, lane-keeping assist, and emergency braking systems, in new vehicles. This has led to a rapid expansion of the vehicle camera market, as automakers strive to meet these requirements and improve their safety ratings.Another key trend driving the adoption of vehicle cameras is the rise of autonomous and connected vehicles. As the industry moves towards higher levels of vehicle autonomy, the reliance on camera-based vision systems for navigation, object detection, and decision-making has increased. Autonomous vehicles require a combination of cameras, LiDAR, and radar to create a detailed map of their environment and navigate safely. This has spurred investments in advanced camera technologies, such as multi-sensor fusion and AI-driven image processing, which enhance the vehicle's ability to perceive and interpret complex scenarios. Additionally, the growing popularity of connected car technologies has paved the way for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, where cameras are used to capture and share real-time visual data with other vehicles and road infrastructure. This trend is transforming vehicle cameras into integral components of a broader connected ecosystem, where they contribute to safer, more efficient, and coordinated driving experiences.

What Factors Are Driving the Growth of the Global Vehicle Cameras Market?

The growth in the global vehicle cameras market is driven by several factors, including advancements in ADAS technology, increasing consumer demand for safety features, and the rising prevalence of regulatory mandates. One of the primary growth drivers is the widespread adoption of advanced driver assistance systems, such as collision avoidance, lane departure warning, and automatic emergency braking, which rely heavily on camera-based vision systems. As automotive manufacturers continue to integrate these systems into their vehicles to enhance safety and achieve higher safety ratings, the demand for high-quality vehicle cameras has grown. The expansion of the electric vehicle (EV) market has also contributed to the growth of the vehicle camera market, as EVs often feature advanced ADAS and connectivity systems that require sophisticated vision capabilities. The development of camera-based solutions specifically designed for EVs, such as thermal cameras for battery monitoring and 360-degree surround-view cameras for parking assistance, has opened up new opportunities for market expansion.Another key growth driver is the increasing emphasis on driver and passenger monitoring systems. In-cabin cameras, which can detect driver fatigue, distraction, or improper seatbelt usage, are becoming standard features in both commercial and passenger vehicles. The rise of ride-hailing services and shared mobility solutions has further accelerated the adoption of in-cabin cameras, as fleet operators seek to ensure driver compliance and passenger safety. The ongoing shift towards Level 3 and Level 4 vehicle autonomy, where the vehicle takes over more driving functions, has also fueled the need for camera-based systems that can monitor driver readiness and take control if necessary. Furthermore, the growing popularity of dashcams for personal and commercial use, driven by the need for evidence in insurance claims and accident investigations, has boosted the demand for aftermarket vehicle cameras. With ongoing advancements in camera technology and the increasing adoption of AI and connectivity solutions, the global vehicle cameras market is poised for sustained growth, driven by a dynamic interplay of technological innovation, regulatory support, and evolving consumer expectations.

Report Scope

The report analyzes the Vehicle Cameras market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (ADAS, Park Assist); Technology (Infrared Camera, Thermal Camera, Digital Camera); View Type (Single View System, Multi-Camera System).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single View System segment, which is expected to reach US$11.6 Billion by 2030 with a CAGR of a 8.6%. The Multi-Camera System segment is also set to grow at 9.8% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vehicle Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vehicle Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vehicle Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ambarella, Inc., Aptiv PLC, Autoliv, Inc., Automation Engineering, Inc., Clarion Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Vehicle Cameras market report include:

- Ambarella, Inc.

- Aptiv PLC

- Autoliv, Inc.

- Automation Engineering, Inc.

- Clarion Co., Ltd.

- Continental AG

- Denso Corporation

- Ficosa International SA

- FLIR Systems, Inc.

- Gentex Corporation

- Hitachi Ltd.

- Kyocera Corporation

- Magna International, Inc.

- Mobileye, An Intel company

- OmniVision Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electro-Mechanics

- SMR Automotive Mirrors Stuttgart GmbH

- STONKAM CO., LTD

- Valeo SA

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ambarella, Inc.

- Aptiv PLC

- Autoliv, Inc.

- Automation Engineering, Inc.

- Clarion Co., Ltd.

- Continental AG

- Denso Corporation

- Ficosa International SA

- FLIR Systems, Inc.

- Gentex Corporation

- Hitachi Ltd.

- Kyocera Corporation

- Magna International, Inc.

- Mobileye, An Intel company

- OmniVision Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electro-Mechanics

- SMR Automotive Mirrors Stuttgart GmbH

- STONKAM CO., LTD

- Valeo SA

- ZF Friedrichshafen AG

Table Information

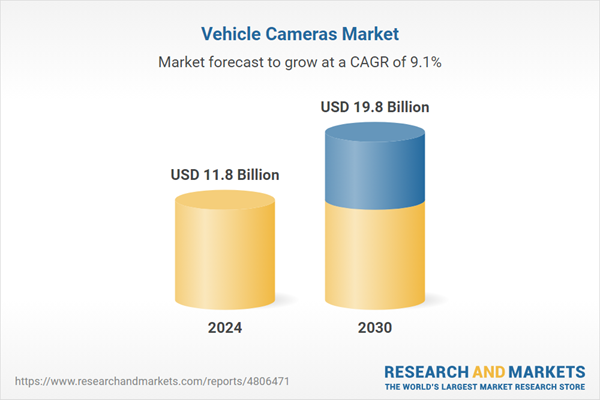

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.8 Billion |

| Forecasted Market Value ( USD | $ 19.8 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |