The novel COVID-19 pandemic has had a significant impact on the entire food and beverage industry, including the Indian bread flour and premixes industry. This pandemic has caused mass production shutdowns and supply chain disruptions, affecting the economy as well. Due to the lockdown, sales of non-edible products were high during the start of 2020, while sales of edible products, such as breads, cakes, bakery products, and many others, were insufficient due to a labor shortage. A high incidence of in-home cooking will foster demand for products in the premixes segment. With fears of job losses and falling income, consumers may cut spends on discretionary categories by down-trading in the same product category. For example, according to this figure, 191.06 million Americans used bread crumbs, coating, and stuffing products/mixes in 2020, compared to 190.42 million in 2019. As a result, according to U.S. Census statistics, COVID-19 had little impact on the bread mix market category (NHCS).

The global bread mixes market is being driven by the increase in awareness for healthy food among individuals. Trade provides the shoppers with broader and healthier flavor profiles. The increase in demand for gluten-free product drives the demand for gluten-free breads. Breads, historically ready from flour also can be ready from ground flours obtained from completely different non-wheat materials like almond and maize. This provides a gluten-free choice to the customers. Surge in financial gains or disposable incomes of the people and rise in population boost the growth of the market.

The shifting trend towards westernization in the developing regions is increasing the demand for convenience foods in the underdeveloped and developing regions of the world. Moreover, there is a rising demand for ancient grain-based and gluten-free bread mixes. Mixes based on ancient grains, such as chia, amaranth, quinoa, Kamut, and sorghum, have also become popular among health-conscious customers.

Key Market Trends

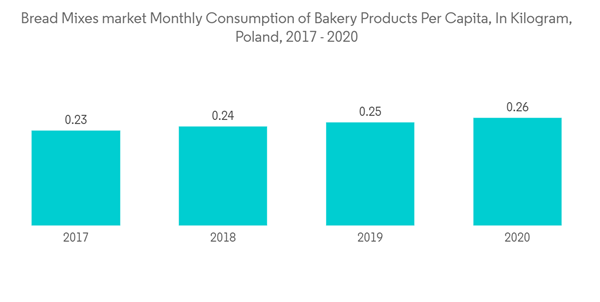

Increasing Per Capita Consumption of Bakery Products

The increasing per capita consumption of bakery products among consumers under different demographics strongly supported by its convenience factor and wide price range is one of the major factors driving the bread mixes market globally. There are several product launches registered every year with convenience and functional ingredient claims, capturing the attention of consumers looking for a healthy food option. The Bakery product market is driven preliminarily by “assistance” that is offered by those convenient products; in that, they significantly reduce the time to prepare meals and thereby providing valuable time-savings in the backdrop of the busy lifestyles. Consumers are demanding additive-free, non-GMO, clean-label, and health-promoting baked goods. Thus health and convenience along with indulgence are expected to be trending in developed markets of bakery products.

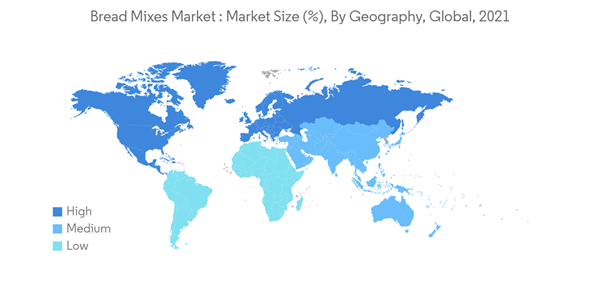

North America Holds the Major Share

Growing consumer awareness, higher disposable incomes, and changing lifestyles are driving the market for end-user applications in the bakery. This is leading to a rise in the sale of bread mixes. North America has the highest market share followed by Europe. The developed countries like the United States, Canada, the United Kingdom, and Germany occupy the major market share followed by fast-developing regions of Asia-Pacific like China, Japan, and India. The increasing westernization trends in the developing regions of South America and Africa are also driving the global bread mixes market.

Competitive Landscape

New product developments, in compliance with the consumer trend, i.e. the target segment, help in better positioning of the company. The leading players have high capital and can indulge in investments with establishment of plants in various regions to offer products in both international and regional markets. Leading players in the market include: Cargil, Corbion, ADM, Frutarom, Tate & Lyle, puratos, and AAK AB, among others.

Companies are competing on different factors, including product offerings, quality, flavours, and marketing activities to gain competitive advantage in the market. These players are focusing on strengtthening their research development facilities. along they are engaging with customers to gain the trust in their product offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill, Incorporated

- Corbion N.V.

- Archer Daniels Midland Company

- Frutarom Industries Ltd.

- General Mills

- Tate & Lyle PLC

- Continental Mills, Inc.

- Associated British Foods

- Simple Mills

- Laucke Flour Mills