Key Highlights

- Colombia is one of the major producers of fruits and vegetables globally. It produces several horticultural crops, namely banana, mango, pineapple, papaya, strawberry, avocado, potato, tomato, pepper, and onion, among others. Banana is one of the largest segments as it has high production among fruits, high export potential, and a strong distribution network. In 2020, The government supported the agricultural sector by launching a USD 320 thousand credit scheme, "Colombia Agro Produce," to support agricultural operations, particularly seed and input purchases for the farmers.

- With the growing importance of nutritional balance among various consumer groups, the consumption of fruits is expanding in the country. Bananas, lemons, limes, berries, onions, oranges, and pineapples, among others, are the highly traded commodities in the fruits and vegetables segment of the country. Due to the nutritional properties of fruits, in recent years, minimally processed juices, beverages, and smoothies have become an alternative for healthy eating habits, which will further boost the country's fresh produce in the coming years.

Colombian Fruits and Vegetables Market Trends

Strong Distribution and Retail Networks are Driving the Colombian Fresh Produce Sector

- In recent years, Colombia's fresh produce import rate has been increasing at a faster pace than global imports, with Chile, the United States, and Peru being the major exporters. This trend can be attributed to changing consumer food preferences, where an assortment of produce that excels at freshness, quality, flavor, safety, and convenience is in high demand. Consumers are willing to pay a premium for it.

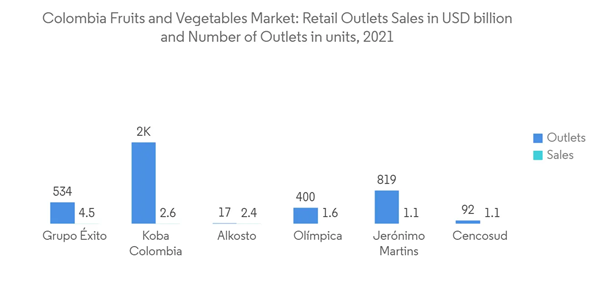

- The increasing demand for fresh produce has created an opportunity for retail chains to import and cater to the needs of consumers, resulting in a surge in the number of retail chains in the country. Retail food players, manufacturers, distributors, and other retailers are expected to leverage this opportunity, with their share expected to increase in the near future.

- Hyper and supermarkets are the primary retail chains focusing on consolidation, with Almacenes Exito, Carulla-Vivero, Carrefour, Supertiendas Olimpica, Alkosto, Makro, Cafam, Colsubsidio and La 14, and Surtifruver being the major players in Colombia. These retail chains are undergoing rapid expansions, strengthening the distribution links of fresh produce in the domestic market.

- Retail chains, manufacturers, distributors, and other retailers need to adjust to the evolving consumer preferences, such as providing fresh, high-quality, flavorful, safe, and convenient produce to meet the increasing demand for fresh produce. The retailers must focus on expanding their distribution channels and consolidating their operations to cater effectively to the growing demand. Overall, the fresh produce market in Colombia is set to witness significant growth in the near future, and companies need to adapt and evolve to take advantage of this opportunity.

Bananas to Dominate the Fresh Produce Sector

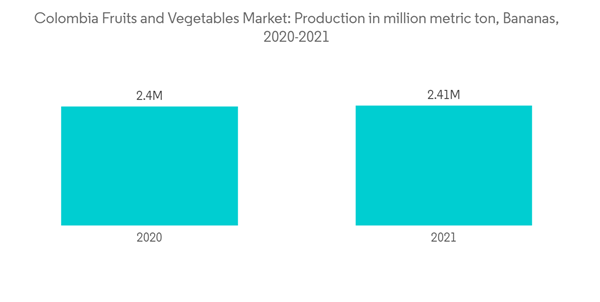

- Bananas are not only the most popular fruit in Colombia but also one of the country's most important tropical foods. In 2021, bananas accounted for nearly 21.7% share of the country's fresh produce. According to Food Agriculture Organization (FAO), banana production in Colombia reached 2413,768.5 metric tons in 2021, which increased marginally by 0.6% between 2020 and 2021.

- Colombia is the 5th largest exporter of bananas globally, with approximately 93% of the bananas produced being exported to foreign markets annually, with more than 50% destined for Europe and the United States. According to Feshplaza, about 1.8 million metric tons of bananas from the Caribbean region have been exported to different countries. The Caribbean region of Colombia accounted for about 48% of the bananas produced in the country.

- In Colombia, the banana market is characterized by horizontal and vertical integration within the value chain, with a highly competitive export market focused on the country. However, the high demand from global markets has led to banana plantations becoming increasingly dependent on agrochemicals, which has slightly hampered production in the country over the past few years.

- Despite these challenges, the high demand for exports and increasing production in the country have helped Colombia become one of the major exporters of bananas globally during the forecasted period.

Colombian Fruits and Vegetables Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.