Global Commercial Aircraft Video Surveillance Systems Market - Key Trends and Drivers Summarized

How Do Commercial Aircraft Video Surveillance Systems Enhance Safety?

Commercial aircraft video surveillance systems are integral safety mechanisms designed to monitor both the interior and exterior of an aircraft, providing real-time video feeds to crew members and ground control teams. These systems are crucial for enhancing situational awareness and preventing potential security incidents during flight. Inside the cabin, cameras are strategically placed to monitor passenger behavior, entrances to the cockpit, and even cargo holds, allowing crew members to address any disturbances quickly. Exterior cameras, typically installed near the landing gear and aircraft doors, help pilots monitor external conditions during takeoff, landing, and ground handling operations. In the era of heightened security concerns, these video systems offer an additional layer of protection, enabling swift responses to both minor disruptions and serious emergencies. The integration of advanced video analytics software allows for real-time threat detection, while high-definition imaging ensures that all areas of the aircraft are monitored with clarity. For airlines, installing comprehensive video surveillance systems is not only about meeting regulatory requirements but also about improving overall operational safety and passenger security.How Has Technology Transformed Video Surveillance Systems in Commercial Aircraft?

Technological advancements have significantly transformed the functionality and effectiveness of video surveillance systems in commercial aircraft. Modern systems now utilize high-definition cameras equipped with wide-angle lenses, ensuring that blind spots are minimized and all areas of the aircraft are adequately covered. These cameras are also becoming more compact and lightweight, reducing the burden on the aircraft's overall weight and power consumption. One of the most notable technological breakthroughs is the integration of advanced video analytics powered by artificial intelligence (AI). These systems are capable of detecting abnormal behavior, such as unauthorized attempts to enter the cockpit or suspicious movements within the cabin, and can alert the crew in real-time, allowing for rapid responses to potential threats. Moreover, the introduction of wireless streaming technologies allows for continuous data transmission from the aircraft to ground control, enhancing the coordination between onboard crew members and airport security teams. Another key innovation is the adoption of infrared and low-light cameras, which enable surveillance even in dark or low-visibility conditions, ensuring that the aircraft is under constant monitoring, regardless of lighting conditions. These advancements have made video surveillance systems more reliable, versatile, and efficient, contributing to a safer in-flight environment.What Challenges Do Commercial Aircraft Video Surveillance Systems Face in Today's Aviation Industry?

Despite their growing importance, commercial aircraft video surveillance systems face several challenges related to privacy concerns, data management, and technological integration. One of the key issues is balancing the need for surveillance with passengers' privacy rights. In an era where data protection is paramount, airlines must ensure that video footage is handled in compliance with stringent privacy laws, such as the General Data Protection Regulation (GDPR) in Europe. This requires the implementation of robust data encryption and secure storage protocols to protect sensitive information while ensuring that it is only accessible to authorized personnel. Another challenge is the sheer volume of data generated by modern surveillance systems. High-definition cameras can produce enormous amounts of video data, and managing, storing, and processing this information in real-time can be resource-intensive. Airlines must invest in scalable data infrastructure that can handle the continuous inflow of video feeds, without overwhelming onboard or ground-based systems. Furthermore, integrating these surveillance systems with other onboard technologies, such as in-flight entertainment and communication systems, adds an extra layer of complexity. Ensuring that these systems work seamlessly together, without causing interference or draining the aircraft's electrical systems, requires meticulous engineering and testing. Lastly, the retrofitting of older aircraft with modern surveillance technology poses logistical challenges, as it often requires significant modifications to the aircraft's wiring and structural design, increasing both costs and downtime.What Factors Are Driving the Expansion of the Commercial Aircraft Video Surveillance Systems Market?

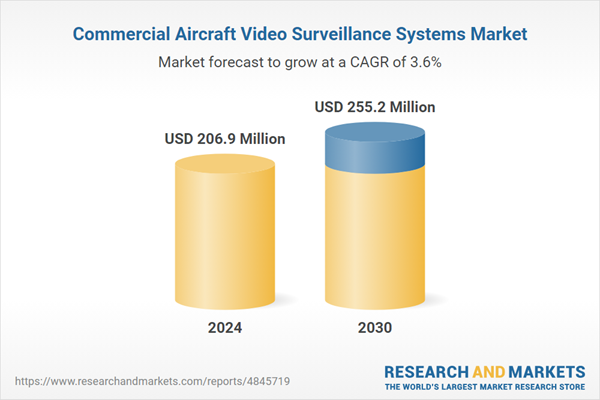

The growth in the commercial aircraft video surveillance systems market is driven by several factors, including advancements in camera technology, increasing regulatory requirements, and rising concerns over in-flight security. One of the key growth drivers is the demand for enhanced onboard security measures in the wake of increasing global security threats. Airlines are under growing pressure to install advanced surveillance systems that can detect and deter security breaches before they escalate. Additionally, technological improvements such as AI-powered video analytics, wireless data transmission, and more efficient data storage solutions are making video surveillance systems more attractive to airlines. These innovations not only improve the effectiveness of security monitoring but also reduce operational costs by minimizing the need for manual oversight. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), are implementing stricter safety standards, further driving the need for advanced surveillance systems in both new aircraft models and retrofitted fleets. Moreover, consumer behavior is also influencing market growth, with passengers expecting heightened safety measures as a standard part of their travel experience. Airlines are responding to this demand by investing in more sophisticated video surveillance technologies, recognizing that safety is a key factor in customer satisfaction and brand loyalty. Finally, the expansion of the global aviation industry, particularly in emerging markets, is leading to an increase in aircraft deliveries, which in turn boosts the demand for cutting-edge surveillance systems. These factors collectively contribute to the rapid growth of the commercial aircraft video surveillance systems market.Report Scope

The report analyzes the Commercial Aircraft Video Surveillance Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: System Type (Cockpit Door Surveillance Systems, Environmental Camera Systems, Cabin Surveillance Systems); Aircraft Type (Narrow-Body, Wide-Body, Regional Jets); Application (Passenger, Cargo).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cockpit Door Surveillance Systems segment, which is expected to reach US$113.6 Million by 2030 with a CAGR of 4.2%. The Environmental Camera Systems segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $55.1 Million in 2024, and China, forecasted to grow at an impressive 3.4% CAGR to reach $40.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Aircraft Video Surveillance Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Aircraft Video Surveillance Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Aircraft Video Surveillance Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AD Aerospace Ltd., Aerial View Systems Inc., Cabin Avionics Ltd., Global ePoint, Inc., Groupe Latecoere SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Commercial Aircraft Video Surveillance Systems market report include:

- AD Aerospace Ltd.

- Aerial View Systems Inc.

- Cabin Avionics Ltd.

- Global ePoint, Inc.

- Groupe Latecoere SA

- Meggitt PLC

- Strongpilot Software Solutions

- United Technologies Corporation (UTC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AD Aerospace Ltd.

- Aerial View Systems Inc.

- Cabin Avionics Ltd.

- Global ePoint, Inc.

- Groupe Latecoere SA

- Meggitt PLC

- Strongpilot Software Solutions

- United Technologies Corporation (UTC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 231 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 206.9 Million |

| Forecasted Market Value ( USD | $ 255.2 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |